Stock Market Today: Forget "Sell the News." Welcome Back, 4%

September 19, 2025 | by ltcinsuranceshopper

This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Thursday. This is TheStreet’s Stock Market Today for Sept. 18, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 5:08 p.m. ET

Well, This is Awkward: Lennar Earnings Still Not Out

In a Sept. 4 press release, Lennar (LEN) said that it would “release earnings for the third quarter ended August 31, 2025 after the market closes on September 18, 2025.”

Well, the market has been closed for over an hour and… well, we haven’t heard anything that would suggest it’s not on. But as of right now, we still have nothing from the homebuilder.

With more tepid Housing Starts in the latest quarter, maybe you could joke and say they’re not necessarily be in a rush to put out these earnings. Still, per data from LSEG, the company has beat earnings in six of the past eight reporting periods. There’s always an angle with expectations, even in this economy.

Maybe time isn’t of the essence here, but we’ll check on those results a bit later.

Update: 4:01 p.m. ET

FedEx Jumps After Beating Earnings

FedEx (FDX) (+5.5% in after hours) delivered EPS of $3.83 (vs. $3.61 expected). Revenue was $22.2 billion (vs. $21.65 billion), +4% year-over-year.

- Company still expects to spin off its FedEx Freight division by Jun. 2026.

- Forecast guidance of 4-6% revenue growth year-over-year.

- Diluted earnings per share of $14.20 to $16 before retirement accounting adjustments; $17.20 to $19 after FedEx Freight spinoff.

- Still expect $1 billion in cost reductions and $4.5 billion in capital spending.

The report is a positive indicator for the logistics industry, even in the face of new economic policies and challenges. It also is a boost to a company which has struggled to meet expectations in recent quarters.

Update: 4:00 p.m. ET

Closing Bell: So Much For “Sell the News”

The U.S. equity markets are now closed. The Russell 2000 (+2.41%) had an absolute power rally today, leaving every other major average in the dust on renewed excitement around rate cuts. Meanwhile, the Nasdaq (+0.94%), S&P 500 (+0.48%), and Dow (+0.27%) all rose as well.

So much for “sell the news,” as analysts had once said. All four indexes set new record closes. Yes, even the Russell finally set a new high after years in the dust.

As mentioned below, earnings from FedEx and Lennar are expected in short order and will be posted here once we have updates.

Update: 3:04 p.m. ET

Coming After the Bell: FedEx and Lennar

Earnings from logistics giant FedEx (+0.34%) and home construction firm Lennar LEN (+0.21%) are coming after the bell.

Stick around for more updates here.

