Stock Market Today: Nasdaq, S&P 500 down over 1% after holiday weekend

September 3, 2025 | by ltcinsuranceshopper

This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Monday. This is TheStreet’s Stock Market Today for Sept. 2, 2025. You can follow the latest updates on the market here with our daily live blog.

Update: 5:23 p.m. ET

P.M. Headlines: Google escapes divestment worries, Trump warns on tariffs

We’re about to head out for the evening. However, a few more notes before we cap off the first trading day of September.

Let’s start with the biggest piece of after hours news, from Alphabet (GOOGL) . Their antitrust suit is finally going their way (well, as ‘their way’ as such a thing could go) after a judge ruled they would not have to divest Chrome or Android.

Related: Alphabet stock soars after Judge rules that Google can keep Chrome, Android

In addition, Trump’s tariffs are taking center stage after today’s tumultuous trading day. Top of mind is what will happen if the Supreme Court ultimately rules against Trump, undoing the tariffs. In that case, billions will have to be paid back to businesses. That has investors on edge.

Related: Trump warns that America could become “a third world country” if this happens

Finally, we wanted to touch on “peak IPO.” There’s three big fintech / crypto reports coming this week and we wanted to highlight them, as well as how retail investors might be able to get their hands on these names before they start trading:

Related: These three buzzy fintech IPOs could be worth buying before they even start trading

Update: 4:09 p.m. ET

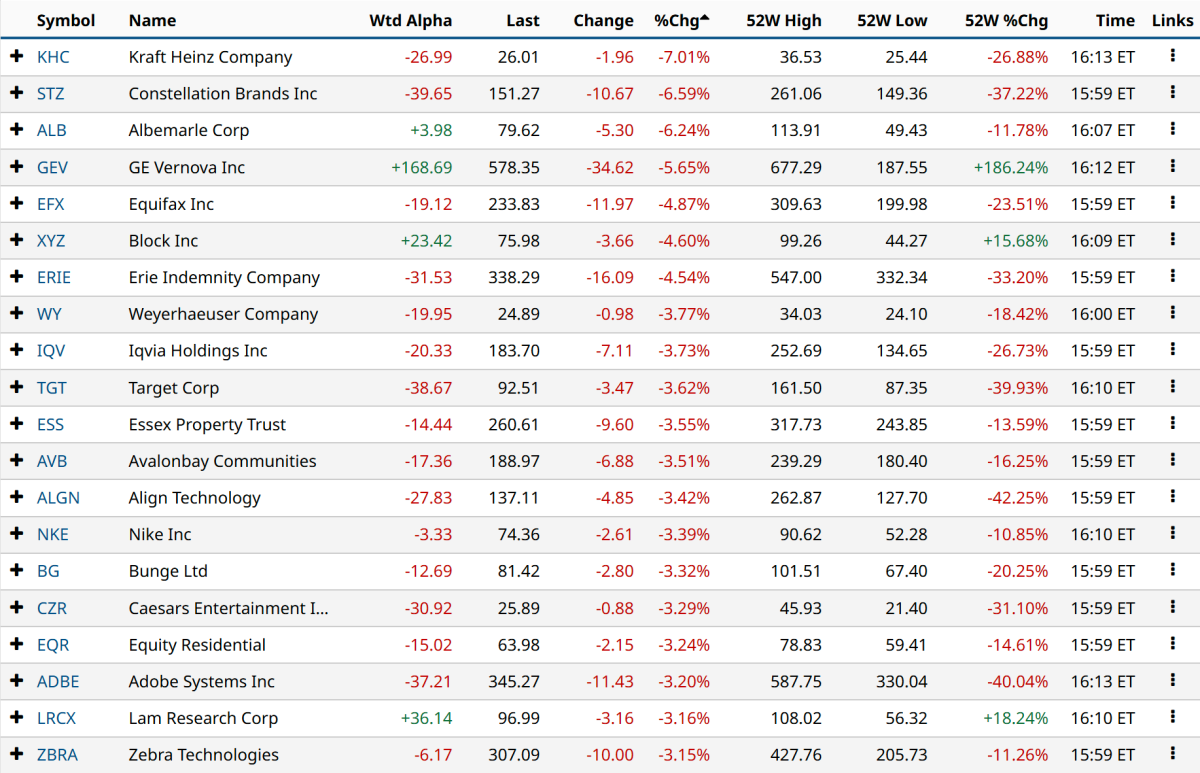

S&P 500 Decliners: Bottom 20

Earlier today, we touched on the handful of stocks in the S&P 500 which were rising intraday. Many of those names remained atop the index, closing out a relatively disappointing first day of September for the index and the broader market.

