I’m a Former Health Care Insider. Even I Couldn’t Escape Prior Authorization Hell.

August 26, 2025 | by ltcinsuranceshopper

I recently got a front-row seat to see how AHIP, the health insurance industry’s big PR and lobbying group, is doing on its pledge to make it easier for patients to receive the care they need by streamlining prior authorization (PA).

That’s the process that insurers require to grant approval for common tests and procedures. I previously characterized their streamlining commitment as akin to “the fox guarding the henhouse,” and after my experience, I don’t see any evidence to the contrary. In fact, it only confirmed that patients and doctors confront too many delays and obstacles.

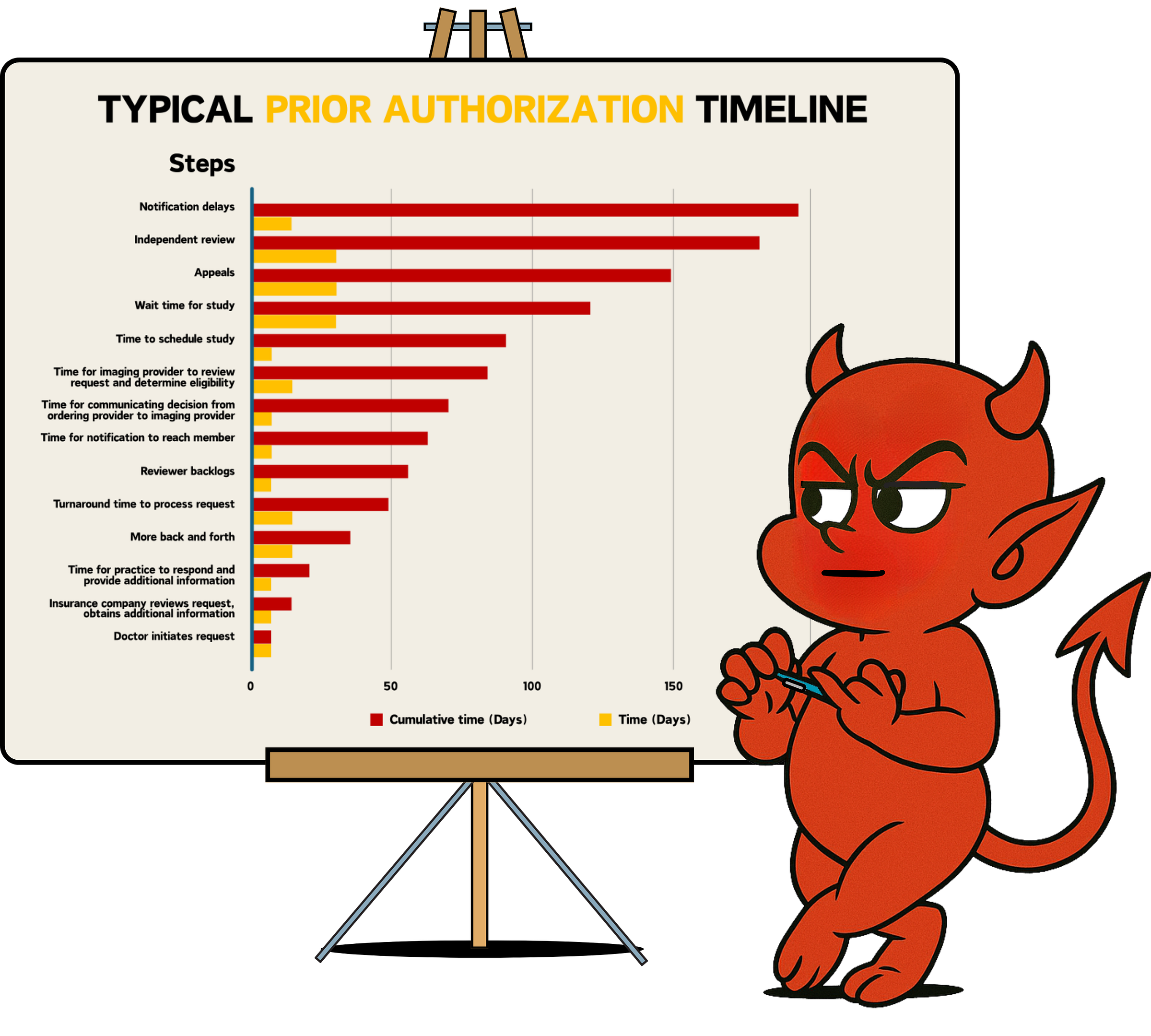

Although insurers tout an average turnaround time of 7-14 days for standard requests, the real-world experience is far longer, often weeks to months. And current industry and federal efforts to reform PA do not address the root cause of this problem.

Last month, my gastroenterologist ordered an MRI/MRCP (a test that provides detailed images of the pancreas), to evaluate an abnormality that was discovered on another test. I immediately wondered how long it would take, how many hoops I’d need to jump through, and how much it would delay my diagnosis and treatment. I reflexively asked her if the MRCP required prior authorization, but I already knew the answer (even if I hoped for a different one). Indeed, my insurance company (like most) requires prior authorization for every single advanced imaging study ordered by a doctor (including MRI, CT and PET scans).

I left the office with a sense of dread, with instructions to “wait a few weeks – that’s how long it usually takes – and then call the imaging center to schedule it.”

I nervously bided my time and called two weeks later to schedule my MRI. I naively assumed my request was working its way through the queue. The woman who answered the phone at the imaging center had no idea who I was (let alone an order or insurance approval for my MRI). I hung up and immediately called my doctor’s office. They told me the insurance company had requested more information (even though the doctor’s office provided them everything they needed up front). Therefore, my doctor held off on transmitting the order to the imaging center. After two weeks of waiting, I was effectively starting over.