Update: 12:19 p.m. ET

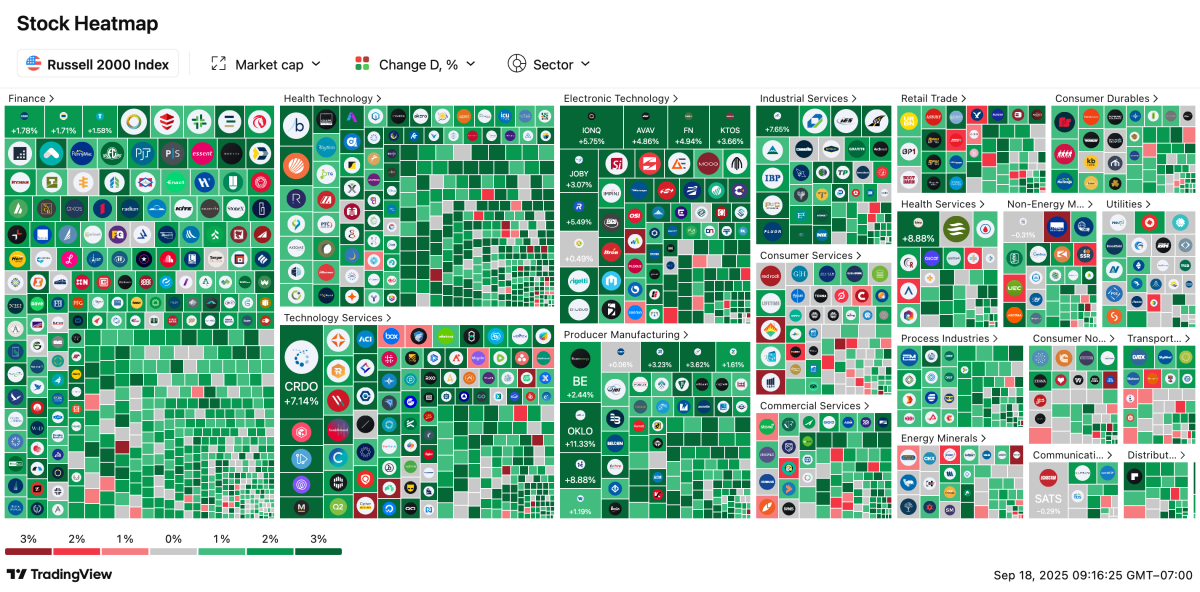

Midday Check-In: Russell 2000 & Nasdaq Composite

We’re almost halfway through the day. Let’s take a look at the Russell 2000 (+1.75%) and Nasdaq Composite (+1.09%), both up over 1% today. So much for “sell the news.”

The Russell 2000 is looking green, as risk assets tend to look when the central bank cuts rates. There’s no rhyme or reason to the rally today. Per data from FinViz, there’s only about 268 of the 2,000 components of the index in the red today.

Among the top-performers today are 89bio ETNB (85.5%), Quantum-Si Incoroprated QSI (+23%), and Ramaco Resources METC (+20.7%). On the flip side, the worst-performers are Replimune Group REPL (-42.7%), Lifeway Foods, Inc. LWAY (-21%), and Triller Group ILLR (-14.8%).

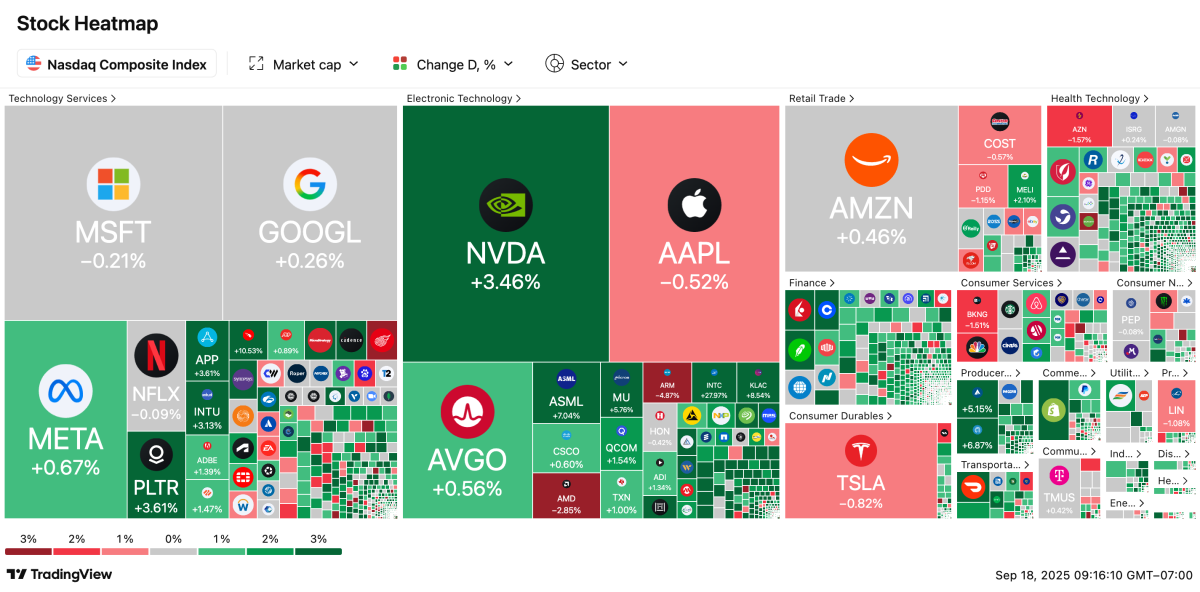

And then there’s the Nasdaq Composite, which is having a great day too, thanks to the march of semiconductor and software companies.

