The Reserve Bank of India’s August 2025 Bulletin once again brought the debate on private sector capital expenditure (capex) to the forefront. While acknowledging a decline in FY25, the RBI projects a revival beginning FY26, relying on improving fundamentals such as GDP growth, lower interest rates, healthier corporate balance sheets, and government-backed infrastructure initiatives.

Yet, when placed against other official data and independent surveys, particularly the Ministry of Statistics and Programme Implementation’s (MoSPI) inaugural forward-looking study, the optimism of the RBI seems fragile, if not overstated. The contrast underscores how uncertain — and elusive — India’s private capex cycle has been for more than a decade despite repeated policy nudges. Given rising public debt, weak job creation, and falling real income, private sector investment is now more critical than ever for sustaining growth.

RBI’s optimistic picture

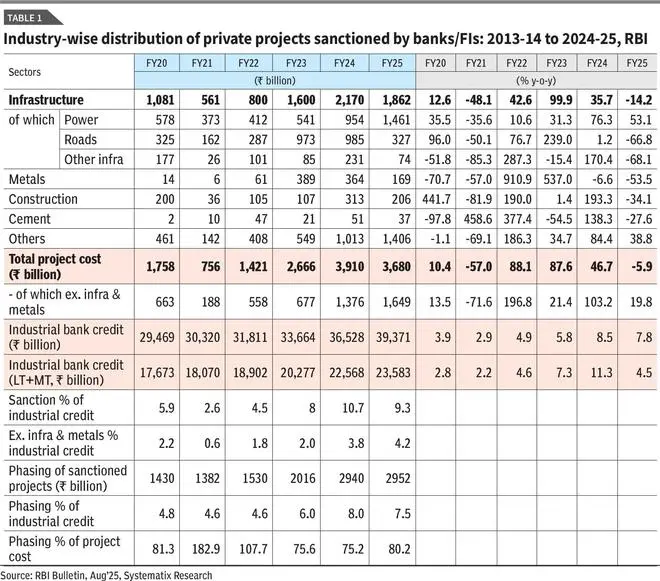

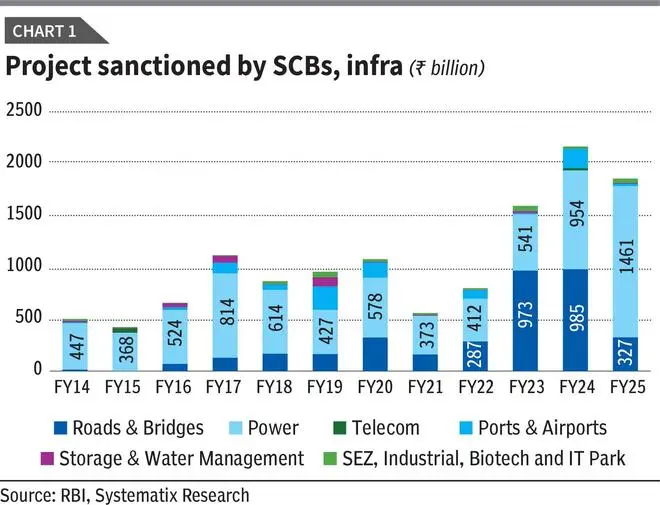

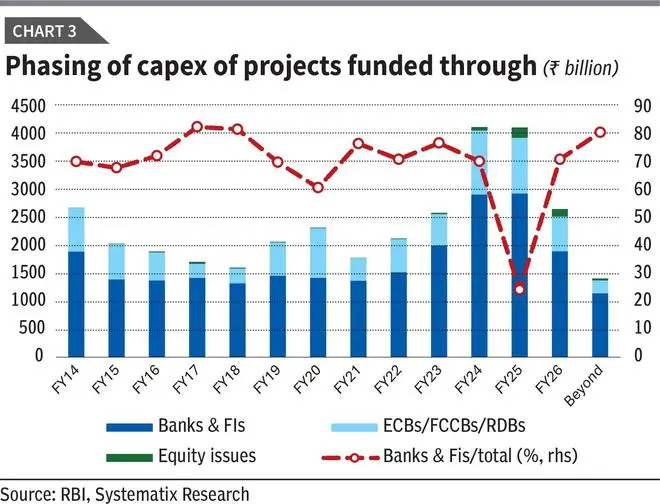

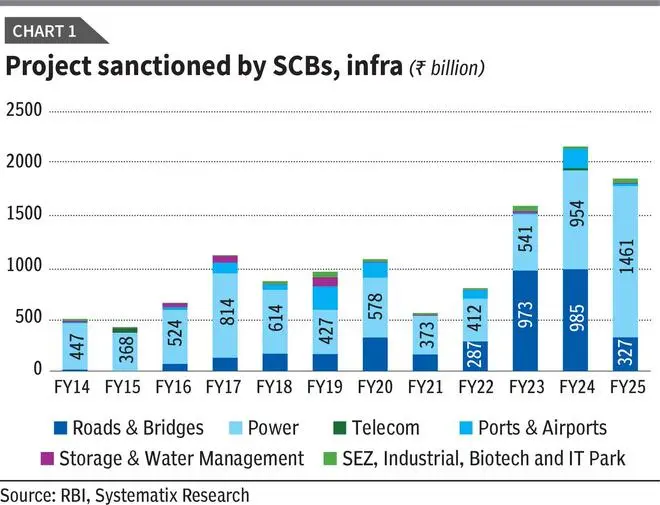

The RBI’s analysis concedes weakness in FY25 but highlights conditions for renewal. Banks and financial institutions sanctioned 907 projects worth ₹3.68 trillion in FY25, a decline from ₹3.91 trillion in FY24 (Table 1). Including external commercial borrowings (₹970 billion) and equity issuances (₹323 billion), the total investment intent reached ₹4.97 trillion across 1,584 projects, about 9 per cent below the previous year. Greenfield infrastructure led the activity, accounting for over 50 per cent of costs, driven by power and roads.

The geographic distribution also remained lopsided, with Gujarat, Maharashtra, Andhra Pradesh, Rajasthan, and Uttar Pradesh collectively absorbing about 60 per cent of the overall project costs. Implementation data indicates that 39.3 per cent of sanctioned projects (₹1.45 trillion) were targeted for execution by end-FY25, 35.2 per cent (₹1.30 trillion) in FY26, and the rest in later years.

