Stock Market Today: Stocks finish on high note ahead of Nvidia earnings

August 28, 2025 | by ltcinsuranceshopper

This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Wednesday. This is TheStreet’s Stock Market Today for Aug. 27, 2025. You can follow today’s market updates here on our daily live blog.

Update: 4:43 p.m. ET

Chipmakers Fall After Nvidia Earnings

Investors are marinating on Nvidia’s (NVDA) earnings, which landed in investors’ ballpark. Although the results saw the company beat and raise, the stock continues to sink. It’s not the only one.

The VanEck Semiconductor ETF (SMH) (-1.2%) is down, falling with other AI names like Advanced Micro Devices (AMD) (-1.8%), Taiwan Semiconductor (-1.58%), and Marvell Technology (-1.39%), among others.

Update: 4:23 p.m. ET

Breaking: Nvidia Earnings Are Here

Investors are starting to digest Nvidia (NVDA) (-3%) earnings, which just dropped:

Revenue: $46.7 billion; +6% QoQ, 56% YoY (vs. LSEG estimate of $46.06 billion)

Earnings (Non-GAAP): $1.05/sh (vs. $1.01 estimated)

Gross margin (Non-GAAP): 72.7%

Data center revenue was $41.1 billion, while Blackwell Data Center revenue was up 17% sequentially. Cloud service providers represented about 50% of data center revenue.

As previously indicated, Nvidia did not ship any H20 chips to China in the quarter. This remains a point of interest for investors, which will likely be covered on the call this evening.

Networking revenue and gaming revenue surprised to the upside, while compute revenue disappointed.

The company sees its current quarter (Q3) guidance at $54 billion, plus or minus 2%. Analysts were looking for $53.1 billion, per LSEG. They see adjusted gross margin of 73% to 74%.

The company is also announcing a $60 billion share buyback. Its quarterly cash dividend will remain $0.01/sh.

Tech stocks are tipping over on the news.

This story is developing and more information will be added shortly.

Update: 4:10 p.m. ET

P.M. Earnings: CrowdStrike, Snowflake, HP

A handful of after hour earnings are trickling in, producing some big after hour reactions. Here are the highlights in after hours, as of publishing:

Crowdstrike Holdings (CRWD) (-7.2%) missed EPS guidance; issued lower-than-expected guidance.

Snowflake (SNOW) (+13%) rising after strong earnings beat, with revenue up 32% year-over-year to $1.1 billion; issued strong guidance.

HP Inc. (HPQ) (+5.1%) is up after a slim beat on earnings and revenue; raising guidance on strong AI hardware results.

Pure Storage (PSTG) (+16%) is up after a healthy earnings beat; annual subscription annual revenue (ARR) rose 18%, faster than the company’s revenue.

Urban Outfitters (URBN) (-7%) after revenue rose 11.3% year-over-year as all five of its core brands saw sales growth.

We are still awaiting results from Nvidia (NVDA) , which will report at 20 after the hour.