Just like in the S&P 500, Intel (INTC) (+29%), Synopsys (SNPS) (+10.6%), and Crowdstrike (CRWD) (+10.1%) are the top-performing stocks in the index.

By points, Nvidia (NVDA) (+3.46%) is the biggest contributor to the index today. It’s popping on news of that deal with Intel that we touched on earlier today. It’s also growing at the expense of the index’s largest decliners today: Arm Holdings ARM (-4.8%) and Advanced Micro Devices AMD (-2.8%).

Update: 12:05 p.m. ET

Trump Asks Supreme Court To Fire Lisa Cook

After being rebuffed by an appeals court, President Donald Trump has asked the Supreme Court for permission to fire Fed Governor Lisa Cook. The Trump DOJ argues that they should be able to fire anybody for “cause, conduct, ability, fitness, or competence of the officer.”

Cook has been in the President’s crosshairs because of accusations that she committed mortgage fraud, claims she categorically denies and that have not been proven. The matter was referred to the Justice Department.

It remains to be seen if the highest court in the land will entertain the President’s demand for near-complete autonomy, which go beyond the simple act of cause.

Update: 10:53 a.m. ET

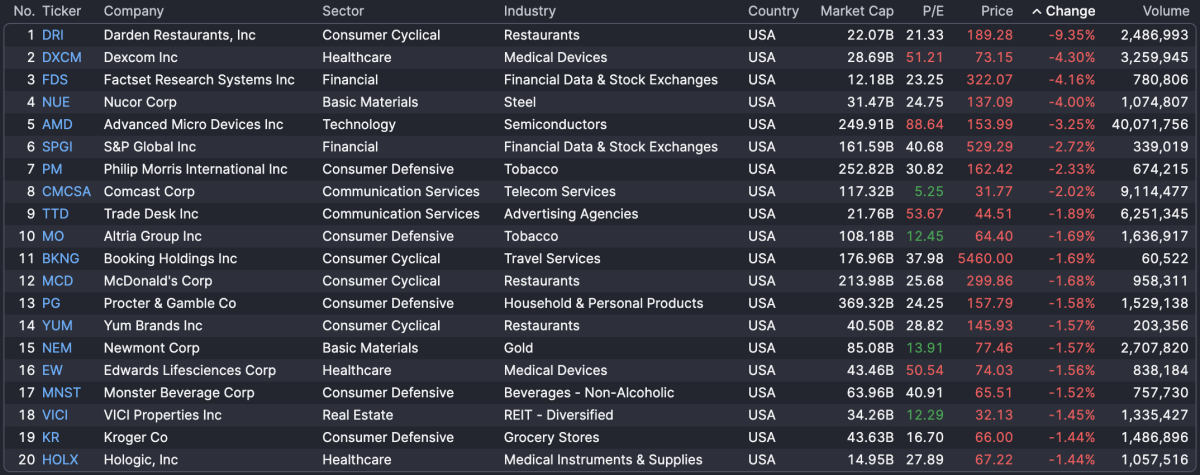

Morning Movers: Intel, CrowdStrike, Darden, Dexcom

Stocks are really starting to move along now, but before we tip over into midday and touch on that, let’s take a look at the stocks defining today, starting with the S&P 500.

Movers

Intel (INTC) (+26%), CrowdStrike (CRWD) (+10%), and Synopsys (SNPS) (+10%) are far and away the index’s top-performers this morning, but sort by sector and you’ll see a trend: it’s pretty much all semiconductors and software!

Laggards

Meanwhile, on the other end of the market, two of the four major earnings reports from the day are languishing at the bottom of the index: Darden Restaurants (DRI) (-9.3%) and FactSet (FDS) (-4.2%) They’re also joined by medical device company Dexcom (DXCM) .

Update: 9:30 a.m. ET

Opening Bell: Stocks Drift Up After Fed Decision

The U.S. equity markets are now open for the day. The Nasdaq (+0.90%) and S&P 500 (+0.71%) are strong out of the gate this morning, while the Russell 2000 (+0.18%) is lagging behind. The Dow (-0.05%) was little moved.

