Popular office supply retailer sold after closing over 1,000 stores

September 23, 2025 | by ltcinsuranceshopper

In the early 1990s, we used a lot of paper and pens, and, as silly as it sounds now, fax machines for business-to-business communications. After all, the internet was only emerging, and dial-up access was slow and clunky.

If you needed copy paper, fax paper, computers, pens, or back-to-school supplies (remember Trapper Keepers?), you had to physically go to a store unless you were a big company and had those things delivered by office supply companies.

A few companies dominated the catalog office-supply business, and small business owners were underserved until a few specialty retail chains — Staples, OfficeMax, and Office Depot — stepped in to fill the void.

The opportunity was so big that all three retail chains became massive, opening thousands of stores nationwide in the 1990s. They hauled billions in revenue and profit, rewarding eager shareholders who bid their stocks to new highs.

Of course, fast-forward a few years, and the widespread embrace of the internet, including e-commerce, and expanded products at big box retailers like Walmart, tossed a big hand grenade at the industry, causing massive store closures and major pivots.

Stiff competition led to OfficeMax’s sale to Office Depot in 2013 for about $1 billion, creating ODP, and Staples’s sale to private venture capital firm Sycamore Partners in 2017 for $6.9 billion.

Unfortunately, the challenges facing these retail chains remain. According to IBISWorld, office-store industry revenue has fallen at a compounded annual rate of 4% over the past five years, totaling an estimated $20.9 billion in 2025.

As a result, the ODP Corporation (ODP) has continued closing stores, and on September 22, it announced it had sold itself lock, stock, and barrel for about the same amount it spent acquiring OfficeMax over a decade ago.

Image source: Getty Images

ODP acquired after massive store closures

After acquiring OfficeMax, Office Depot accelerated store closures to help maintain profitability. It also expanded into business-to-business, most recently targeting the multibillion-dollar hospitality industry.

