Stock Market Today: U.S. stocks dip; Dollar Index rises after strong economic data reports

September 26, 2025 | by ltcinsuranceshopper

This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Thursday. This is TheStreet’s Stock Market Today for Sept. 25, 2025. You can follow the latest updates on the market here in our daily live blog.

Update 4:42 p.m. ET

Costco Wholesale (COST) shares were down nearly 1% after hours despite sales and revenue beating Street estimates.

The report came after stocks fell for a third day in a row.

The wholesale-club retailer reported $5.87 a share in earnings on revenue of $86,2 billion. Earnings beat Street estimate of $5.80 a share and revenue estimates of $86 billion.

The revenue number includes $1.7 billion in membership fees, up from $1.5 billion a year ago.

The fees were equal to 66% of net income of $2.61 billion.

After hours, the shares were off 0.6% at $937.15. The regular close of $943.31 was off 0.2%. The shares are up 3% this year, although they peaked at $1,078.23 in February. They are up 165% in the last five years.

Update: 4:18 p.m. ET

Stocks fall for a third straight day ahead of Costco earnings

Stocks slid for a third day in a row because of economic reports that were more bullish than expected.

Initial jobless claims were decent, and a revision to second-quarter growth suggests an economy has some strength.

Reports on both boosted bond yields, and there were worries the summer rally was losing steam.

At the close, the Standard & Poor’s 500 Index was off 0.5% to 6605. The Nasdaq Composite dropped 0.5% to 22385. The Dow Jones industrials fell 174 points, or 0.4% to 45947.

The problems include

- Rising bond yields. The 10-year Treasury yield rose to 4.175% from 4.15% on Wednesday.

- Worries about Euro-Russian tensions.

- Earnings wariness about earnings from Costco Wholesale (COST) , whose shares were down 0.2% at $943.31.

Also lower: Tesla (TSLA) , down 4% to $424.23 on weak sales reports from Europe, and Oracle (ORCL) , down 5.7% to $291 after the shares were downgraded by Rothschild analyst Alex Haissl.

He argued that investors have been “overestimating the value of Oracle’s contracted cloud revenue.”

Update: 2:49 p.m. ET

P.M. Update: Stories Making Headlines

We’re almost heading downhill into the end of the day. Here are a cropping of the stories making headways at the moment:

Stocks are still down on the day; Russell 2000 (-1.07%) at last look, Nasdaq (-0.61%) and S&P 500 (-0.55%) in tow.

European countries have reportedly told Russia that it is ‘ready’ to shoot down jets or drones entering their territories, escalating a standoff

The U.S. government civilian workforce has declined 3.6% this year, per a Bloomberg analysis

Starbucks (SBUX) will lay off corporate employees as a cost-cutting measure; close underperforming stores

Amazon (AMZN) will pay $2.5 billion to settle claims that it deceived customers into paying for its Prime subscription

Oracle (ORCL) , Silver Lake, and MGX will reportedly own 45% of TikTok and board seats, per Bloomberg report