However, we didn’t touch on the decliners. There’s been a bit of movement on this front since midday. Here are the 20 largest decliners in the S&P 500 index today:

Two of the SPDR sector funds — Health Care (XLV) and Energy (XLE) — were in the green, but only by a few basis points. The remainder of them saw steep decliners, especially Real Estate (XLRE) (-1.70%).

You can see the impacts on real estate in the S&P 500. In notable decliners, timber company Weyerhaeuser (WY) (-3.77%) was the XLRE’s worst-performing component. And not far behind, some of America’s largest consumer landlords made the bottom 20 today, including Essex Property Trust (ESS) (-3.55%), Avalonbay Communities (AVB) (-3.51%), and Equity Residential (EQR) (-3.24%).

In other decliners, Kraft Heinz (KHC) (-7.01%) led the losers today after announcing a plan to break itself up into two distinct businesses, drawing the ire of long-time believer Warren Buffett. Similarly-situated consumer name Constellation Brands STZ (-6.59%) also saw steep declines after cutting its guidance.

Update: 4:01 p.m. ET

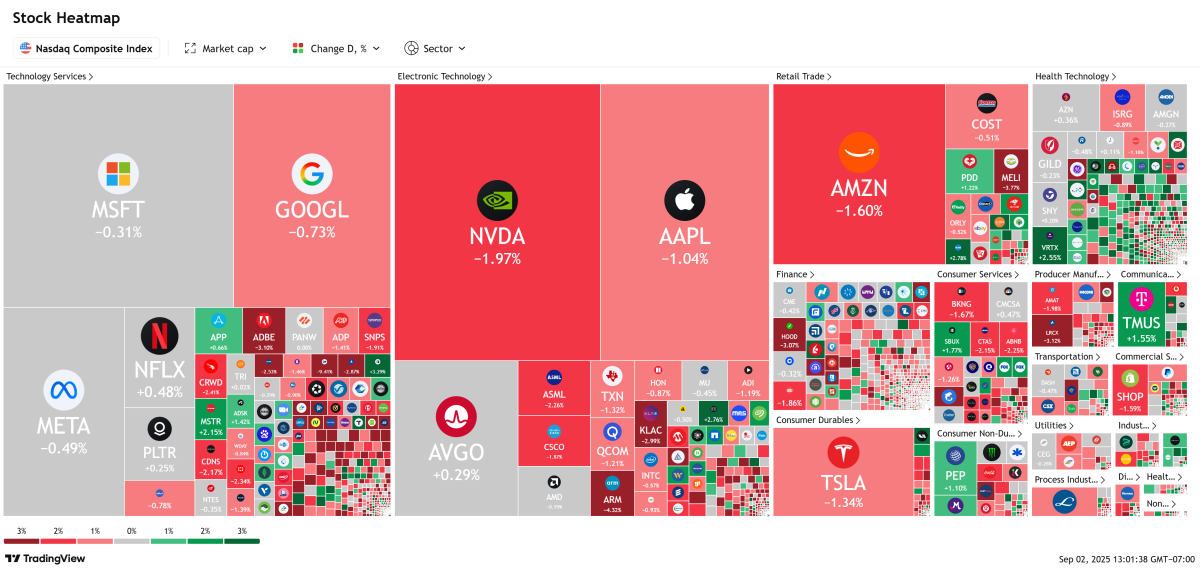

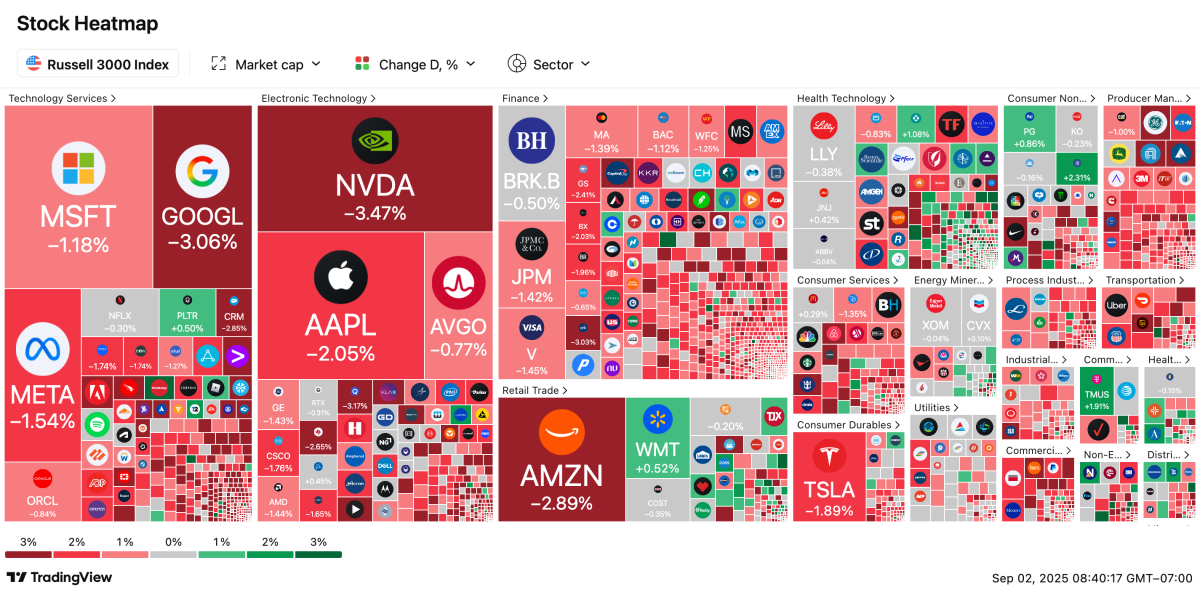

Closing Bell: Heatmaps

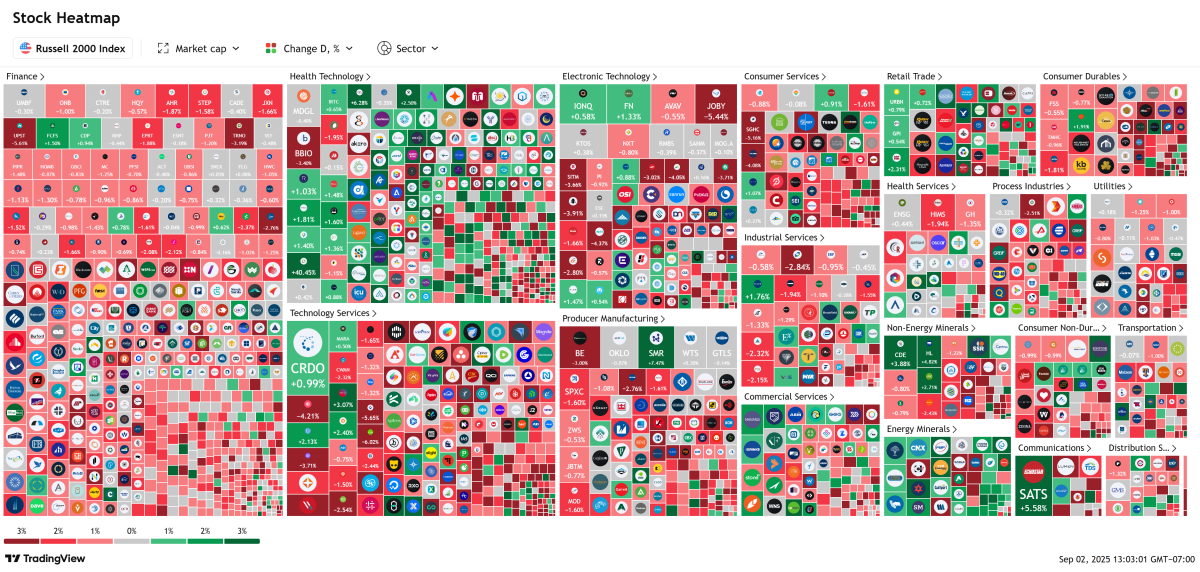

The U.S. stock market is now closed for the day. U.S. equity indexes declined nearly 1%, with the Nasdaq (-0.82%) leading the bunch. Still, it’s worth celebrating the modest comeback; at one point, it was down nearly 2% intraday.

The declines were not exclusive to megacap tech companies, though. The Russell 2000 (-0.62%) saddled losses of its own. In fact, it was a little more polarizing than the grey that we see across the Nasdaq. But there were some striking similarities, namely in health technology.

Update: 3:40 p.m. ET

Gold Eclipses $3,600 for the First Time

Gold prices eclipsed $3,600 for the first time ever, hitting $3,600.40, marking a new record high for the precious metal and safe haven. Its rise today comes amid greater concerns about inflation, possible tariff refunds, and an impending government shutdown.