Factoring in these pipelines, RBI forecasts revival: capex envisaged at ₹2.95 trillion in FY25 is projected to rise 21.4 per cent to ₹2.67 trillion in FY26. The central bank is confident that a supportive macro environment — GDP growth of 6.5 per cent, balance sheet improvement, 100 bps policy rate cuts since early 2025, ample liquidity, infrastructure push, and production-linked incentive schemes — provides fertile ground for investment expansion.

While the numbers reflect intent, the key concern is that similar conditions have existed in recent years without translating into a durable upturn. With demand weak and global trade uncertainties intensifying, the revival narrative appears overly reliant on wishful optimism.

MoSPI’s sobering outlook

MoSPI’s April 2025 forward-looking survey of private investment intentions tells a more sobering story. Intended capex for FY26 is estimated at ₹4.88 trillion, a sharp 25 per cent decline from ₹6.56 trillion in FY25. The number of participating enterprises also fell by 20 per cent, reflecting lack of corporate confidence. The earlier rebound in actual private investment, 9 per cent CAGR between FY22 and FY24, was more statistical recovery from the pandemic than genuine capacity expansion.

Now, the reversal reflects corporates’ caution amid weak demand, faltering government spending momentum, and deteriorating global conditions. In particular, the worsening trade frictions between India and the US, including a steep 50 per cent tariff on Indian exports, have compounded vulnerabilities.

Only 71 per cent of respondents indicated willingness to invest in FY26 as against much higher proportions historically. This translates into a compound annual growth rate of just 5.5 per cent relative to FY22, or a mere 1.5 per cent once inflation is factored in. Manufacturing leads at 44 per cent of intended capex, followed by ICT and transport, with more than half of the spending directed at machinery and equipment rather than large-scale greenfield expansions.

