Stock Market Today: Stocks notch fresh records despite hotter than expected inflation print

September 12, 2025 | by ltcinsuranceshopper

This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Thursday. This is TheStreet’s Stock Market Today for Sept. 11, 2025. You can follow the latest updates on the market here with our daily live blog.

Update: 4:07 p.m. ET

Market Roundup: New Records, Galore

The U.S. equities market is now closed. The Russell 2000 (+1.72%) careened closer to an all-time high, jumping to 2,418.95. The Dow (+1.36%) surpassed 46K for the first time, ending the day at a record 46,108. The S&P 500 (+0.85%) rose to 6,587.47, a new record. The Nasdaq (+0.72%) set new its fourth consecutive close; 22,043.07.

Update: 2:59 p.m. ET

Afternoon Headlines: Skydance Bids on WBD, Mortgage rates decline, Trump Appeal

Here are a few bits of news making afternoon headlines:

- Reuters reports that Paramount Skydance plans to bid for Warner Bros. Discovery, cable networks and all, with a bid backed by the now-richest man in the world.

- Mortgage rates hit an 11-month low, per new data reported by Freddie Mac; a 30Y fixed mortgage was 6.35%, a 15Y fixed was 5.5%.

- The Trump Administration asked a U.S. appeals court to review a decision that ruled that the President could not fire Fed Governor Lisa Cook

Update: 1:57 p.m. ET

Midday Check-Up: Zoom Out

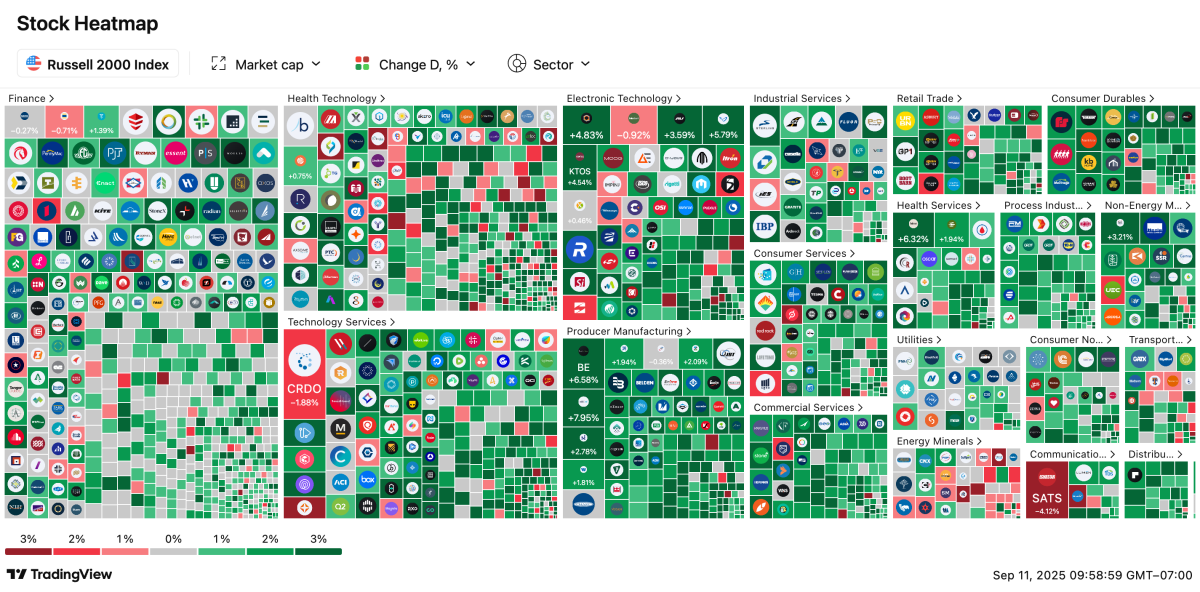

Over the midday hump, some equity benchmarks have pulled back a bit. not the Russell 2000 (+1.44%), though. It’s having an absolute power hour right now.