Insurers are required by most state and federal regulators to issue a decision within 7-14 days of a prior authorization request (the “turnaround time” for standard requests). But insurers have craftily moved the goal post so that their “clock” starts once they (self)-determine they have sufficient information to process the request (not when they first receive it). This creates opportunities to manufacture delays –by asking doctors clarifying questions, for instance, or requesting additional records. And because regulators rarely hold insurers accountable to the Time 0 standard (when they first receive the request), these delays are largely camouflaged, while creating additional burden for physician practices already stretched to maximum capacity.

So, I waited longer for the approval to work its way through the insurer’s queue. I checked my online insurance portal daily, and after a week, I called the insurance company for an update. It turned out they had reached a decision three days prior – I didn’t know because they had sent me a letter via snail mail that was still en route. As I feared, my intuition was correct. DENIED.

I was flummoxed. Here I was, a knowledgeable and experienced physician and a former health insurance executive, blocked by my insurance company from obtaining a test that both my doctor and I knew was not only “medically necessary” but important.

Fortunately, I know a senior medical executive at my insurance company and called her for an explanation. She said the authorization team followed their standard medical policy and procedures and deemed it not medically necessary. I asked a few probing questions: Does your medical team have a gastroenterologist? Who created and approved this policy? Why would you deny a non-invasive test when the alternative is a costlier and more invasive one – an endoscopic ultrasound with a biopsy?

I learned that the entire process had been outsourced to a vendor (which is part of a for-profit, publicly traded company) – a common practice among insurers. And when I reviewed the vendor’s medical policy, I discovered it was counter to recommendations from the American College of Gastroenterology and the American College of Radiology, both of which advise obtaining an MRI/MRCP for my situation. I also conferred with several accomplished gastroenterologists in my network for a sanity check. They were similarly dumbfounded at the insurer’s actions.

At this point, my only official option was to file an appeal. I knew the process would take a minimum of 60 days, another 60 days if it required an Independent Medical Review, plus other built-in delays that I now knew were part of the process.

So, I called my contact back at the insurance company and confronted her with my research about their vendor’s medical policy and my conversations with well-respected gastroenterologists. To my surprise, she was able to get the decision reversed, so I wouldn’t need to file a formal appeal. I was relieved but also felt a deep sense of unease knowing that I was able to leverage my industry contacts and extensive medical and insurance knowledge to achieve this outcome, whereas the “average” consumer is trapped in a system designed to exhaust and stonewall, rather than help them.

It took another two weeks to finally schedule my exam, since neither my doctor nor the imaging center received an updated approval letter from the insurer. I eventually tracked it down myself, emailed it to my doctor, who in turn uploaded it to the imaging center portal. My MRCP is scheduled for early September – two months to the day after my doctor ordered the test.

If one factors in the typical delays and bottlenecks in the prior authorization process, the true timeline from when a test is ordered to when it is completed is commonly 180 days or more – far longer than the turnaround time of 7-14 days typically reported by insurers and regulators. And this doesn’t take into account the human cost – the incalculable anxiety, frustration, helplessness and fear that patients experience, and the invariable delays in their treatment, some of which have life-and-death consequences.

Current reform efforts at the Centers for Medicare & Medicaid Services and the CMS Innovation Center are largely focused on using technology to improve PA efficiency and on new PA programs, such as CMMI’s WISeR (Wasteful and Inappropriate Service Reduction) pilot project to root out fraud, waste and abuse in traditional Medicare. But as I have argued, these are incremental fixes to a system that is fundamentally broken and used by the health insurance industry to delay and deny care and put profits over people.

If insurers believed technology was the root cause of the problem (or had an interest in fixing it), they would long ago have upgraded legacy prior authorization systems, which largely rely on standards created in the 1970s. And technology alone is not a magic bullet for fixing a fragmented system. In my example, each major stakeholder (the insurer, the prior authorization vendor, the physician’s office, and imaging provider) had designed a system and processes to optimize their own operations and financial outcome, and I (the patient) was merely an afterthought.

To make real progress, we need to design systems around the patient, with the goal of optimizing experience, access and affordability (which are enabled by technology), and dramatically curtail the use of prior authorization except for highly specific cases. It should be the exception, not the rule.

The notion that we should root out fraud, waste and abuse by expanding prior authorization in traditional Medicare – as WISeR would do – is backwards. We need to look no further than the fact that more than 80% of Medicare Advantage denials are overturned on appeal or after independent medical review. That tells us that what is truly unnecessary here is not the care being denied but the rampant overuse of prior authorization.

While doctors try to provide the best possible care for their patients, my personal experience with prior authorization is nearly universal. We all aspire to root out fraud, waste and abuse, but those efforts should put the horse before the cart and focus on identifying and holding the bad actors accountable, not creating more obstacles for everyday patients and physicians, who are already doing their best in the face of incredible adversity.

A more sensible and cost-effective approach is to:

-

Identify and manage entities with utilization patterns that indicate fraud, waste and abuse and;

-

A better approach is to root out the massively wasteful and harmful use of PA. Expanding its use makes sense only to those who profit from it.

I recently received an appointment reminder from the imaging center about my MRCP. It included a disclaimer that my appointment is contingent on a final eligibility check with my insurance company. What could possibly go wrong? In the meantime, I’m crossing my fingers that whenever I finally get my MRCP, the result is what I’m hoping for, and the two-month (and counting) delay in obtaining it does not adversely affect my treatment or prognosis.

Seth Glickman, MD, is a former insurance and health system senior executive. He now is a researcher and advocate for reform in the health care finance space.

RELATED POSTS

View all