(Bloomberg) — Anxiety that tariffs and government firings will torpedo growth in the world’s largest economy extended a three-week stretch of volatility across global markets. US stocks fell toward the lowest since September as Wall Street tempered bullish views while demand for recession havens boosted sovereign bonds.

Most Read from Bloomberg

A selloff in the S&P 500’s most influential group — big tech — weighed heavily on trading amid a rotation into defensive shares. The benchmark extended its plunge from a record to 8% while the Nasdaq 100 sank over 3% on Monday. A gauge of the Magnificent Seven megacaps tumbled 5%. Treasury yields slid on bets that an economic slowdown would force the Federal Reserve to slash interest rates. Bitcoin slipped below $80,000.

Speculation is intensifying that President Donald Trump is willing to tolerate hardship in the economy and markets in pursuit of long-term goals involving tariffs and smaller government.

He said the US economy faces “a period of transition,” deflecting concerns about the risks of a cooldown as his early focus on tariffs and federal job cuts causes market turmoil. Asked on Fox News’ Sunday Morning Futures whether he’s expecting a recession, Trump said, “I hate to predict things like that. There is a period of transition, because what we’re doing is very big.”

“President Trump doubled down on the current policy path and acknowledged the chance of a slowdown, and that’s weighing on sentiment,” said Tom Essaye at The Sevens Report.

On Monday, at least, sagging sentiment was confined overwhelmingly to the megacap tech space, a cohort where valuation excesses have been building since the pandemic lockdown. A version of the S&P 500 that strips out market-value biases fell much less than other indexes — just 0.5%.

The S&P 500 fell 2.3%, set to close below its 200-day moving average for the first time since November 2023. In the megacap space, Tesla Inc. sank 12% while Nvidia Corp. drove a closely watched gauge of chipmakers to the lowest since August. The Dow Jones Industrial Average lost 1.2%. Wall Street’s closely watched volatility gauge – the VIX – hit the highest this year.

The yield on 10-year Treasuries slid seven basis points to 4.23%. The dollar rose 0.2%. US credit risk soared, and over 10 high-grade companies delayed bond sales.

The latest moves mark an abrupt about-face for markets, where the dominant driver of the last few years had been the surprising resilience of the US economy even as growth weakened overseas. That’s shaking the aura of economic and market exceptionalism that has dominated for more than a decade.

“This is a period of high uncertainty on a global macro scale – and as a result, we continue to see de-risking in US stocks,” said Dan Wantrobski at Janney Montgomery Scott. “Added to the potential geopolitical disruptors are the ongoing narratives of inflation, growth, and now potential recession (exacerbated by tariff wars) in the US.”

The talk of tariffs is in a lot of ways worse than the implementation of them, according to David Bahnsen, chief investment officer at The Bahnsen Group,

“I do not believe the administration knows how the tariff situation will play out, but if I were a betting man, I would say that it will persist long enough to do damage to economic activity for at least a quarter or two, and ultimately result in a deal with different countries that make everyone wonder why we went through all the fuss,” Bahnsen said.

He also noted that if a tax cut extension and further tax reform bill is passed through budget reconciliation sooner than later, that will help “offset the damage.”

A chorus of Wall Street strategists is warning about higher stock volatility, with Morgan Stanley’s Michael Wilson the latest to sound the alarm on economic growth worries. Other market forecasters including at JPMorgan Chase & Co. and RBC Capital Markets have also tempered bullish calls for 2025 as Trump’s tariffs stoke fears of slowing economic growth.

“There are always multiple forces at work in the market, but right now, almost all of them are taking a back seat to tariffs,” said Chris Larkin at E*Trade from Morgan Stanley. “Until there’s more clarity on trade policy, traders and investors should anticipate continued volatility.”

To Sam Stovall at CFRA, how long this period of investor caution persists depends on how quickly it will take the global trade clouds, and the resulting threat of recession, to dissipate.

“Markets continue to prove sensitive to trade policy, as considerable uncertainty remains over the size and scope of tariffs to be implemented,” said Jason Pride and Michael Reynolds at Glenmede. “Just as important may be how long the tariffs stay on. Are they temporary in order to extract concessions, or are they a new permanent fixture of US trade policy?”

From rookie retail traders to hedge fund pros, no one knows what the eventual cost of Trump’s sweeping policies really are. His pro-growth plans were tax cuts, deregulation and energy dominance. Tariffs were supposed to bring manufacturing back to the US and create jobs. But so far there’s little evidence of that.