Update: 12:09 p.m. ET

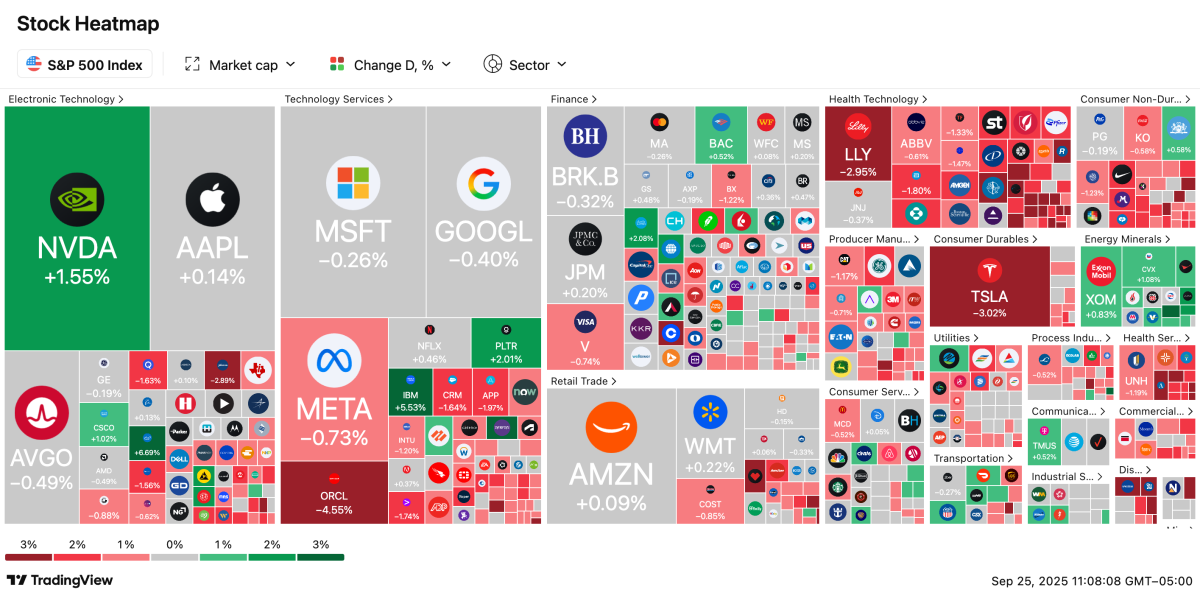

Heatmap: S&P 500

The S&P 500 (-0.34%) is at session highs right now, along with the other equity benchmarks.

In notable rises right now: Albermarle (ALB) (+6.77%) [industry sentiment/news], Intel (INTC) (+6.52%) [European sales news], and International Business Machines (IBM) (+5.66%) [collaboration with HSBC].

In notable decliners: Oracle (ORCL) (-4.55%) [downgrade], Tesla (TSLA) (-3.02%) [news], and Eli Lilly (LLY) (-2.95%) [discontinuing clinical trial].

Check out the heatmap:

TradingView

Update: 10:14 a.m. ET

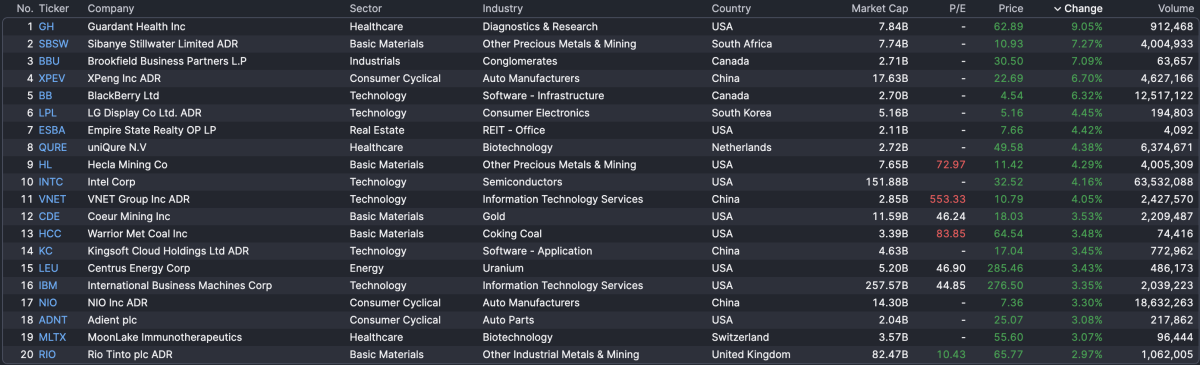

A.M. Movers: Guardant, Brookfield, CarMax, Transocean

Existing Home Sales are out, showing 4 million homes sold in the month of August, a slight decline from July’s 4.01 million and mostly in line with expectations.