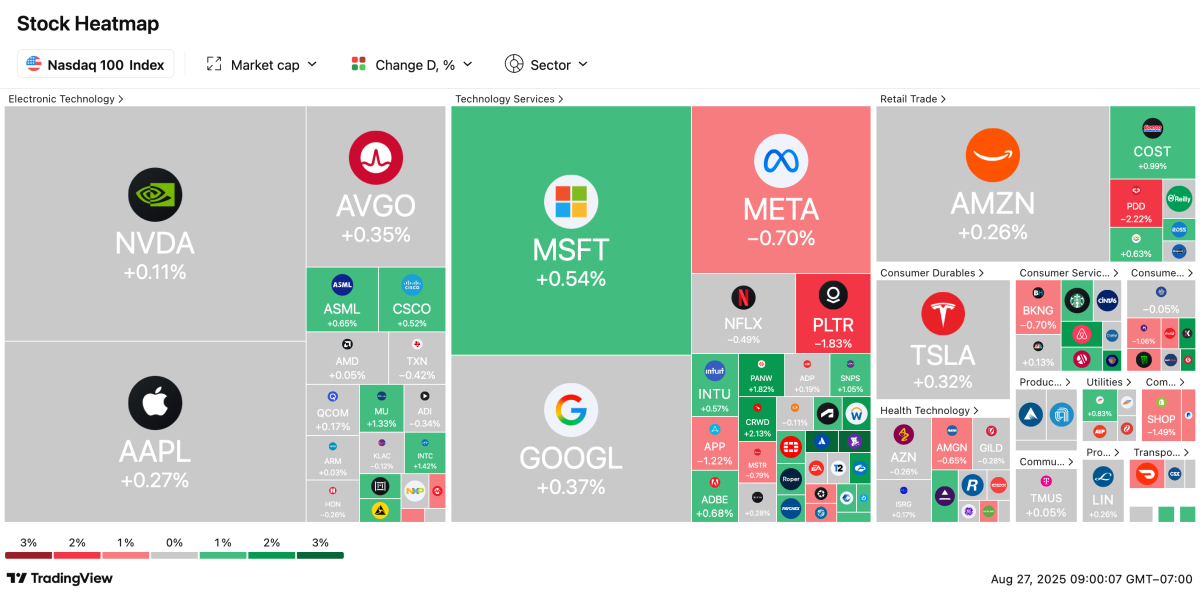

After Market: Movers & Losers

The U.S. stock market is now closed for the day. The Russell 2000 (+0.64%) pulled out another stellar performance, trailed by the Dow (+0.32%), S&P 500 (+0.24%), and Nasdaq Composite (+0.21%). The Nasdaq-100 (+0.17%) which is being carefully watched ahead of some big tech earnings after the bell, saw a modest end-of-day gain.

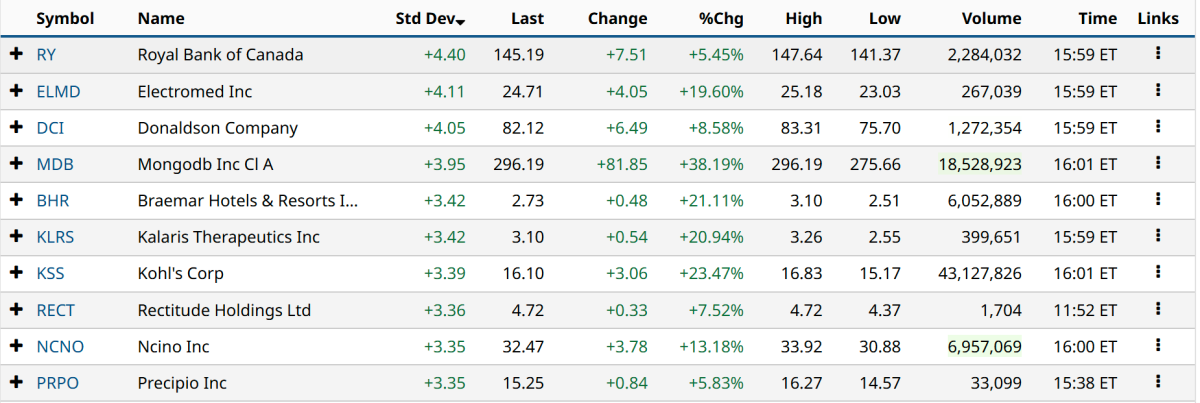

Here were the top ten performers on U.S. exchanges today, per Barchart:

And on the other end of the market, here were the ten worst-performing names today:

Update: 3:40 p.m. ET

Investors await Nvidia Earnings

We’re about 20 minutes away from Nvidia’s (-0.08%) long-awaited quarterly earnings; arguably the biggest report of the season.

Investors have traded the stock in a narrow band over the last few hours. Right now, it’s settled to about even on the day.

The tech-heavy Nasdaq-100 (+0.09%) is similarly situated, up just a few bips, as many of the world’s largest businesses brace for the results.