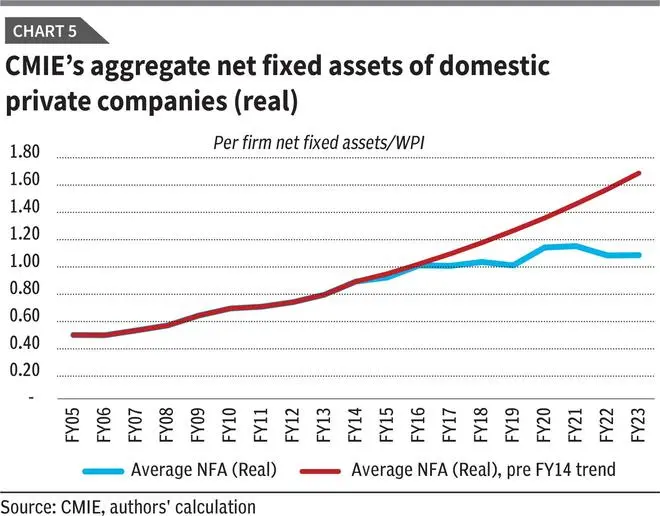

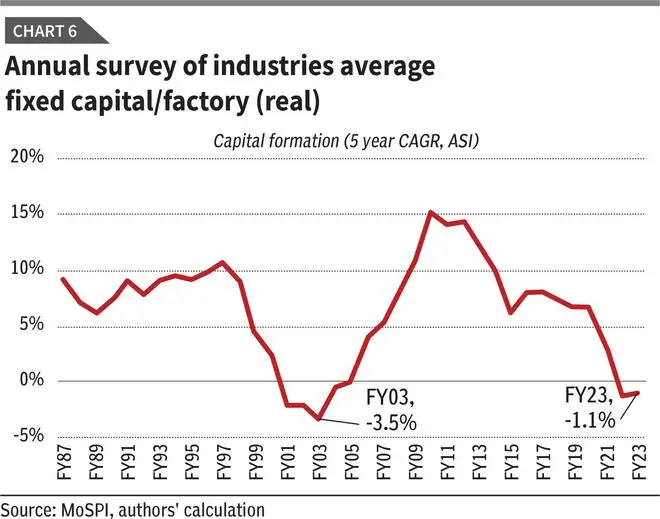

Additional data confirms these concerns. CMIE’s sample of 32,000 companies shows real net fixed capital growth averaging only 1.2 per cent over the past five years. Broader Annual Survey of Industries (ASI) data is even more concerning, showing a 1.1 per cent annual contraction. Corporate fixed assets are now estimated at 36 per cent below the trend line based on a decade-ago trajectory.

