Stock Market Today: Stocks decline after disappointing consumer & business sentiment data

August 29, 2025 | by ltcinsuranceshopper

This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Friday. This is TheStreet’s Stock Market Today for Aug. 29, 2025. You can follow today’s market updates here on our daily live blog.

Update: 4:00 p.m. ET

Closed for the Long Weekend: August Roundup

That’s a wrap on August. The U.S. stock market is now closed for the Labor Day weekend. And while it certainly could’ve ended off better— as U.S. equities sank on economic data concerns —we need to zoom out a little bit.

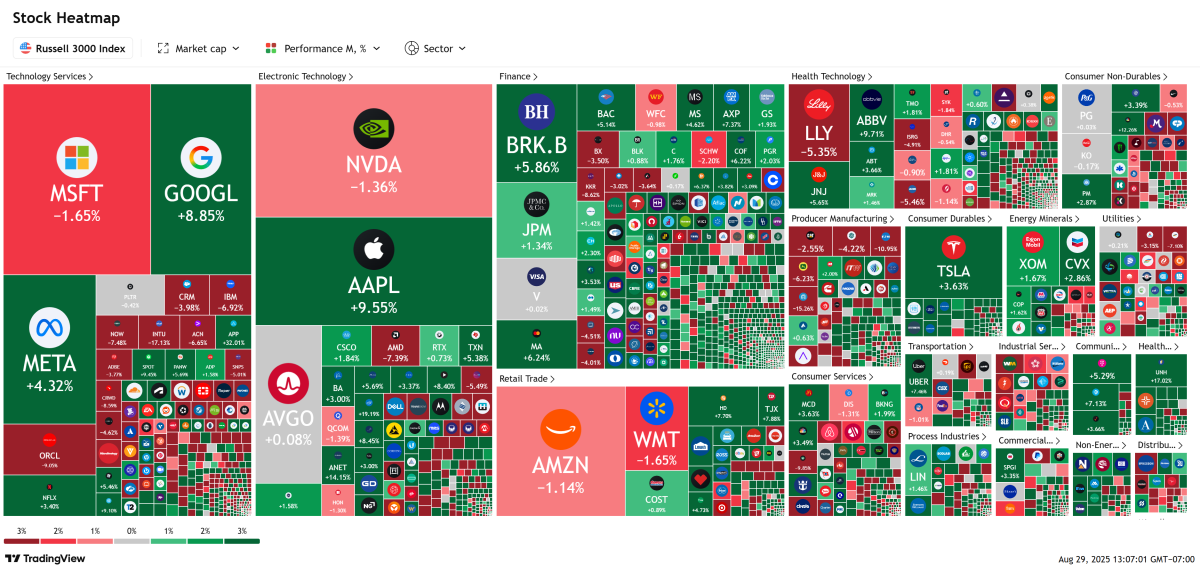

Check out the 1-month performance on the Russell 3000, an index which captures most of the universe of small, mid and large-cap equities in the U.S. Sure, there’s pockets of red, but there’s a whole lot of green:

TradingView

With today’s close, the Nasdaq Composite notched its fifth consecutive monthly gain, rising 1.69% in the month of August. The S&P 500 notched its 20th all-time high on Thursday, joining the Dow in capping off its fourth consecutive month of gains; they rose 1.4% and 2.04% in August respectively.

August was also the month that the Russell 2000, which has lagged behind its index peers, made the right kind of headlines. It ascended 5.33% this month on rate cut hopes. It’s also catching investors’ eyes for its favorable valuation.

Update: 3:06 p.m. ET

Oops, All AI: Ambarella, IREN Limited, Marvell, Dell Technologies

Aside from today’s China-themed stocks, many big-movers are coming from AI land. Semiconductor design company Ambarella (AMBA) (+17.7%) and data center firm IREN Limited (IREN) (+13.2%) are ripping. Those might be unfamiliar names, but their respective earnings show that they’re benefiting from the halo of the boom in the AI market.