We’ll be back in an hour or so to take a look at how individual stocks are faring out of the gate.

Update: 8:33 a.m. ET

Pre-Market Check-In

We have about an hour left until the market opens. Futures are quite a bit higher, a positive omen for today. Some economic data and earnings have trickled in over the last few hours, so before the bell, here’s the summary:

Earnings

Darden Restaurants (DRI) (-7%) narrowly missed earnings, while revenue came within expectation; forward guidance raised.

FactSet Research (FDS) (-0.3%) missed on earnings, while revenue came within expectations; profit guidance was tepid.

Headlines

Nvidia (NVDA) (+2.7%) will invest $5 billion in Intel (INTC) (+28.6%) and co-design chips, making the company one of the largest shareholders, with a ~4% stake.

Fearing political attacks from regulators, Disney (DIS) (-0.8%) pulled Jimmy Kimmel’s show on ABC, drumming up fresh controversy about the First Amendment.

Meta (+0.6%) announced new Meta Ray-Ban Display glasses with a built-in AI assistant at its annual Connect event; they will retail for $799.

American Express (AXP) (+1%) announced a refreshed AmEx Platinum Card with an $895 annual fee, making it the most expensive, widely-available ‘premium’ credit card.

Related: American Express just made a controversial change to its flagship Platinum card

Initial Jobless Claims dropped by the most in almost four years (more data below)

Coffee prices saw their third-largest decline this century, with volatility in New York-based futures soaring to a four-year high.

Economic Data

Initial Jobless Claims (Wk of Sept. 13): 231K [Prev: 264K] [Exp: 240K]

Continuing Jobless Claims (Wk of Sept. 13): 1.92M [Prev: 1.927M] [Exp: 1.95M]

Philadelphia Fed Manufacturing Index: 23.2 [Prev: -0.3] [Exp: 2.3]

Philly Fed Business Conditions: 31.5 [Prev: 25]

Philly Fed CAPEX Index: 12.5 [Prev: 38.4]

Philly Fed Employment: 5.6 [Prev: 5.9]

Philly Fed New Orders: 12.4 [Prev: -1.9]

Philly Fed Prices Paid: 46.8 [Prev: 66.8]

All data is for the month of September unless otherwise indicated.

Update: 4:02 a.m. ET

Welcome Back, 4%

To quote Fed Chairman Jerome Powell, “Good afternoon.” Happy Thursday.

Today dawned a new world: It’s a 4% world now, and we’re all living in it… At least until the Fed gets around to cutting rates again. Still, that’s a topic of great discussion based on the Dot Plot, the worrisome state of Fed independence, and the subject of “data.”

On that note, here’s what we have on deck for today:

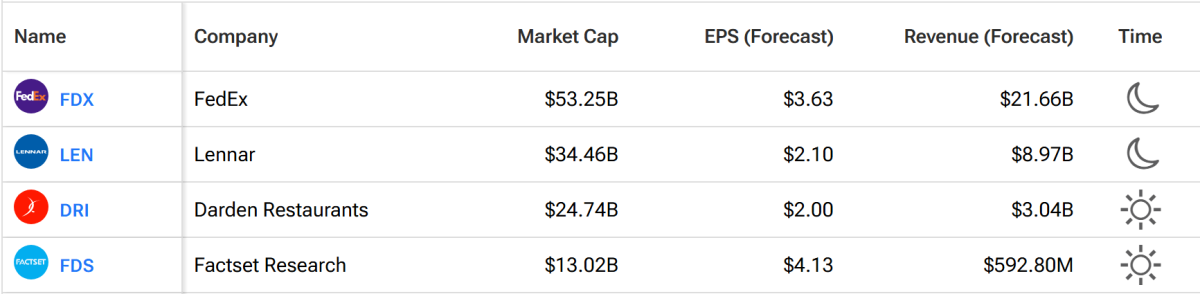

Earnings Today: FedEx, Lennar, Darden, FactSet

Data from TipRanks has us down for seven reports today, four of which are for firms with a market cap exceeding $1 billion.

