Article content

(Bloomberg) — UK-focused equity capital market bankers are looking to an ongoing series of reforms to reignite initial public offering activity as London listings see their slowest start to the year since 2023.

March 5, 2025 | by ltcinsuranceshopper

UK-focused equity capital market bankers are looking to an ongoing series of reforms to reignite initial public offering activity as London listings see their slowest start to the year since 2023.

(Bloomberg) — UK-focused equity capital market bankers are looking to an ongoing series of reforms to reignite initial public offering activity as London listings see their slowest start to the year since 2023.

Article content

Article content

The city has seen less than $76 million in IPO deal volume in 2025, a fraction of the nearly $2.8 billion recorded at other exchanges in Europe, data compiled by Bloomberg show. The lack of activity continues a yearslong trend of underperformance, which has prompted the government, regulators and the local bourse to pursue a wide-ranging rules revamp to attract new candidates.

Advertisement 2

Article content

Some of the reforms have already borne fruit, as shown by Canal+ SA’s spinoff in December, said Matthew Ponsonby, head of global banking in the UK for BNP Paribas SA. The bank also sees interest in IPOs rising on the back of expected changes to prospectus rules later this year, he said.

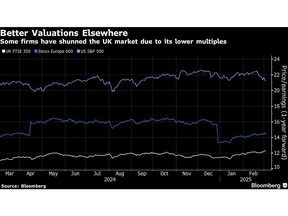

Confidence levels in UK capital markets are markedly higher than six months ago as London-listed equities, alongside European peers, outperform US stocks, said Sam Dean, vice chairman of investment banking at Jefferies Financial Group Inc. The rules revamp is also likely to spur an increase in flows to UK equities from other asset classes, he said.

“We are having the right conversations with companies and their shareholders,” Ponsonby said. “We would expect to see some coming in the first half but probably weighted toward after the summer.”

Market participants have been banking on a blockbuster listing by Shein to kickstart momentum in London IPOs. Founded in China but now based in Singapore, the fast-fashion retailer has had a bumpy ride in its attempts to go public, with questions raised over its supply-chain operations and labor practices, while uncertainty over global trade relations is mounting.

Article content

Advertisement 3

Article content

Beyond Shein, the pipeline of companies with known London listing plans appears sparse.

British payments group Ebury last year started sounding out potential investors for a local IPO, Bloomberg News has reported. Greece’s Metlen Energy & Metals SA filed an application to list on the London Stock Exchange in December, Bloomberg News has reported.

Unilever Plc will list its ice cream unit primarily in Amsterdam, the consumer goods company said, with London and New York getting secondary listings when the maker of Ben & Jerry’s is spun off this year.

Index provider FTSE Russell said Monday that stocks that trade in euros and US dollars will be able to join major UK benchmarks. The firm will also lower the so-called fast-entry thresholds to enable newly listed companies to enter indexes within days of their market debuts.

The index changes will improve the UK’s competitiveness, forming part of the most significant reforms in global capital markets, a spokesperson for the London Stock Exchange Group Plc told Bloomberg.

Some companies “are reluctant to list in London because they have a dollar or euro functional currency and do not want foreign exchange noise,” said Mike Jacobs, a partner specializing in capital markets at law firm Herbert Smith Freehills. “These reforms should very much address these concerns.”

Advertisement 4

Article content

The next phase of the reform agenda will focus on channeling more domestic pension funds toward UK equities, he said.

Further changes which have also been mooted, such as scrapping stamp duty on share purchases and capping cash tax-free savings accounts, could further stimulate investments, BNP’s Ponsonby said.

“The UK capital markets must continue to evolve and build on any investor optimism and momentum it can find,” said Jason Paltrowitz, a director at OTC Markets, a US-based trading platform. “If the government can carefully steer the ship on the course of its long-term fiscal policy, centered on a pro-business and growth agenda, business’ will only have a clearer sense of clarity and ambition.”

—With assistance from Pablo Mayo Cerqueiro.

Article content

View all