On the other hand, more-recognizable AI trades like Marvell Technology (MRVL) (-18.5%) and Dell Technologies (DELL) (-8.8%) are plummeting after their respective earnings. The former’s data center revenue and forecast left something to be desired, while the latter met expectations but issued weaker guidance. Obviously, one is paying a much steeper price today.

Update: 2:06 p.m. ET

Tale of Two Chinese Stocks: Alibaba and Chagee

It’s a little past midday, but we figured we’d spare some space for two Chinese stocks making big intraday moves on the market. Both reported earnings this morning and are now going completely different directions.

Alibaba

Chinese tech giant Alibaba (BABA) (+13%) is having a fantastic day after reporting earnings this morning. The company’s cloud business is to thank for the pop; it grew 26% year-over-year.

The high-margin business bolstered the company’s net income by over 78% in the quarter. Its revenue, for contrast, grew just 2% YoY. Without cloud growth’s contribution, net income would have actually declined in the quarter.

Chagee

Flip side of the China trade today, Chinese tea company Chagee Holdings CHA (-11.8%) is facing some steep losses intraday after its own earnings. Revenues rose 10.2%, but net income shrank by 87.7%.

The company, which has over 7,000 worldwide stores, has only recently begun its rollout in the U.S. market. Its first location at Westfield Century City in Los Angeles, CA is planned to be the first of hundreds in the States.

Update: 12:46 p.m. ET

Midday Movers: Whether Small-cap or Mega-Cap…

Doesn’t matter, it’s down today. After a slew of economic reports this morning, stocks are just off session lows. The Nasdaq (-1.05%) is still at the bottom of the major indexes, trailed by the S&P 500 (-0.62%) and Russell 2000 (-0.47%). Gold is now up 1.2% intraday.

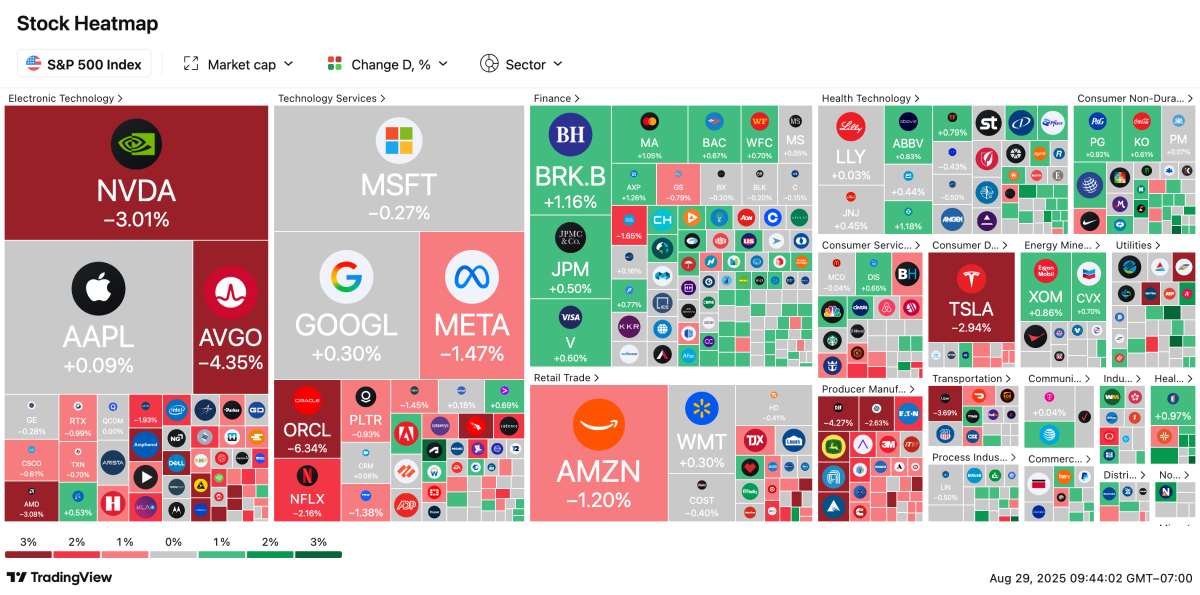

Starting at the very top, Nvidia (NVDA) investors are selling off the stock, taking down a significant portion of the tech sector with. Here’s how the S&P 500 is cropping up at mid-day:

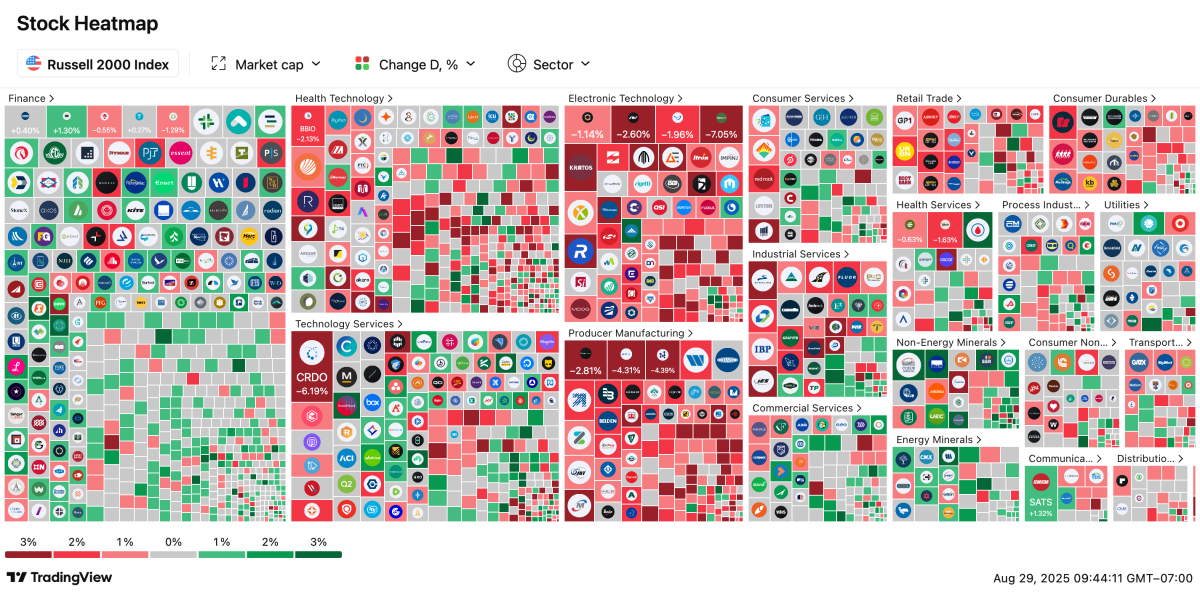

That trend isn’t just the case for the S&P 500, mind you. It’s also the case in the Russell 2000, which has been a best-performer out of the major U.S. indexes over the last two weeks. Take note where the losses are coming from today:

Update: 11:34 a.m. ET

Headlines Ahead of the Long Weekend

Here’s what is making newsprint before the three-day Labor Day weekend:

- Core PCE is the highest its been since Feb. 2025, likely signaling higher inflation ahead; Gold rose 1% on the report.

- U.S. oil production hit a record high in Jun. 2025, per EIA, surpassing a previous record from Oct. 2024. [Reuters]

- Over 90% of shipments to the U.S. will now face a flat tariff rate when they arrive as the de minimis exemption is wound down.

- The U.S. revoked licenses allowing South Korea’s Samsung and SK Hynix to use domestic technologies in hardware sold to China. [Bloomberg]

- Japan’s top trade negotiator called off a planned trip to the U.S. as further negotiations were needed.

- Odds of a government shutdown are seen rising on predictions markets such as Kalshi and Polymarket.

Update: 10:04 a.m. ET

Opening Bell: Steep Start

The market is now open and it’s off to a bad start. After a wide array of economic reports this morning, the Nasdaq Composite (-1.25%) is off a full percentage point. The S&P 500 (-0.73%) wasn’t far off, with its decline spiking the Cboe Volatility Index (+5%) in the early trade. The Dow (-0.53%) and Russell 2000 (-0.07%) were most-insulated against the poor readout.