Update: 3:32 p.m. ET

Preview: The New Normal in the Labor Market

This week’s impending payrolls report has been cast as a deciding factor in the September Fed decision, so I wanted to get out ahead of the ADP’s data on Thursday and the BLS’s actual report on Friday.

This afternoon, I had an opportunity to talk with Lightcast Senior Economist Elizabeth Crofoot. For the unacquainted, Lightcast provides labor market data to the majority of the Fortune 100.

We covered a large number of topics in a short period of time and I’ll have a longer primer up about this tomorrow, but something that has really stuck with me is the potential “new reality” emerging in the labor market.

Crofoot told me that — because of changing demographics and more restrictive immigration policy — the days of the 100, even 200,000 payroll additions are likely in the rear view.

“There are just not the people to have the jobs,” she added. As a result, Americans should expect “job growth to be 50-75,000 per month” and that it could “keep unemployment steady since we’re not expanding the labor force.”

Update: 1:03 p.m. ET

What’s Even Going Up?

Given the state of markets, it’s a fantastic question. In the S&P 500, which is off about 1%, here are the ten top-performing names in the index:

Barchart

Atop the list is Ulta Beauty (ULTA) (+7.58%), Biogen (BIIB) (+4.4%), and Ralph Lauren (RL) (+4%).

We’ll reflect on some of the top movers and losers across the broader market after the close in roughly an hour’s time.

Update: 12:35 p.m. ET

Midday Update: Manufacturing Data Weighs On Indexes

We’re over the midday hump. Equities are coming back from their session lows, with the Nasdaq (-1.67%) still leading the losses; the S&P 500 (-1.37%) and Russell 2000 (-1.34%) weren’t far behind. The Cboe Volatility Index (+17%) rose, while the 30Y Treasury sat at 4.98%.

Indexes Sink

As we established earlier today, there aren’t a lot of stocks in the green today. In fact, of Nasdaq and Dow constituents, just 10 and 8 are sitting in the green as of this writing. The S&P 500 is better-situated, but that’s not saying a whole lot, given that it’s still down over 1%. There’s at least sort of a reason why.

