Stock Market Today: Stocks Emerge Stronger Into Close Despite Economic Data Delays, Gov't Shutdown

October 3, 2025 | by ltcinsuranceshopper

Stock Market Today, our daily live blog, is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Thursday. This is TheStreet’s Stock Market Today for Oct. 2, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 4:00 p.m. ET

Closing Bell: Index Roundup

The U.S. stock market is now closed. If you could use one word to describe the performance of S&P 500, Dow, Nasdaq, and Russell 2000, you might just say: “Flat-ish, flat-tastic, not exceptionally flat, and fantastic.”

That’s because the indexes all finished the day in the green, even if the returns from the S&P 500 (+0.06%) and Dow (+0.17%) weren’t particularly awe-inspiring. Showings from the Nasdaq (+0.39%) and Russell 2000 (+0.61%), on the other hand, were a little more inspiring.

And just to think, this is all happening during a government shutdown, with economic data currently on the rocks! Is it too early to declare this ignorance bliss? Or are investors just getting excited about the increasingly heavy sense that the Fed will choose to cut rates in the dark?

Stick around SMT: In a few minutes, we’ll release our market roundup for the day.

Update: 2:53 p.m. ET

You’ve Seen This One Before: Stocks Rise Into Late Day

The Nasdaq Composite (+0.40%) has been going strong all day, but it seems the rest of the major U.S. equity indexes want to come along with. In fact, the Russell 2000 (+0.51%), which spent a healthy portion of the day sagging, is now leading the mix. The Dow (+0.26%) and S&P 500 (+0.12%) are also on the rise, heading into the last hour of trading.

Update: 12:35 p.m. ET

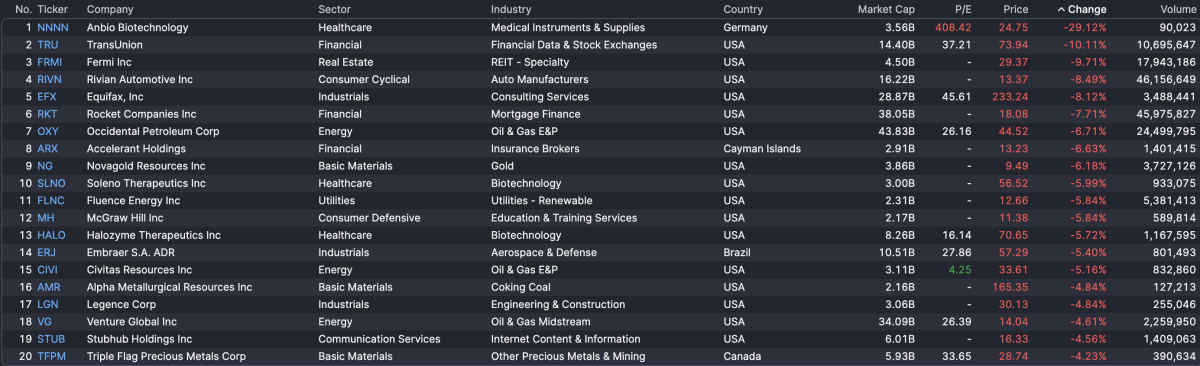

Today’s Movers & Losers: Ondas, Fair Isaac, Anbio, TransUnion

Here are today’s top and bottom 20 performers on the market today (sorted with market cap >$2 billion).

Movers

In movers today, Ondas Holdings (ONDS) (+25%) is leading the mix, followed by Fair Isaac FICO (+20%), which we touched on below. Sarepta Therapeutics SRPT (+16%) is also among the bunch.

Here’s all of the top 20 performers at midday:

Losers

Anbio Biotechnology NNNN (-29%) is the worst-performer amid valuation concerns. Not far behind, market newcomer Fermi FRMI (-9.7%) is having a bad second day on markets, falling after a fantastic IPO day.

TransUnion TRU (-10%) and Equifax EFX (-8%) are also still in the dumps, which we covered below.

Update: 11:58 p.m. ET

Stock of the Day: Fair Issac’s Fairly Impressive Rally

Credit score provider Fair Isaac FICO (+20%) is the best-performing stock in the S&P 500 today after rolling out a new pricing option that allows mortgage lenders to go directly to them to pull credit scores, rather than interfacing with the three major U.S. creditors.

The new product will allow lenders to also choose how they want to be billed: either a flat $10 fee or a performance option which includes $4.95 upfront and a $33 fee once a loan closes.

The shakeup bodes some big changes for credit-scoring, coming after the Federal Housing Finance Agency tapped the three credit agencies’ VantageScore for government-backed mortgages, threatening its long-standing leadership in the market.

The news is weighing on shares of major creditors, including TransUnion (-12.5%), Experian (-5.2%), and Equifax (-9.4%). The latter of which is now the worst-performing stock in the S&P 500 today.