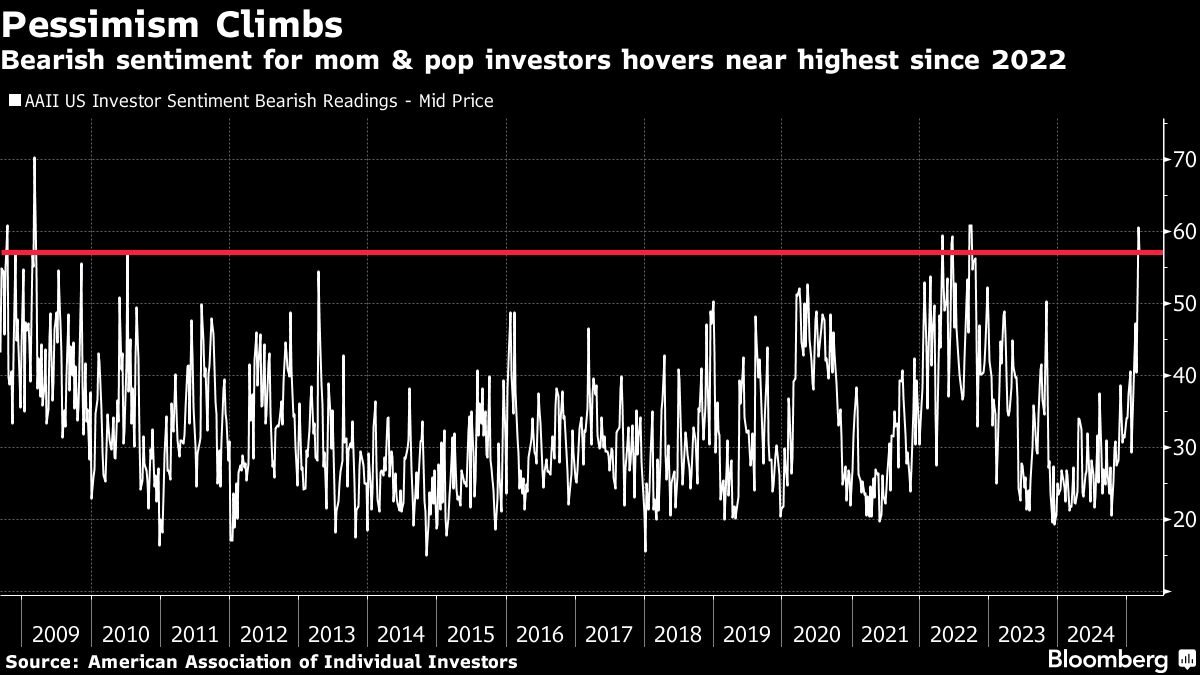

All of this has mom-and-pop investors spooked. For the first time since 2022, the majority of individual investors say they believe stock prices will drop over the next six months, according to a survey by the American Association of Individual Investors. Fewer than 20% say they expect prices to rise over that period.

“Here again we would reiterate that despite sentiment indicators like the AAII bull/bears numbers showing excessive bearishness from retail (newsletter writers), actual positioning of both Main Street and institutional investors remains skewed toward long equities,” said Wantrobski. “ This implies that there could be more firepower to unwind if our unstable macro landscape persists in the coming weeks/months.”

Mark Hackett at Nationwide says he has greater confidence that we are near a bottom rather than on the cusp of a new wave of selling.

“We do need to keep an eye on the pessimistic scenario though, where labor market fears and consumer pullbacks could lead to stagflation, but the proof will be in the datapoints that come out over the next few weeks,” he noted. “If key risks like the debt ceiling, government shutdown, and tariffs resolve in a better-than-worst-case scenario, and economic data remains stable, we could see a recovery follow this selloff.”

Key events this week:

Japan GDP, household spending, money stock, Tuesday

US job openings, Tuesday

Canada rate decision, Wednesday

US CPI, Wednesday

Eurozone industrial production, Thursday

US PPI, initial jobless claims, Thursday

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

The S&P 500 fell 2.3% as of 12:50 p.m. New York time

The Nasdaq 100 fell 3.4%

The Dow Jones Industrial Average fell 1.2%

The Stoxx Europe 600 fell 1.3%

The MSCI World Index fell 2.1%

Bloomberg Magnificent 7 Total Return Index fell 5.3%

The Russell 2000 Index fell 1.7%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro was little changed at $1.0830

The British pound fell 0.2% to $1.2888

The Japanese yen rose 0.5% to 147.23 per dollar

Cryptocurrencies

Bitcoin fell 4.7% to $79,175.54

Ether fell 1.9% to $2,008.58

Bonds

The yield on 10-year Treasuries declined seven basis points to 4.23%

Germany’s 10-year yield was little changed at 2.83%

Britain’s 10-year yield was little changed at 4.64%

Commodities

–With assistance from Sujata Rao and Catherine Bosley.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.