Despite that, the U.S. equities market has had a fantastic August. So long as things don’t get much worse, the Nasdaq will have notched a fifth consecutive monthly gain. The S&P (good for 20 all-time highs as of Thursday) and the Dow will cap off their fourth consecutive month of green.

We will add more information here as events develop.

Update: 8:12 a.m. ET

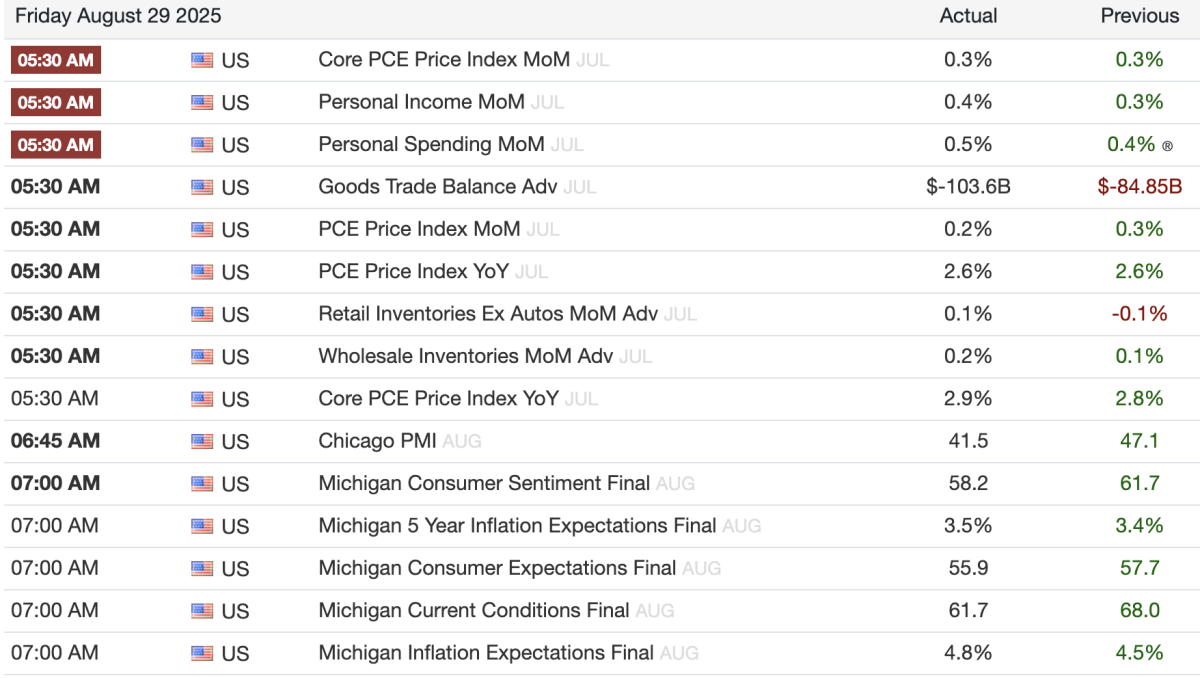

Data Drop: PCE, PMI, UM Consumer

Investors were in for a treat before the market open this morning: a large swath of economic data. Unlike in recent days, it wasn’t seen positively.

Core PCE accelerated at the fastest rate since Feb. 2025, rising 2.9% year-over-year, matching expectations.

Personal spending outstripped personal income, while Consumer Sentiment and Chicago PMI (business sentiment) sagged month-over-month. Both came in below analyst expectations.

Here’s the breakdown of everything that reported this morning:

TradingEconomics

Update: 4:11 a.m. ET

Pre-Market Reactions: Stocks down ahead of key economic prints

Mere hours after the S&P 500 and Dow notched record highs, U.S. stock market indexes are dipping, heading into the final market day before the Labor Day weekend.

The Dow (-0.24%), Nasdaq Composite (-0.23%), Russell 2000 (-0.18%), and S&P 500 (-0.16%) are all down for the moment.