Update: 11:55 a.m. ET

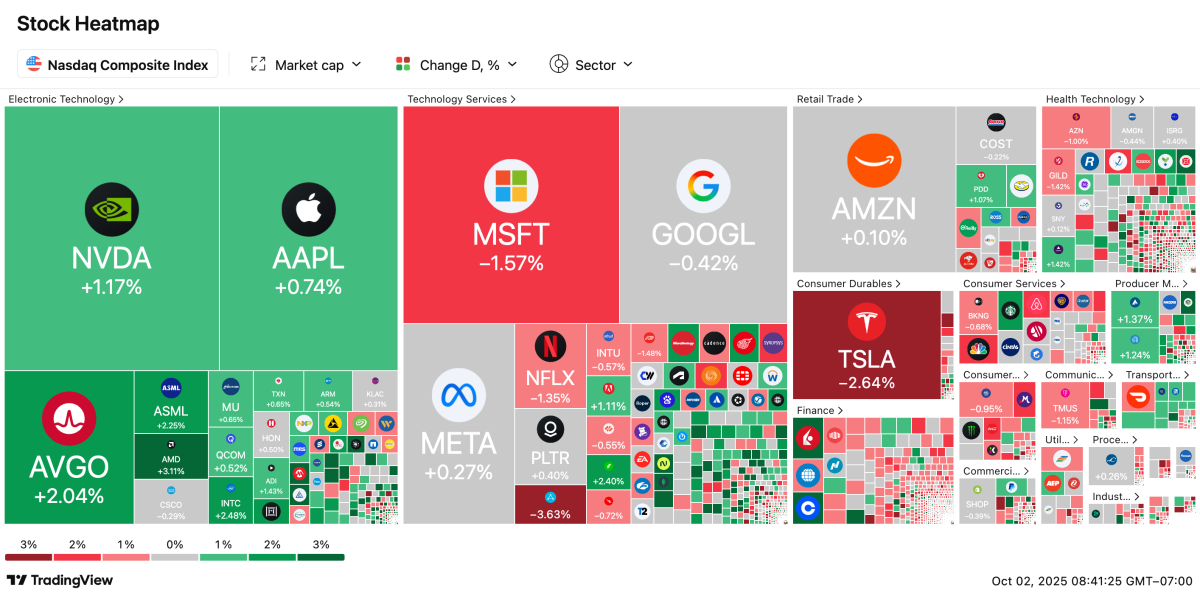

Heatmap: Nasdaq Composite

Let’s take a second and look at the one index that’s keeping its head above water today: the Nasdaq Composite (+0.25%).

They say some things never change. The Electronic Technology sector is the sole consolation of the broader index today, while companies like Tesla (TSLA) (-2.64%) and Microsoft (MSFT) (-1.57%) weigh down other megacaps.

Otherwise, it’s a pretty grey day for the index:

Update: 11:35 a.m. ET

Midday Briefing: Stocks Tip Over

In recent days, stocks have been sluggish out of the gate and mounted a surprise comeback to close out the day. Today looks like it might be going a little different.

Heading into midday, stocks are dipping. The Russell 2000 (-0.14%), S&P 500 (-0.17%), and Dow (-0.26%) are all in decline. The Nasdaq (+0.06%) is the sole exception right now, but it’s still barely above session lows.

Meanwhile, the Cboe Volatility Index VIX (+3.1%) is jumping.

Update: 10:44 a.m. ET

Challenger, Gray & Christmas: Hiring Plans At Lowest Since 2009

According to a report from outplacement firm Challenger, Gray & Christmas, U.S. employers are planning to add jobs at the slowest rate since 2009.

This year, employers have planned to add less than half of the jobs they added last year, with just 204,939 job additions. Meanwhile, job cuts have towered near a million, a milestone not seen since the Covid-19 pandemic.

Update: 9:30 a.m. ET

Opening Bell: Stocks Jump Out of the Gate

The U.S. equities market is now open. Out of the gate, the Nasdaq (+0.59%) is leading the pack, sitting at 22,890.44, approaching 23K. The S&P 500 (+0.24%) is sitting above 6.7K at 6,725.69. Both hit an intraday record shortly after the open.

Also notable: The Russell 2000 (+0.24%) is at 2,442.54. Lastly, the Dow (+0.14%) is at 46,496.05. Outside of equities land, Gold is also on the rise, approaching the $4K threshold. Spot hit a record of $3,895.23. Futures are also trending higher.

Update: 9:03 a.m. ET

Tesla Delivers Q3 Deliveries: 497,099 Vehicles

Tesla (TSLA) just announced Q3 deliveries which vastly beat expectations. The company delivered 497,099 vehicles, vs. the Bloomberg estimate of 439,612. That made it its best quarter of deliveries ever.

The surprise likely stemmed from last-minute EV buying, which came ahead of the sunsetting of a federal tax credit. However, production came up short of expectations, with just 447,450 cars produced. Analysts were looking for 450,313.

Announced in concert, EV competitor Rivian (RIVN) delivered 13,201 vehicles, versus estimates of 12,955. It now sees deliveries for the year in a range between 41,500 to 43,500.

Update: 4:38 a.m. ET

Everything Happening Today (That We Know Of)

Good morning and an (un)happy day two to government shutdown watchers. Yesterday, as the government shut down at 12:01 a.m. ET, various agencies began furloughing approximately 750,000 employees. Today, we might get a glimpse of President Donald Trump’s plans to conduct mass layoffs.

This morning, stock futures are pointing up, with the Nasdaq (+0.39%) and Russell 2000 (+0.39%) showing gains before the open. The S&P 500 (+0.17%) and Dow (-0.07%) are showing less impressive moves from the close yesterday, which saw stocks stage a late-day rally.

Here’s what is on deck for today:

Economic Data & Events

Ordinarily, today would have marked the release of Initial & Continuing Jobless Claims. However, with the government shut, data from the Bureau of Labor Statistics will be delayed. So too will other data, like Factory Orders.

So what will we get? Well, the Challenger Job Cuts data, which is already out and showed 54,064 layoffs in September. That was a considerable deceleration from last month’s 85,979 cuts and a hair more than a third of the analyst expectation of 150,000.

Then, later today, we’ll hear from Dallas Fed President Lorie K. Logan at 10:30 a.m. ET. Otherwise, nothing else is really on the docket.

Earnings Today

As we roll over from the third quarter into the fourth quarter, we’ll have a lull in terms off reports from companies. As a result, there are no substantive earnings reports today, per data sourced from Nasdaq.

RELATED POSTS

View all