But for a second, let’s talk about stocks who are beating (or not meeting) expectations this morning. Here’s the movers & losers:

Movers

Losers

It would stand to reason that it’s bound to be a much longer list of stocks in the red, with 73.9% of U.S. equities declining this morning per FinViz. But hey, we’re just looking at the bottom 20 stocks today.

Update: 9:30 a.m. ET

Opening Bell: September to Remember?

The U.S. stock market is now open. As foreshadowed earlier, stocks are lower to start the day, after strong economic data seemed to put more rapid Fed rate cuts on ice.

For the opening print: The Russell 2000 (-0.92%) is facing the steepest declines, while the Nasdaq (-0.84%), S&P 500 (-0.56%), and Dow (-0.28%) are also sinking.

If things stay this way today, it would be the third consecutive losing day for the market. That might briefly satisfy the institutional investors who said to “sell the news” after the 25 basis point cut.

However, even though we’ve had a few memorable red days here as of late, it’s still not saying much: stocks aren’t even down 1% from their all-time highs.

Update: 8:39 a.m. ET

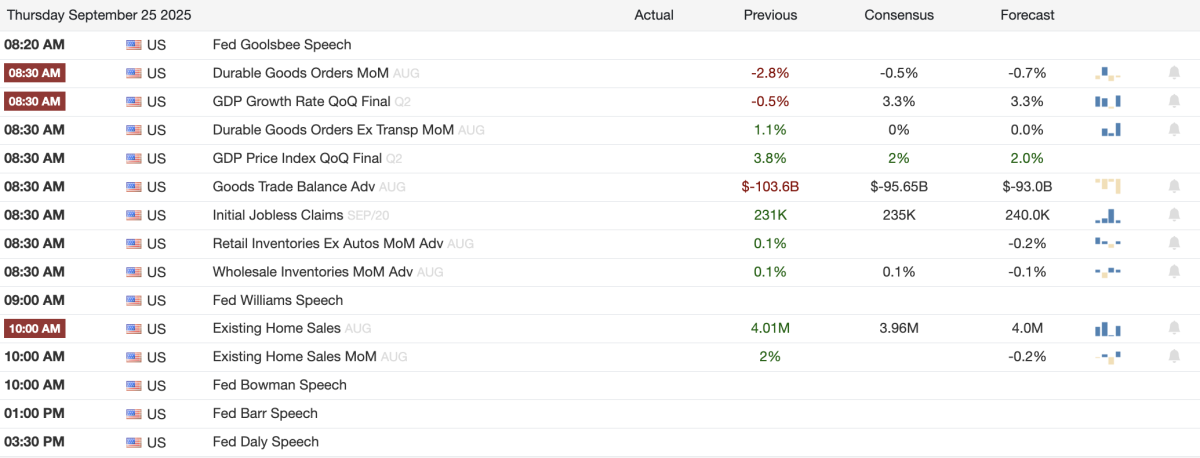

Data Drop: It’s All Strong

We just got a wide range of economic data drops in the last few minutes. Remarkably, they’re all pretty strong, which is great for the economy. However, it’s not so bad about investors, who have spent this whole quarter pricing in more rate cuts (and pricing it in accordingly):

- Durable Goods orders ticked up after two months of declines, +2.9% month-over-month [Prev: -2.7%] [Consensus: -0.5%]

- GDP Growth Rate erased last quarter’s 0.6% decline, replacing +3.8% quarter-over-quarter [Consensus: +3.3%]

- Initial Jobless Claims were lower than expected (good sign for the labor market!) at 218,000 [Prev: 232,000]

On the news, the Dollar Index DXY (+0.36%) rose to its highest point in three weeks.

Unfortunately for the bulls, U.S. equities are taking a walk off a cliff this morning anyway, with futures for all four indexes in decline today. The Russell 2000 (-1.16%) is worst off, while the Dow (-0.31%) is best-situated going into the open. This is likely because strong data flies in the face of more rapid cuts from the Fed.

There’s more coming at 10 a.m. ET with the Existing Home Sales report for August.