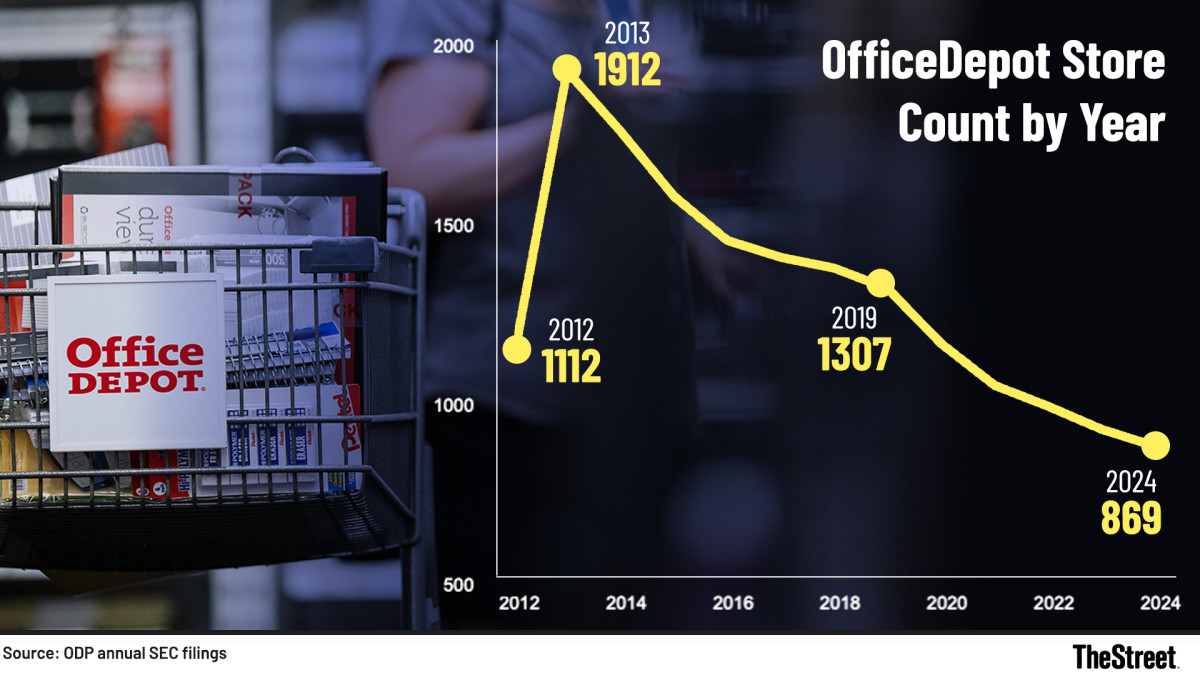

In 2013, when ODP acquired OfficeMax for $1.17 billion, OfficeMax boasted 941 stores, and Office Depot operated 1,112 stores, generating $15.1 billion in revenue alone before the acquisition. ODP was running 1,912 stores after the merger at the end of 2013. The two companies were hauling in about $18 billion in annual revenue when the merger happened.

Related: T-Mobile CEO sends Apple iPhone message after launch

Wall Street analysts expected the deal would lead to store closures, given that Office Depot and OfficeMax often competed in similar markets. Credit Suisse, for example, projected that 600 stores would be closed.

It wound up being far more than that.

ODP has closed over 1,000 stores since its 2013 merger, reducing its store count by about 55%.

Source: ODP annual SEC filings/TheStreet

In 2024, ODP reported revenue of $7 billion, a far cry south of its post-merger total and revenue of $11.7 billion 10 years ago in 2015.

Given the declines, it’s understandable that ODP agreed to sell itself to Atlas Holdings in an all-cash transaction for $28 per share, roughly $1 billion, an amount that was less than it paid to buy OfficeMax.

Office Depot retail stores by year:

- 2024: 869

- 2023: 916

- 2022: 980

- 2021: 1,038

- 2020: 1,154

- 2019: 1,307

- 2018: 1,364

- 2017: 1,394

- 2016: 1,441

- 2015: 1,564

- 2014: 1,745

- 2013: 1,912

Source: ODP Corporation 10-K SEC filings

What happens now with ODP?

Investors will walk away with cash in their pockets. Short-term shareholders will applaud that the deal sent ODP shares surging 33% on Monday. However, long-term holders won’t be happy, given shares were trading above $50 as recently as May 2024.

Loyal customers? Well, that remains to be seen.

More Retail Stocks:

- Kohl’s takes drastic action to fix concerning customer behavior

- Costco Drops Long-Term Policy On Offering Only 1 Credit Option

- New Target CEO Making 3 Major Changes to Win Back Shoppers

Atlas is also a much bigger company with deeper pockets. It owns 29 companies, employs 60,000 workers, and generates over $20 billion in annual revenue. Its businesses include auto supply, building materials, construction, and others.

Atlas Holdings hasn’t said whether it will close stores after the deal is complete. It has deeper pockets, and given how many stores have already been shuttered, it may not need to make the same drastic store closures as in the past. Also, despite falling sales, ODP has been turning a profit, generating $3.30 per share in earnings in 2024.

“Atlas brings an understanding of our industry, along with the operational expertise, resources and track record of supporting its companies that will fast forward our B2B growth initiatives and strengthen our position as a trusted partner to our customers,” said ODP CEO Gerry P. Smith.

“Atlas has a long history of transitioning public companies into successful private enterprises,” said Atlas Managing Partner Michael Sher. “The ODP Corporation’s leadership has already taken several steps to mitigate the challenging retail environment, and we are the right partners to support The ODP Corporation’s continued evolution in its next chapter.”

Key takeaways:

- Office Depot has closed 55% of its stores since acquiring OfficeMax in 2013.

- Atlas Holdings is acquiring ODP Corporation for $28 per share in an all-cash transaction.

- The ODP Corporation will become a privately held company.

- Once the deal closes, its common stock will no longer be listed on the NASDAQ stock exchange.

- The acquisition is expected to be complete by the end of 2025.

Related: Iconic retail chain closed 80% of its stores

Long before working on Wall Street, Todd Campbell’s first job out of college was as an assistant store manager for OfficeMax in 1993.

RELATED POSTS

View all