Update: 3:55 a.m. ET

Economic Data: PCE, PMI, UM Consumer Sentiment

Nasdaq says that just 19 firms are set to report today, meaning that economic data will be the most important force in the market today. Here’s what the market will likely be watching out for:

8:30 a.m. ET

- Core PCE Price Index [Prev: +0.3% MoM; +2.8% YoY]

- PCE Price Index [Prev: +0.3% MoM; +2.6% YoY]

- Personal Income [Prev: +0.3% MoM]

- Personal Spending [Prev: +0.3% MoM]

9:45 a.m. ET

- Chicago Business Barometer [PMI] (Jul) [Prev: 47.1]

10:00 a.m. ET

- UM Consumer Sentiment Final (Aug) [Prev: 61.7]

- UM Consumer Expectations (Aug) [Prev: 57.7]

- UM Current Conditions (Aug) [Prev: 68.0]

- UM Inflation Expectations (Aug) [Prev: 4.5%]

- UM 5 Yr Inflation Expectations (Aug) [Prev: 3.4%]

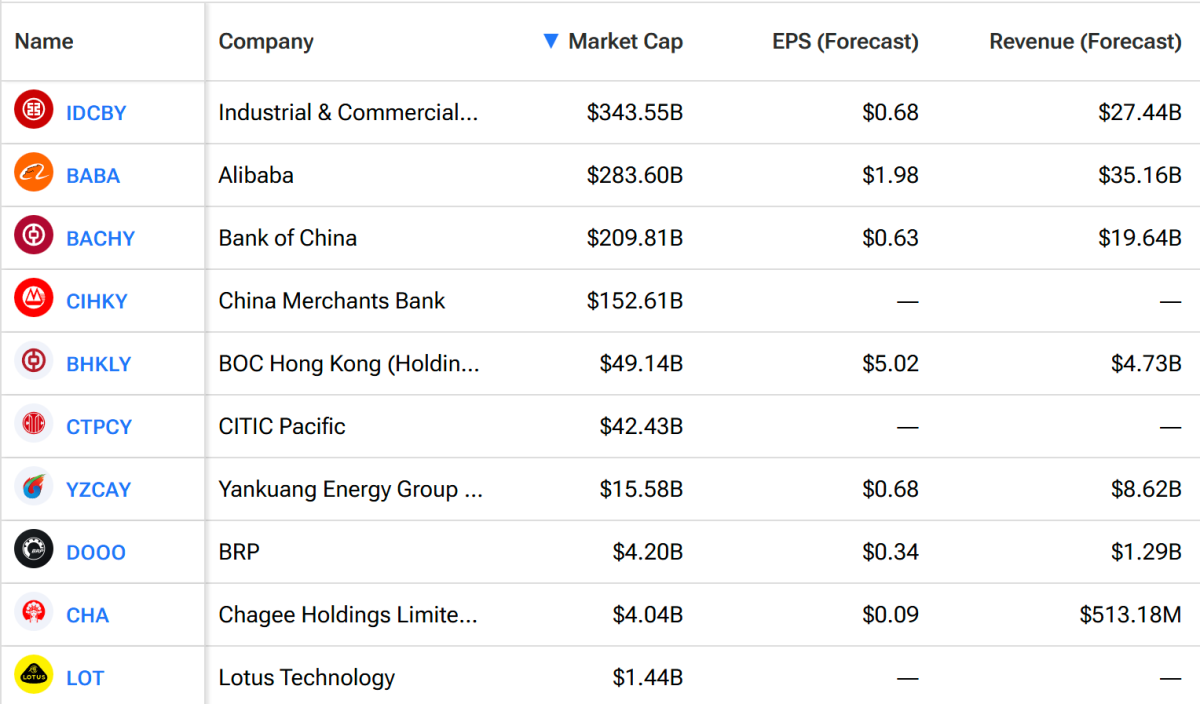

A.M. Earnings: China Earnings, Front and Center

Capping off a busy week of earnings is a Friday full of reports, particularly from Chinese-based firms. Atop the list are firms like Alibaba (BABA) and Chagee Holdings CHA.

RELATED POSTS

View all