Update: 5:28 a.m. ET

Everything (We Know) Happening Today

The final full week of the third quarter is drawing to a close. It has been an eventful quarter, which has seen stocks to fresh highs amid the backdrop of weaker economic data and Federal Reserve-flavored anticipation.

But before we wrap up the quarter, we have one more big day of earnings and economic data. Yes, we’ve had plenty of those in what feels like the distant past. However, today is really the last “goodbye” to this remarkably strange three months in the market.

Here’s what to keep an eye on today:

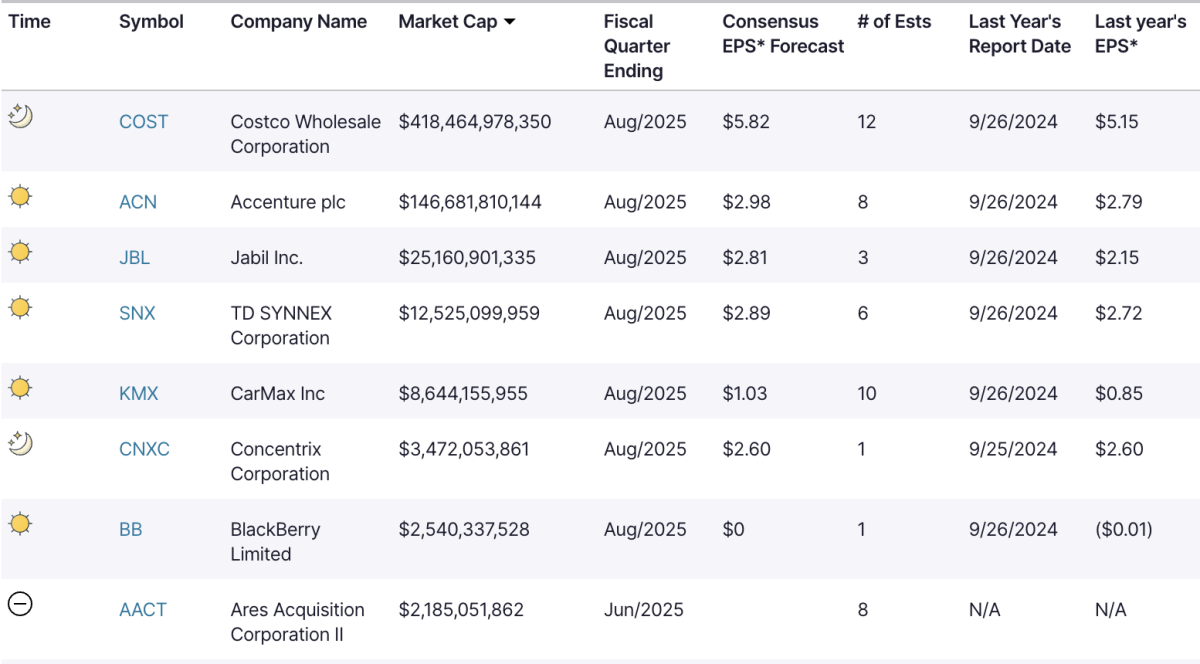

Earnings Today: Costco, Accenture, Jabil

Per Nasdaq, there’s 27 earnings today, including Accenture (ACN) , Jabil (JBL) , and CarMax (KMX) , which are all reporting this morning. And this evening, consumer staple Costco (COST) will be up at the batter’s box, It’s the biggest report of the week.

Here’s all of them with a market cap greater than $1 billion:

Nasdaq

Economic Data & Events: Durable Goods, GDP Growth, Existing Home Sales

Today is the busiest day of economic data this week, with Durable Goods Orders, Q2 GDP Data, Initial Jobless Claims, and Existing Home Sales among the reports coming this morning.

Not only that, but those versed in Fedspeak will be up bright and early for commentary from the Chicago Fed’s Austan Goolsbee. Later in the day, there’s even more Fed leaders slated to speak.

Here’s everything on the docket for today:

TradingEconomics

RELATED POSTS

View all