It’s also a big deal for the U.S. economy: AI has been a driving force in the U.S. GDP in recent quarters, making up for an American consumer which is increasingly facing economic pressure.

As a result, its results could offer clues of where AI is going, as well as how it might contribute to economic growth.

Update: 2:13 p.m. ET

Swiftie See, Swiftie Do

In case you missed it: Taylor Swift is engaged. Yes, we all know.

And now, so does the stock market.

Earlier today, we touched on how fiancé Travis Kelce is announcing a new partnership with American Eagle (+8%), helping boost the stock and its newfound retail popularity.

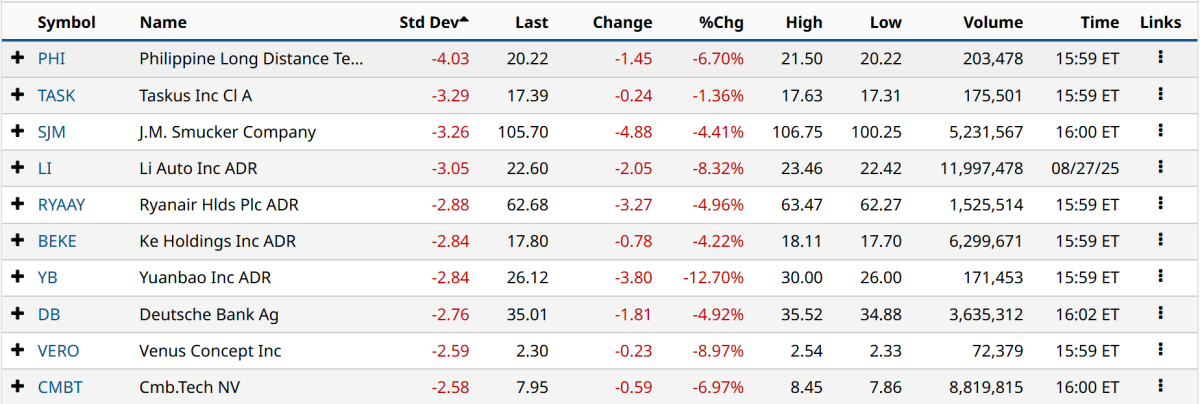

It turns out it isn’t the only stock that the Swifts are moving today. The public wanted to see the ring. In fact, it has become the largest related query when you look up Taylor Swift and Travis Kelce on Google Trends.

Google Trends

It’s a one-of-one though, designed by Artifex Finew Jewelry’s Kindred Lubeck. Still, investors pumped up publicly-traded jewelry company Signet Jewelers (+6%), betting that the ‘cushion cut’ look would fetch the attention of late 20s and early 30-somethings seeking their own fairytale engagement.

Update: 12:31 p.m. ET

Midday Movers: MongoDB, ViaSat, Summit Therapeutics, Deutsche Bank, American Eagle

We’re finally at the midpoint of the market day. Stocks have sank in the last 30 minutes, pushing the Nasdaq Composite (-0.10%) into the red. The S&P 500 might not be far behind, following a similar trajectory. However, the trend is not as pronounced for the Dow (+0.16%) and Russell 2000 (+0.50%).

We’re still adding some details here, but here are some of the stocks that are making headlines and big moves intraday:

MongoDB

Database software company MongoDB (MDB) (+34%) is soaring after its after hour earnings yesterday. Revenues grew 24% to $591 million, while losses narrowed. The company said it added over 5,000 customers in the first half of the year. It’s the market’s best-performing stock today.

ViaSat

Yesterday, AT&T (T) settled on a $23 billion deal for EchoStar’s (SATS) (+13.2%) 50 MHz spectrum licenses in North America. The two are up again today and they’re bringing ViaSat (+5.86%) along with. That’s because an analyst note from William Blair says that the company’s 68 MHz of L-band spectrum might not be sufficiently captured in the company’s valuation.

