Taiwan Life Insurers’ $700 Billion Bet on the US Is Backfiring

June 12, 2025 | by ltcinsuranceshopper

For decades, Taiwan’s life insurance companies boasted of above-average returns from their heavy investment in US bonds. That reliance is now a major risk threatening more than $700 billion of assets.

Unlike insurers in other countries like Japan where diversification is the norm, Taiwanese firms have more than 90% of their overseas assets denominated in the dollar. This puts them at risk of a long-term decline in the US currency as the appeal of American exceptionalism wanes.

Worse, there are few signs that the $1.2 trillion industry is ready for a major overhaul of its investment model given the limited size of the local financial market and a habitual dependence on regulatory support when times are tough. That means the sector’s $4 billion currency loss between January and April and some of its biggest players’ worsening earnings woes may only mark the start of more shocks, raising questions of systemic risks to the island’s finances and retirement savings.

More broadly, the woes of Taiwan’s insurers are a reminder of the predicament that plagues many export-oriented economies with large surpluses but limited domestic investment opportunities. It also trains the spotlight on the Asian exporter’s efforts to maintain a competitive exchange rate — an issue that has periodically drawn Washington’s scrutiny and a key focus of speculation over the island’s trade talks with the US.

“Taiwan is an extreme case on the size of the lifers’ foreign bond portfolio, the scale of the unhedged book and the concentration in US dollars,” said Brad Setser, a senior fellow at the Council on Foreign Relations. “The Taiwan central bank’s long history of smoothing volatility and at times blocking all appreciation through significant intervention clearly has created the perception that holding dollars unhedged doesn’t pose large risks.”

Now worth 1.5 times Taiwan’s economy, the industry has enjoyed a two-decade boom thanks to deregulation and an aging population. The number of firms has ballooned to more than 20 from just two in the 1940s, according to official data.

The combination of a small local bond market, a tightly managed exchange rate and consistently higher US interest rates have prompted the insurers to flock to the world’s biggest debt market to seek yield. Their incessant demand for US dollars also in turn reduces the need for Taiwan’s central bank to use intervention to suppress the value of its currency.

More than 90% of the insurers’ $778 billion foreign assets were denominated in the dollar as of end-March, with most of them parked in US corporate debt, according to Taiwan’s Financial Supervisory Commission. With policy premiums mostly collected in the Taiwan dollar, that has created “the most significant asset and liability currency mismatch” among their peers at least in Asia, said Kelvin Kwok, an analyst at Moody’s Ratings.

When the dollar is strong, the business model works perfectly well.

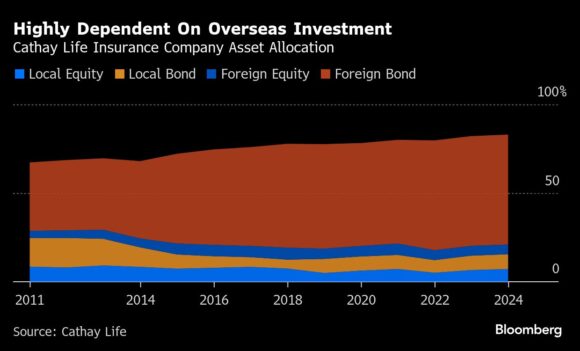

Cathay Life Insurance Co., the island’s biggest life insurer by assets, has increased its foreign assets to 68% of its total as of end-March, up from around 40% in 2011 when such data became available. Out of the insurer’s $180 billion overseas assets as of March 31, 97% were denominated in the US dollar.

The company has delivered an average annual investment return of around 5% since 2016 when it began making such disclosure, versus 0.9% for the island’s 10-year government bond yield, according to Cathay’s annual reports and Bloomberg-compiled data.

“We have more exposure to those areas with political and economic stability and Taiwan has been in closer relations with the US,” said Hsu Shu-po, chairman of Taiwan Life Insurance Co., the island’s sixth largest. While the company also has exposure to other markets, “many US investments are more mature than others,” he added.

That sense of security was thrown into doubt in early May, when the Taiwan dollar surprised markets with its sharpest rally against the greenback in 37 years. It has gained more than 9% versus the US currency this year, making it Asia’s top performer.

Compounding the blow from a weaker greenback, which makes the insurers’ dollar assets worth less, is the firms’ lack of risk mitigation. The insurers’ average currency hedging ratio was 61.5% as of end-March, according to the FSC.

The currency shock last month led Goldman Sachs Group Inc. analysts to estimate that for every 10% of Taiwan dollar appreciation, the insurers would incur about $18 billion of unrealized currency losses. Meantime, Fitch Ratings has revised its outlook for the sector to “deteriorating” from “neutral.”

FSC’s chairperson Peng Jin-lung said late last month that Taiwan’s insurance companies have enough cash on hand, and won’t have liquidity issues.

Officials from FSC and Taiwan’s central bank couldn’t immediately be reached for comment.

“The biggest problem for Taiwan’s insurers is there’s too much money and there are too few investment targets in Taiwan,” said Stan Shih, founder of tech firm Acer Inc. who sits on the board of Nan Shan Life Insurance Co. “That’s why insurers have to invest overseas.”

For one, Taiwan’s government bond issuance of NT$538 billion ($18 billion) last year was a drop in the bucket compared with the insurers’ assets.

That likely explains why short-term, top-down solutions, including proposals to ease rules on calculating insurers’ foreign asset exposure and the use of more reserves to reduce currency hedging, remain the playbook for now.

At an earnings briefing in May, Cathay Life’s spokesman Lin Chao-ting said there’s limited room to reallocate the insurer’s assets in the short term. “Corporate bonds with decent yield and good ratings remain concentrated in the US,” Lin said at that time.

Without the insurance firms’ foreign asset accumulation, the central bank would have intervened more in the market to maintain a weak currency in the face of persistent external surpluses of over 10% of GDP, said Setser at the Council on Foreign Relations.

Meantime, the Taiwanese central bank’s willingness to prevent currency appreciation also has protected the insurers from losses on their foreign assets, he said, adding that there are also echoes of the island’s challenge in neighboring exporters Japan and South Korea.

“What cannot go on eventually has to end, and I don’t think Taiwan can continue to maintain a clearly undervalued currency for much longer,” Setser said. “Its financial institutions need to be strengthened to prepare for an unavoidable shock.”

Photograph: Pedestrians cross a street with the Taipei 101 building, center, in the distance in Taipei, Taiwan, on Sunday, July 9, 2023. Photo credit: An Rong Xu/Bloomberg

Copyright 2025 Bloomberg.

Topics

USA

Carriers

RELATED POSTS

View all