RBI’s optimism doesn’t reflect in lending trends

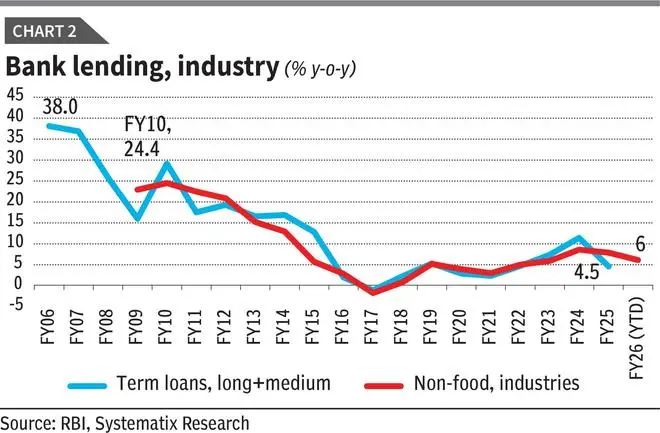

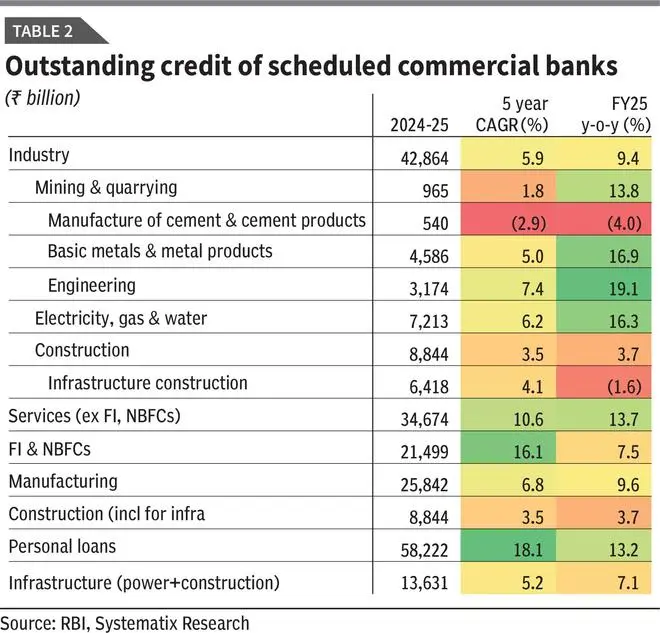

The gap between project sanctions and actual lending further challenges RBI’s optimism (see Charts 1, 2 and 3, and Table 2). Scheduled Commercial Banks’ long- and medium-term lending grew just 4.5 per cent in FY24 and has averaged 6 per cent over five years. Overall industrial credit rose 7.8 per cent in FY25 but slowed to 6 per cent in the first quarter of FY26.

Sectorally, credit flows remain uneven (see Chart 4). Lending to power, metals, and engineering has improved, but infrastructure lending, in contrast to RBI’s project sanction data, grew just 7.1 per cent in FY25. Extending the definition to telecom, airports, railways, ports, and roads, overall infrastructure lending even contracted slightly (-1 per cent YoY) in 1QFY26 — despite a six-year average of only 4.1 per cent growth. Conversely, construction loans rose 10 per cent and other industries by 9 per cent.

Deeper structural headwinds

Macro conditions reinforce caution. Household demand is subdued under high taxes, limited income growth, and pressure on savings. Household savings, a crucial investment funding source, have been declining. Compounding this, India’s capital goods index under the IIP has been trending downward since 2011, indicating persistent weakness in industrial expansion.

The government’s efforts to “crowd in” private sector investment with large public outlays have not shifted corporate hesitation. Instead, firms prefer deploying cash flows for deleveraging, automation, and digital upgrades rather than committing to bold new capacity-building projects.

Externally, global trade protectionism, unpredictable geopolitical developments, and slow global growth are worsening investment sentiment. With US trade policies turning sharply protectionist, Indian corporates are leaning heavily toward caution.

Narrow optimism vs wider reality

When compared, the RBI’s pipeline-driven optimism looks narrow and overly dependent on assumptions about execution. In contrast, MoSPI’s survey data, along with CMIE and ASI’s long-term trends, depict a cautious corporate sector that prioritises incremental efficiency investments over capacity creation (see Charts 5 and 6). The risk of overestimating a capex revival, as has happened repeatedly in the past decade, is high.

The prolonged weakness in private capex comes from both external shocks and domestic policy gaps. Despite monetary easing, healthier balance sheets, and infrastructure push, a decisive upcycle remains distant. GDP statistics, which policymakers continue to cite as uplifting evidence, risk providing a misleading signal — masking structural demand weakness.

Meanwhile, post-2024 election policy shifts have shown some recognition of this reality, with GST cuts, income-tax reliefs, and an employment-linked incentive scheme aimed at strengthening household demand. Yet, the collective fiscal allocation amounts to less than 1 per cent of GDP and seems inadequate to kickstart a meaningful multiplier effect. Against the backdrop of a 50 per cent US tariff shock, these appear modest, perhaps too little and too late.

The recent shift in India’s policy framework offers hope for a comprehensive reorientation aimed at fostering decentralised industrialisation and strengthening service-led employment. Both are vital components for reviving aggregate demand, stabilising household finances, and mitigating external vulnerabilities.

However, there is a discernible risk that the strategy might slide toward protectionist measures designed to shield domestic industries from global competition. Yet, given the extensive supply-side incentives and structural support extended to Indian corporates over recent years, these firms are arguably better positioned than before to confront international challenges. The moment has therefore arrived for Indian industry to demonstrate true competitiveness and resilience in the global marketplace.

The writer is CEO and Co-Head of Equities & Head of Research, Systematix Group. Views are personal

Published on September 9, 2025