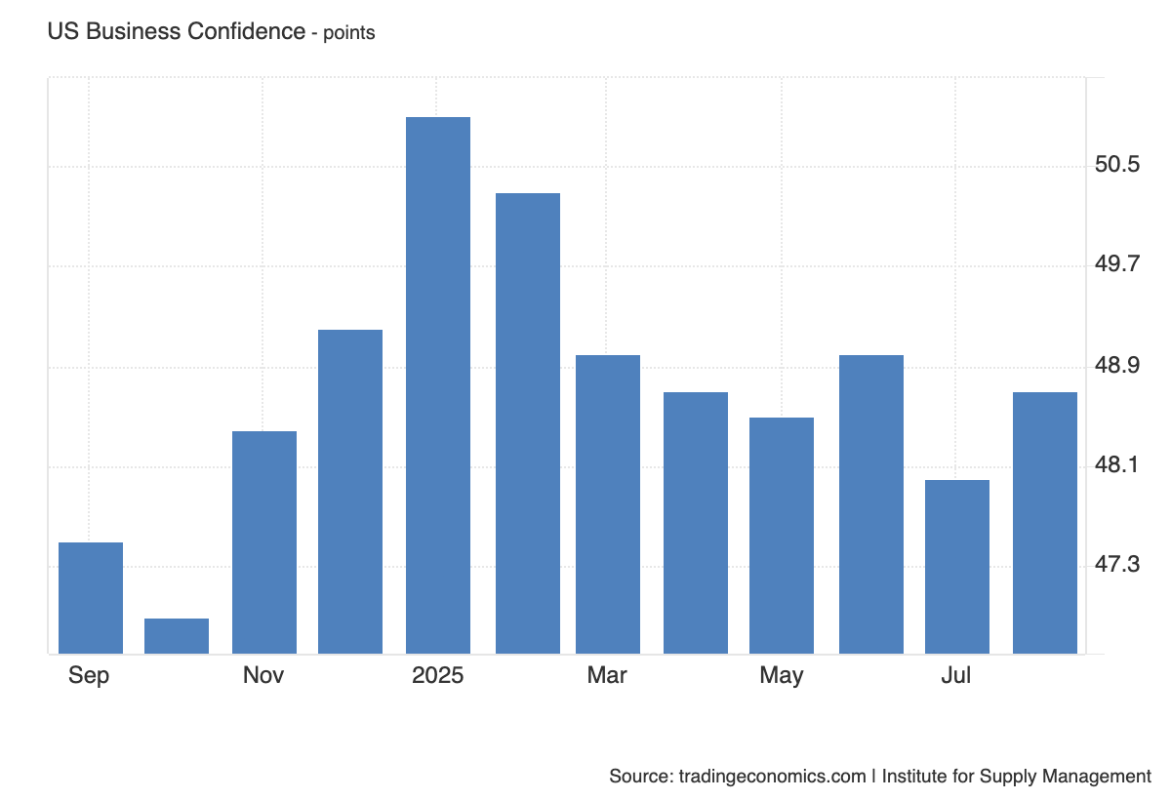

Manufacturing Hammered

Part of the reason for the steeper intraday decline in recent hours was the release of the ISM Manufacturing report, which was obviously not well-received by investors. It showed manufacturing activity shrinking for a sixth consecutive month (a score less than 50 signifies contraction.)

TradingEconomics

Tariff Refunds

The federal government has collected billions in revenue from new and perplexing tariff policies. In the event that the tariffs run into a brick wall of legal challenges, they might have to return it all to affected parties. This is one factor pulling up yields, seeing how it would exacerbate funding issues.

Government Shutdown Nearly Assured

Congress returned to work this week, but they might not get much done anytime soon, as the Republican party works to reach a bipartisan deal to keep the government open past Oct. 1. That’s looking increasingly unlikely as tensions build.

Gold Approaches $3,600

Another highlight of today’s trading session, depending on how you look at it, has been the bullishness of investors in commodities. Crude Oil (+2.52%), Silver (+2.15%), Gold (+2.14%) all rose.

Gold is currently sitting at an intraday high of $3,591. If it keeps rising, it could even surpass $3,600 by its close today, a milestone it has never notched before. That would signal even more angst among investors, who are increasingly worried about the declining Dollar and rising worries about tariff inflation.

Update: 12:14 p.m. ET

What’s Trump Teasing?

Over the last few days, social media has been on fire as a result of rumors about the President’s health. With an announcement this afternoon, Americans shouldn’t really expect any surprises.

At about 2 p.m. ET, Trump is expected to make an announcement, per a release of his schedule by the White House. Pundits have speculated that the announcement has something to do with moving the Space Force, renaming the Department of Defense, or expanding a national crackdown on crime using the National Guard.

However, the most important revelation in Trump’s announcement will be the state of his health. In light of silence from White House staff and allegations of edited images, political observers have been increasingly worried about the President, who had not made any public appearances in recent days.

The opportunity might grant the President an opportunity to quell the concerns. Or, alternatively, it could stir even more controversy, much as President Joe Biden’s disappointing debate performance did in 2024. That could also weigh on the markets.

Update: 11:39 a.m. ET

Oops, All Red: Indexes Sink to Session Lows

September’s first trading session is giving investors more reasons to perk up and pay attention. At last glance, the Nasdaq Composite (-1.8%) was down nearly 2%, with the S&P 500 (-1.43%), Dow (-1.15%), and Russell 2000 (-1.14%) not far behind.

Zooming out, the Russell 3000 (-1.23%) is awash in red, but losses seem to be coming from the very top. Nvidia (NVDA) (-3.47%), Google (GOOGL) (-3.06%), and Amazon (AMZN) (-2.89%) are among the steeper decliners atop the index today.

We’ll dig in a little more in our midday movers, which will be out after the hour. There, we’ll take a look at which stocks are making headlines, going bust to start the month, and breaking upwards (since that seems to be a slim list by the looks of it.)

Update: 10:08 a.m. ET

Nasdaq Down Over 1% After Jumpy Investors Return from Holiday

The U.S. stock market is now open, with all four major equity indexes down. The Nasdaq (-1.17%) is leading the way, trailed by the S&P 500 (-0.91%) and others.

Before the open, U.S. equity indexes had flashed signs that today was going to be interesting. Futures touched session lows, with the Russell 2000 (-1.38%), Nasdaq Composite (-1.27%), and S&P 500 (-0.99%) leading the declines.

Update: 7:21 a.m. ET

Pre-Market Update: Gold Scores Record, Stock Futures Dip

Happy September (to those who celebrate.) After a months-long rally back from April’s tariff tumult, the stock market might face its match this month as market optimism is made to face reality. It’s not starting off quite how investors might like.