Summit Therapeutics

Summit Therapeutics (SMMT) (-9.3%) is pulling back after new survival data was released on its partnered drug with Akeso. Ivonescimab, already approved in China, hit its primary endpoint in its phase 3 HARMONi-A trial. Given optimism around its commercial potential in the U.S. and Europe, Summit has soared. The stock has risen over 32% in the past six months.

Deutsche Bank

Investment bank Deutsche Bank (-5%) is falling after being downgraded to “neutral” by Goldman Sachs. They remain bullish, but after nearly doubling year-to-date on the NYSE, the German bank isn’t computing as a “buy” anymore. (Goldman also downgraded Commerzbank AG.)

American Eagle

Fashion retailer American Eagle (AEO) (+8%) has appreciated a much-needed injection to its stock price thanks to a partnership with American heartthrob Sydney Sweeney. Although controversial, the stock has risen 41% since mid-June, thanks in part to the praise of the President himself. Today, it’s going higher again on a new partnership, this time with Travis Kelce. Seen him in the news in the last 24 hours? Seems timing is on their side, even if sales seem not to be.

Update: 12:03 p.m. ET

Temp Check: Stocks Up Ahead of Nvidia Earnings

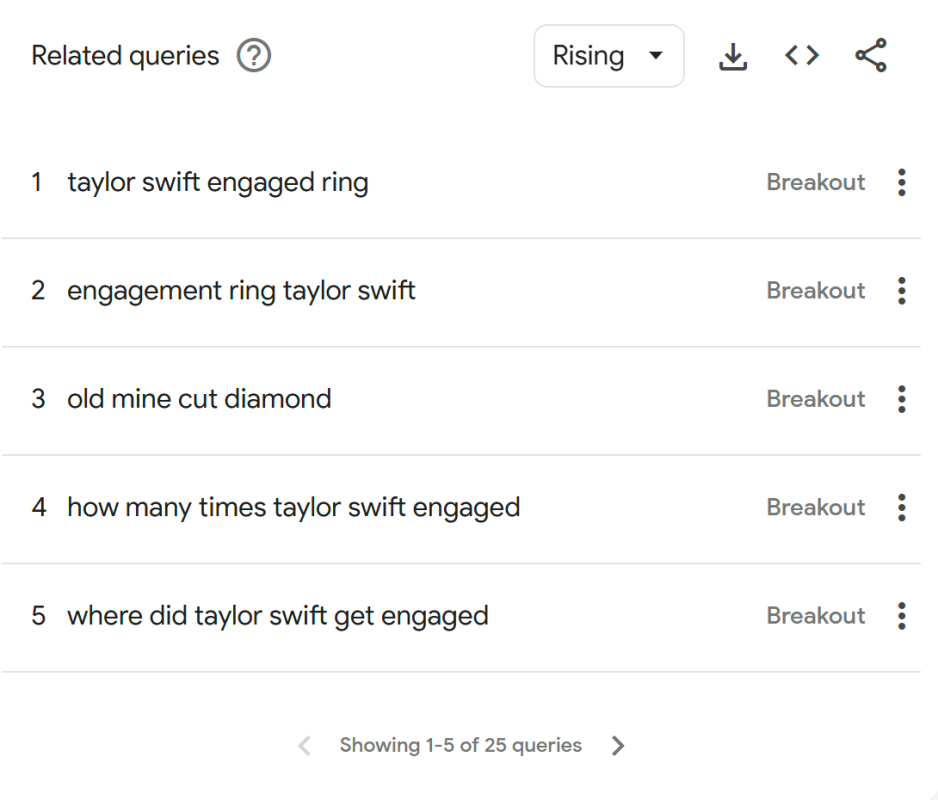

Stocks are now at their session highs, continuing a pattern we’ve seen a lot of recently: slow start, then a rocket. The Dow (+0.22%), S&P 500 (+0.21%), and Nasdaq Composite (+0.17%) are all in the green.