Two of those reports are this morning — Olive Garden parent Darden Restaurants (DRI) and financial data company FactSet Research (FDS) . And this evening, logistics giant FedEx (FDX) and home builder Lennar (LEN) will take their shot at analysts’ estimates.

Related: General Mills, Darden, FedEx earnings could reveal inflation trends

Interestingly enough, they’re all a weird microcosm of the economy, even at this late stage in the quarter. With a restaurant chain, an enterprise software feature, a logistics giant, and a homebuilder, we might have all sorts of interesting insights to glean from the reports.

Here’s what to expect from the firms:

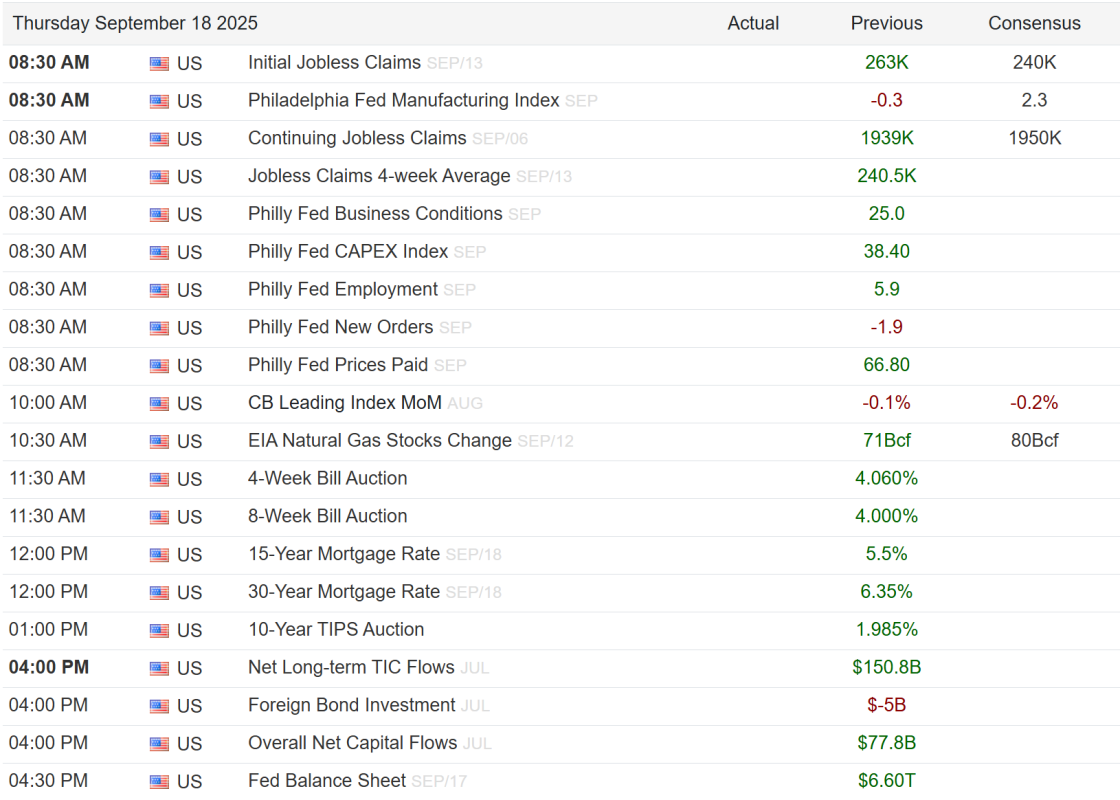

Economic Data: Labor Data, Philly Fed Data, TIC Data

The Fed’s 25 basis point cut came as a result of a more tepid picture for the labor market. This morning. we’re gonna get a glimpse of the most recent snapshot of the market as Initial & Continuing Jobless Claims are due out at 8:30 a.m. ET.

Also set to report, a series of data points from the Philadelphia Fed. Among them will be its Manufacturing Index, plus other data points on Business Conditions, Capital Expenditures, Employment, and other variables.

Rounding out the day, Net Long-term Treasury International Capital (TIC) Flows will come out, a gut-check on investment in the U.S. economy.

Here’s the full slate of reports coming out today:

RELATED POSTS

View all