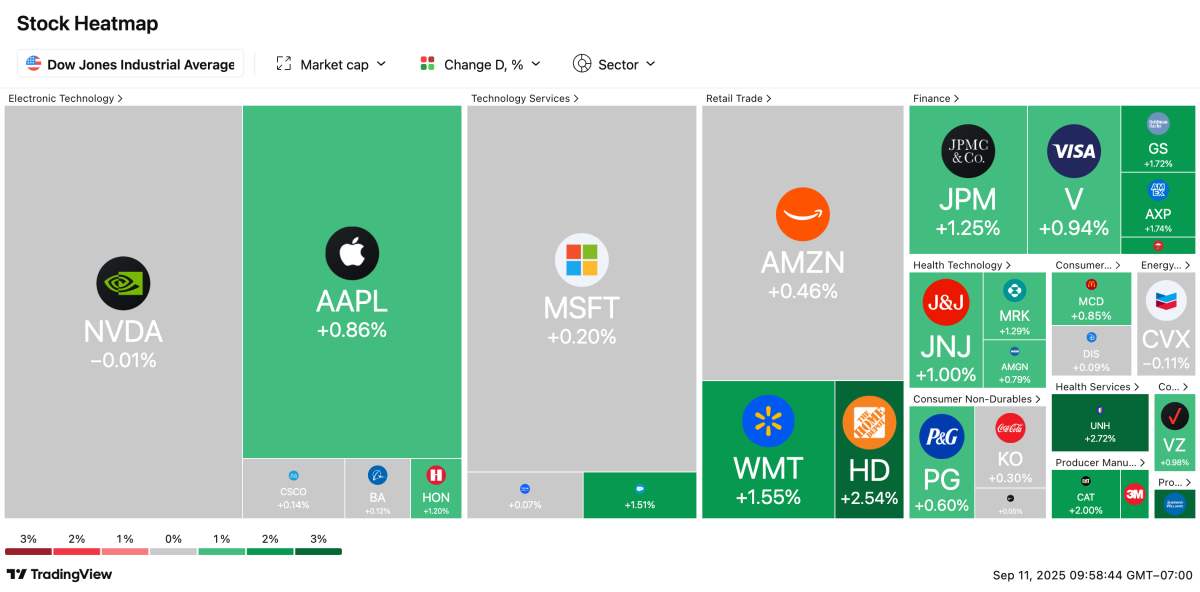

Moving down the list, the Dow (+1.26%) is looking fresh like mint. Almost all of the index’s members are trading to the upside today, or little-changed. Really, the only asset that’s down right now is Chevron (CVX) and Nvidia (NVDA) , down 0.11% and 0.01% a piece.

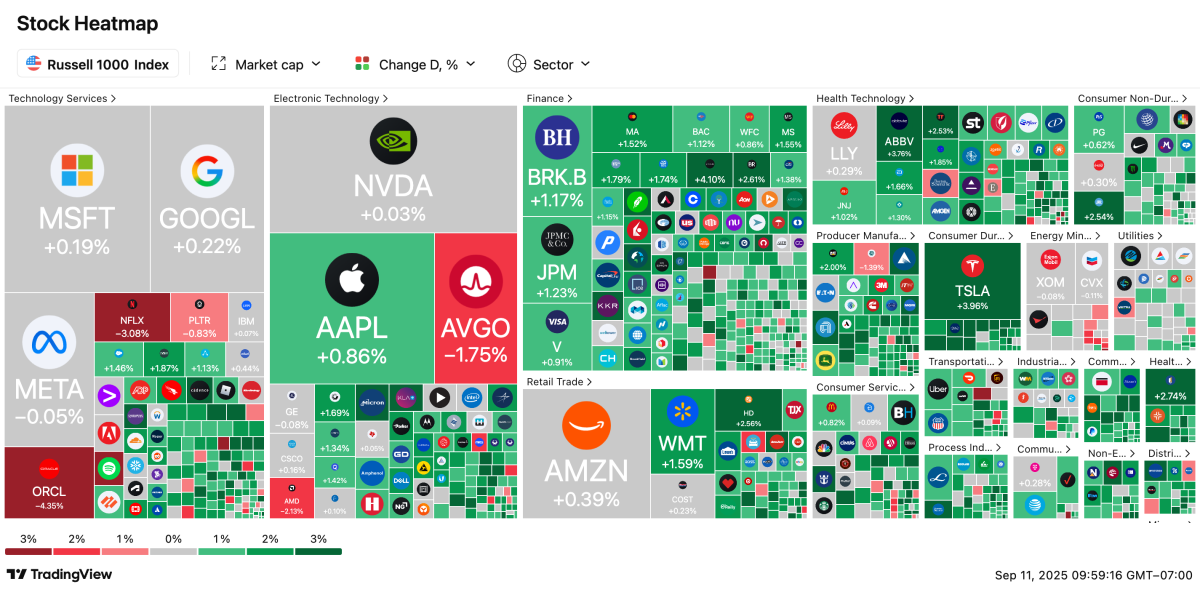

And finally, the S&P 500 (+0.77%) and Nasdaq (+0.64%) are still on track or a record close. Zooming out a bit further, the Russell 1000 (+1.09%) index captures substantially all of the S&P and Nasdaq universe, plus some other mid and large-cap names. Check out where all the gains are concentrated…

Update: 10:36 a.m. ET

Equities Rally: Indexes Setting All-Time Highs

The Dow (+1.27%), S&P 500 (+0.71%), and Nasdaq Composite (+0.56%) just notched fresh intraday highs, continuing to add to gains which have accelerated in light of ailing economic data and rising rate cut odds. At 46,070.56, 6,578.52, and 22,008.94, the indexes could also be on track to set new record closes at this rate, too.