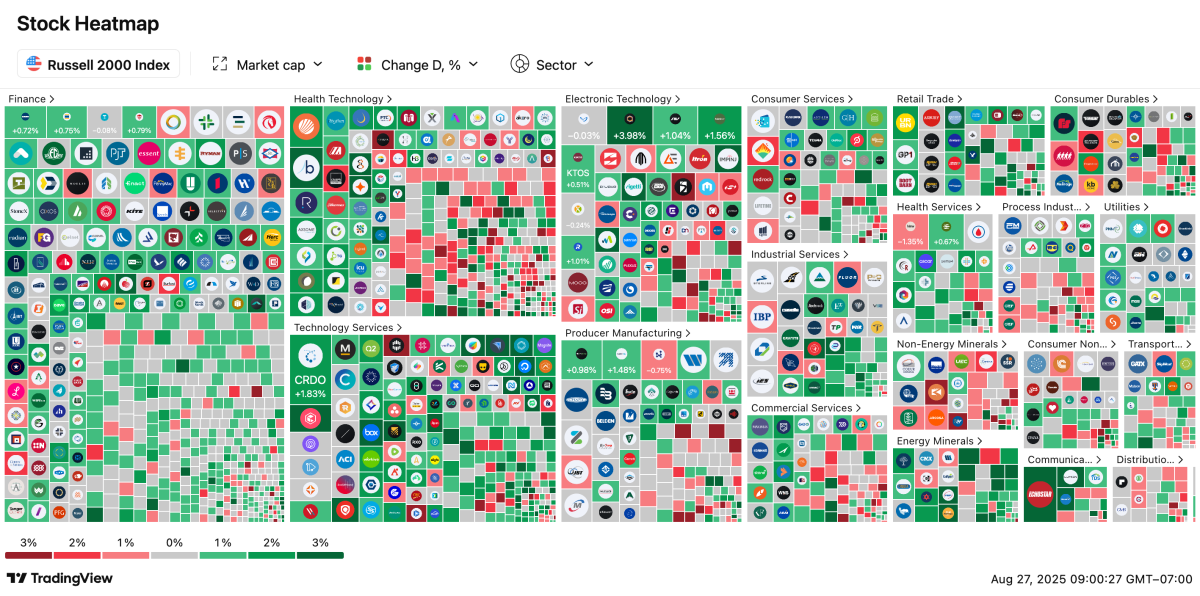

Let’s talk Nasdaq 100 (+0.12%). This concentrated bundle of tech stocks is underperforming every other index. With Nvidia’s (NVDA) (+0.11%) highly-anticipated report coming after the bell, many traders are in ‘wait and see’ mode. You can see it i just how minimal the moves are on the heatmap, especially at the top.

Growth stocks are doing something totally different, though. The Russell 2000 (+0.52%) is awash in green and grey, adding to its days-long rally since the Fed’s rate cut revelation in Jackson Hole, Wyo. last Friday. It’s now up 6.44% on the year, with almost all those gains coming in the month of August.

Update: 10:03 a.m. ET

In Focus: Nvidia Earnings After the Close

This morning, Nvidia (NVDA) (-0.83%) is down before its heavily-anticipated after hours report. Analysts polled by Bloomberg are looking for earnings per share of $1.01 on $46.2 billion in revenue today. That would put year-over-year growth at 49% and 53% respectively.

A lot is riding on hitting those numbers. Options are pointing to a $260 billion price swing on the earnings release. And aside from that, Nvidia is the largest component of the S&P 500 (at 7.64% of the index) and Nasdaq-100 (14.43%). It’s also part of the Dow.

TheStreet team has been writing at length about the earnings and the sky-high expectations imposed on the market’s biggest stocks.

Analysts have recently been revisiting their stock targets for the stock, which our Silin Chen covered last night. For the most part, analysts have been looking to the upside.

