Resideo Technologies: Institutional Activity Signals 30% Upside

September 25, 2025 | by ltcinsuranceshopper

Key Points

- Institutional investors are heavily backing Resideo Technologies, signaling strong confidence and potential for upside.

- Recent technical breakouts and bullish analyst upgrades support a target price increase of 30% or more.

- Despite short-term risks like debt and rising short interest, long-term growth is supported by tech innovation, housing market trends, and operational clarity.

Resideo Technologies’ (NYSE: REZI) is gaining serious traction with institutional investors, setting new records in Q3 2025 and driving a robust technical outlook.

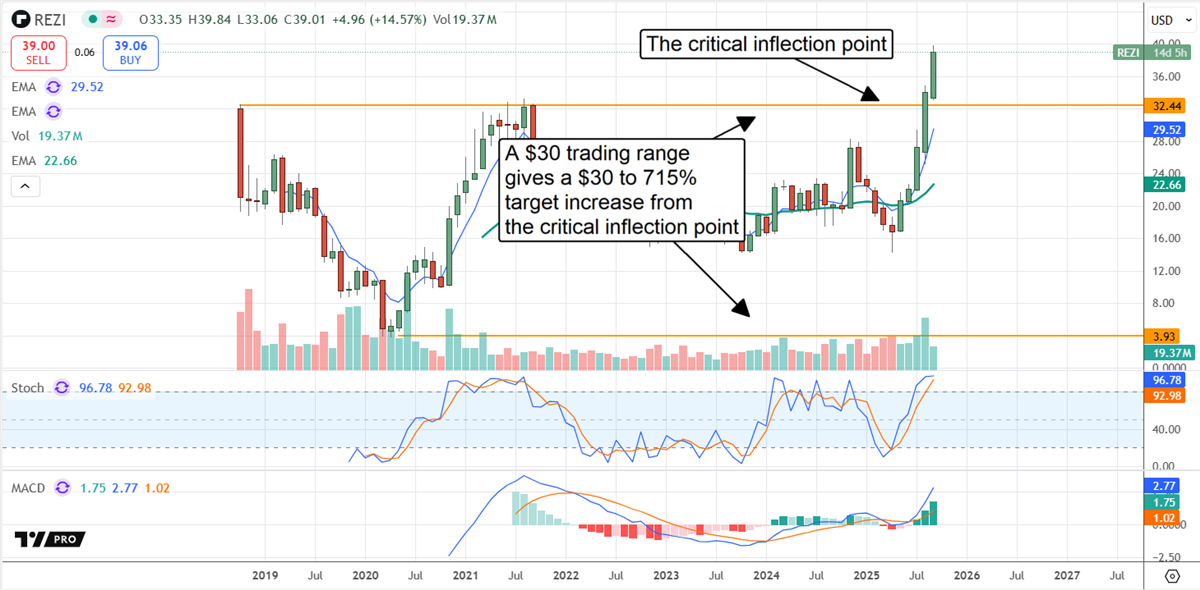

The stock’s recent breakout from a multi-year trading range has laid the groundwork for a potential rally, with price targets indicating a possible $28 climb from current levels.

At the high end, the stock could deliver a moderate triple-digit percentage gain.

A Breakout Moment: Technical Indicators Signal Rally Potential

Technical analysis supports the bullish case. After years of range-bound movement, Resideo broke through to new highs. The break is an inflection point that can lead to a rally equal to the dollar value of the trading range or, in the bull-case scenario, one equal to the percentage gain from low to high.

With both scenarios pointing higher, the setup looks increasingly favorable for investors.

Activist Investors Influence Resideo Operations

The institutional activity is centered in a single institution: Channel Holding LP, an investment arm for Clayton, Dubilier, & Rice (CD&R), one of America’s oldest investing firms.

Following the acquisition of Snap One, CD&R acquired a 10% stake and aims to influence its operations. CD&R sees a stronger market position and opportunities to improve sales and operations.

Still, the activity is broad-based across the group, including purchases by public and private wealth managers in addition to fund managers, who collectively own about 92% of the stock.

Analysts are less bullish on this technology stock, with only three tracked by InsiderTrades. Even so, the recent upgrade from Morgan Stanley to Overweight is telling, as it follows a comparable upgrade from Oppenheimer issued in July and a price target increase from JPMorgan in June.

The takeaway is that three of the leading financial institutions rate this stock as a Buy and are leading its market highs. The consensus in mid-September is for a nearly 30-percent stock price increase, but it is rising, and the high-end range provides some support.

Morgan Stanley analysts noted the impact of indemnification termination and how underappreciated it was by the market. Resideo had to pay more than a billion dollars to get out of the agreement, but future payments now unburden it and allow it to focus entirely on its business and growth.

The company resumed growth in 2025 and is expected to sustain it for the foreseeable future. Among the opportunities for investors is the consensus outlook, which is likely to be low.

With interest rates anticipated to fall over the coming years, spurring the housing market, and digital technology, including AI, advancing, this business has numerous tailwinds.

Key Risks for Resideo Investors: Debt, Short Sellers, and Market Timing

The balance sheet reflects the impact of the one-time payment to Honeywell but is otherwise in good shape. The debt increase it will cause is manageable, and the company remains well-capitalized. The more critical factor is the outlook for cash flow, which includes sufficient capital to rebuild its cash position, reinvest in the business, and reduce its debt over time.

Short-sellers are the bigger risk. As of early September, short interest was still low, at nearly 4%, but it was rising. Short interest was up significantly from its typical levels, hanging at record levels for a second reading and may not have fallen much since.

The outlook for Resideo is bullish, but there are still risks, including the timing of interest rate cuts and when they will be reflected in the housing data. That may not be until summer 2025 or later. Resideo will next report in early November and may be able to provide more clarity.

Companies in This Article:

| Company | Current Price | Price Change | Dividend Yield | P/E Ratio | Consensus Rating | Consensus Price Target |

|---|---|---|---|---|---|---|

| Resideo Technologies (REZI) | $40.64 | +0.3% | N/A | -7.42 | Buy | $34.67 |

RELATED POSTS

View all