This weekend, Gold jumped to a new all-time high, surpassing $3,500 on renewed policy worries. Joining it, the 30Y Treasury rose to its highest point since Jul. 2025, hitting 4.98%. Top of mind? Government spending.

That’s boiling down to stocks. With just two hours left until the opening bell, stocks are currently set for some marked declines in their first session of the month. Stock futures on major U.S. indexes are down between 1% (Russell 2000) and -0.5% (Dow) or the moment. The Cboe Volatility Index (+11%) just crossed above 18.

A.M. Headlines

- Several big IPOs are expected this week: Klarna ($14 billion valuation), Legence ($3 billion), Gemini ($2.2 billion), and Black Rock Coffee Bar ($861 million).

- Activist investor Elliott Management is said to have amassed a $4 billion stake in PepsiCo, per WSJ.

- Kraft Heinz will split itself into two publicly-traded companies as part of a strategic split of the company.

- Treasury Secretary Scott Bessent has teased that the Trump administration could declare a ‘national housing emergency’, per Bloomberg.

- President Trump is expected to make an announcement in the Oval Office this afternoon, per schedule.

- Nestlé hired Nespresso CEO Philipp Navratil to replace its second CEO of the year, who was terminated over a workplace affair.

Update: 7:03 a.m. ET

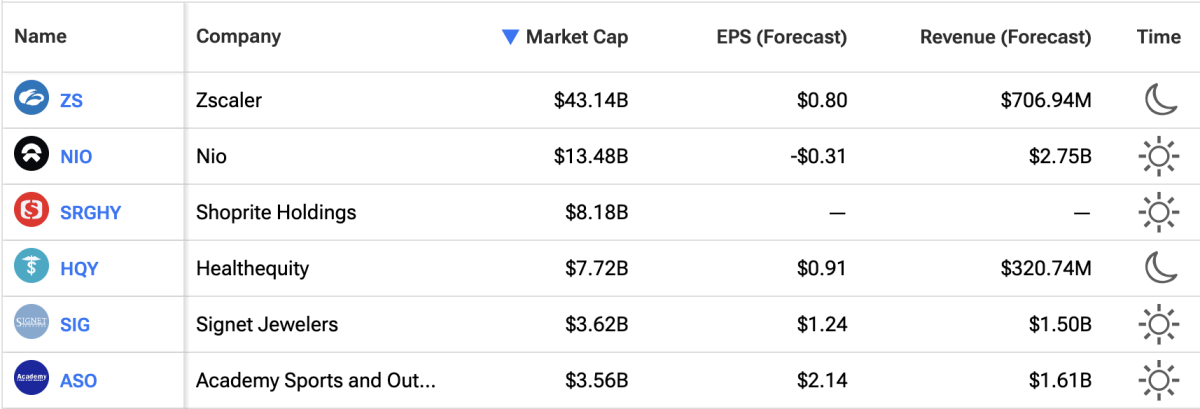

Earnings Today: Zscaler, Nio, Healthequity

This shortened market week, we’ll be treated to a final earnings hurrah, with the last of Q2 earnings making their mark on investors.

Today, per Nasdaq, we are expecting up to 21 earnings reports. Sourced from data from TipRanks, here are the ones worth >$1 billion that are due out today:

Economic Data: ISM PMI, Construction Spending, Total Vehicle Sales

Starting off this week, investors will be getting quite a lot of smaller, lesser-known economic data reports ahead of an all-important jjob report, which will be the economic highlight of the week.

Here are the highlights for today:

6:00 a.m. ET

- LMI Logistics Managers Index (Aug) [Prev: 59.2]

9:45 a.m.

- S&P Global Manufacturing PMI (Aug) [Prev: 49.8]

10:00 a.m.

- ISM Manufacturing PMI (Aug) [Prev: 48]

- ISM Manufacturing Employment (Aug) [Prev: 43.4]

- ISM Manufacturing New Orders [Prev: 47.1]

- ISM Manufacturing Prices [Prev: 64.8]

- Construction Spending (Jul) [Prev: -0.4% month-over-month]

10:10 a.m.

- RCM/TIPP Economic Optimism Index (Sept) [Prev: 50.9]

Other Reports Today

- Total Vehicle Sales (Aug) [Prev: 16.4 million]

- 3mo and 6mo bill auction due out at 11:30 a.m.

- 52wk bill auction due out at 1:00 p.m.

RELATED POSTS

View all