Related: Analyst reboots Nvidia stock forecast before earnings

Those targets will have to meet reality today, though. And to that end, Faizan Farooque wrote at length this morning about what investors should keep an eye on in this afternoon’s earnings report:

Related: Nvidia Makes Bold Bet on Future As Earnings Loom

Update: 9:38 a.m. ET

Opening Bell: Better Than You Thought

The market is now open. Three of the four indexes are in the red to start the day, including the Nasdaq Composite (-0.18%) and Russell 2000 (-0.13%). Although, in recent days, the indexes have started their days to the downside, only to rally in the late session.

Speaking of which, the S&P 500 (+0.03%) and Dow (+0.29%) are up to start the morning. Sectors like energy, consumer services, and health technology are flashing green in the early session. However, at large, individual stocks within indexes are pretty flat at the moment.

Update: 8:35 a.m. ET

A.M. Earnings: Royal Bank of Canada, Williams Sonoma, Abercrombie & Fitch

We have seen a few earnings reports cross the wire this morning. Here are some of the highlights, with data provided by TipRanks:

Royal Bank of Canada (RY) (+2%) reported a record quarter as provisions for credit losses came in lower than expected.

Williams Sonoma (WSM) (+1%) delivered strong earnings, while revenues came in line; EPS of $2/sh on $1.837 billion in revenue.

JM Smucker (SJM) (-6%) reported a double miss, with earnings of $1.90 per share on $2.11 billion.

Abercrombie & Fitch (ANF) (-1%) reported a narrow beat, with $2.23 per share on $1.2 billion in revenue.

Kohl’s (KSS) (+17%) delivered nearly double the EPS as expected, with $0.56 per share on $3.35 billion in revenue.

Update: 8:11 a.m. ET

Futures At Session Lows

Futures are suggesting something about the anticipation around today’s blockbuster report, with the S&P 500 and Nasdaq 100 at session lows in futures trading. We’ll see if they can lock in for the open.

Update: 7:35 a.m. ET

Goldman Sach’s Low-$50 Oil Prediction

Goldman Sachs GS is out with a fresh note on the oil market, saying that Brent crude will drop to the “low $50s” by the end of 2026 as additional capacity is utilized. From today’s brent price, such a decline would be between 15% and 25%.

Update: 5:21 a.m. ET

Earnings Today: Nvidia, CrowdStrike, Snowflake

Investors have been awaiting today’s biggest report all season: chip giant Nvidia (NVDA) . The company is the most valuable company in the world (and the largest component of both the S&P 500 and Nasdaq-100 indexes). As such, its report is bound to be a major market mover when the report comes down after hours.

Despite its enormous importance, it won’t be alone today. In fact, there’s a number of other reports on deck. Per Nasdaq, there are 61 reports in order today, including Royal Bank of Canada (RY) , CrowdStrike Holdings (CRWD) , and Snowflake (SNOW) .

Economic Data: MBA Mortgage Data & EIA Data

Taking a backseat today, economic reports from the Mortgage Bankers Association and Energy Information Administration will be at the forefront of economic data reports. All data is for the week of Aug. 22, 2025.

7:00 a.m.

- MBA 30-Year Mortgage Rate [Prev: 6.68%]

- MBA Mortgage Applications [Prev: -1.4%]

- MBA Mortgage Market Index [Prev: 277.1]

- MBA Mortgage Refinance Index [Prev: 926.1]

- MBA Purchase Index [Prev: 160.3]

10:30 a.m.

- EIA Crude Oil Stocks Change [Prev: -6.014 million]

- EIA Gasoline Stocks Change [Prev: -2.72 million]

- EIA Cushing Crude, Distillate Fuel, Heating Oil, and Refinery Crude Runs Change

11:30 a.m.

- 17-Week Bill Auction [Prev: 4.050%]

12:45 p.m.

- The Richmond Fed’s Tom Barkin will speak

1:00 p.m.

- 5-Year Note Auction [Prev: 3.983%]

All times are in Eastern Time.

RELATED POSTS

View all