The Russell 2000 (+1.01%) might also be heading that way too, just a few points off of two fresh records of its own; its latest intraday high was in Nov. 2024 (2,466.49), while its last close was in Nov. 2021 (2,442.74). It’s currently sitting at 2,402.52.

Update: 9:32 a.m. ET

Opening Bell: Stocks Recovering

The U.S. stock market is now open. Stocks, which sold off after a mixed morning of economic data, are soldiering back. The Nasdaq, S&P 500, and Dow are up 0.37%, 0.33%, and 0.22% respectively. The Russell 2000 (-0.16%) fell.

Here are some of the headlines making headways this morning:

Three interest rate cuts by year-end are now fully priced in, reflecting anxiety about a weakening U.S. economy.

Delta (DAL) (-0.23%) restated its annual profit forecast and narrowed revenue expectations as travel demand remained strong; airfares rose 5% year-over-year in the CPI report

Novo Nordisk (NVO) (+0.07%) has told staff to return to office five days a week after announcing that it will lay off over 9,000 workers

Opendoor (OPEN) (+53%) has brought its co-founders back to the board and hired Shopify’s COO to head up the ailing firm and recent retail favorite.

Oracle (ORCL) (-4.5%) is declining after recent earnings performance; 35%+ rally in the last two trading sessions.

Centene CNC (+11.6%) rising after affirming its full-year guidance, pulling up other health care peers.

Blockchain lending company Figure FIGR is set for its IPO today, pricing at $25/sh

Update: 8:46 a.m. ET

Pre-Market Check In: Investors Marinating On Results

A hotter-than-expected CPI print and the worst initial claims showing in roughly four years caused U.S. equity futures to tank in the run up to the opening bell.

At last look, the Nasdaq, S&P 500, and Dow are up just a few bips now, paling losses from the negative reports. Still, despite the increase in inflation, investors still see a 25 basis point (0.25%) cut by the Fed as a lock at the forthcoming central bank meeting.

The Russell 2000 fell into the negative ahead of the trading day. The 10Y Treasury, a key benchmark, briefly dropped to 4.002% (-0.74 bips) after the economic data results.

Really, the only asset rising off the backs of today’s report was Gold. Comex Continuous Futures jumped in the report, but to call it ascendent would be a little misleading, seeing how it is: a) once again falling; and b) still lower than where it was last night.

Update: 8:30 a.m. ET

Data Drop: Consumer Price Index Is Out

After yesterday’s wholesale inflation release showed that prices declined in August, some investors wondered what that would bode for consumer prices.

Surprisingly, the Consumer Price Index (CPI) just dropped and was hotter than expected. Inflation advanced 0.4% in August, rising 2.9% year-over-year, faster than expected.

Energy, food, and shelter inflation were to blame for some of the reading. Energy rose 0.7%, food prices rose 0.5%, and shelter rose 0.4%, per the Bureau of Labor Statistics.

If you take out food and energy though and just look at Core CPI, you’ll see that prices came in as expected. Core CPI rose 0.3% to 3.1%, falling within expectations.

Investors were looking for an increase of 0.3% on both the CPI and Core CPI. The surprise advance, especially after the Producer Price Index (PPI) saw surprise a decline in the month of August, could introduce new questions about the Fed’s direction.

However, in positive news: tariffs did not rear their ugly head in the CPI print for the month, as heavily-imported components of the report (e.g: furniture, apparel) did not see significant month-over-month changes.

Data Drop: Initial Jobless Claims Tick Up Again

Initial & Continuing Claims are just crossing the wire for the week.

Initial Claims rose to 263,000 (Prev: 236,000), the highest reading in about four years, bringing the four-week average of claims to 240,500 (Prev: 230,750).

Continuing Claims stayed grounded at 1.939 million.

Earnings Today: Adobe, Kroger, RH

Yesterday, we had two domestic firms lined up to report with a market cap greater than $1 billion. Today, we have a few more; five, to be exact.

Among them are design tech company Adobe (ADBE) , grocery giant The Kroger Company (KR) , RH (RH) , and National Beverage Corp. (FIZZ) . China-based Cheetah Mobile CMCM is also reporting.

The reports are among the stragglers of an earnings season which has defied investors’ expectations and stirred newfound optimism about the trajectory of U.S. equity markets. In a short few weeks, many investors will turn their attention to the next wave of earnings as Q3 earnings tee off.

RELATED POSTS

View all