How Telematics Apps Are Used in Canada: A Guide for Drivers

July 30, 2025 | by ltcinsuranceshopper

Telematics apps in Canada are becoming the go-to solution for drivers looking to save money and drive more safely. With rising insurance premiums and increased focus on road safety, driving apps Canadians use with telematics are reshaping the way auto insurance works in the country. But how do these apps work, and how are Canadians actually using them?

Let’s explore the process, benefits, and the real-world usage of telematics apps among Canadian drivers.

What Is a Telematics App?

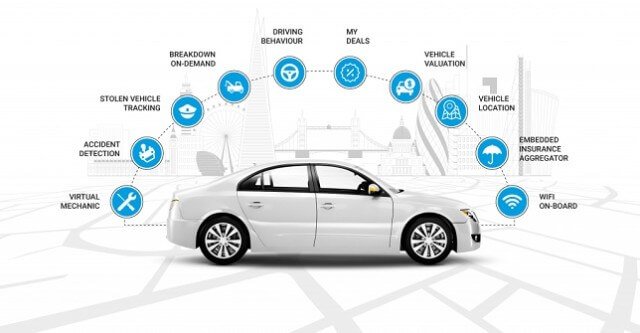

A telematics app is a smartphone application (or device-based tool) used to monitor driving behavior and send data back to the insurer. These apps collect data on:

- Speed and acceleration

- Braking patterns

- Cornering behavior

- Time and distance driven

- Phone usage while driving

In Canada, insurance providers like Intact, belairdirect, Desjardins, Aviva, TD Insurance, and CAA offer telematics programs to reward safer drivers.

Also Read:

How Do Policyholders Use Telematics Apps in Canada?

Once a policyholder signs up for a usage-based insurance (UBI) program, here’s how telematics apps work in Canada step by step:

a) App Installation

The insurer provides access to their official telematics app. The driver downloads and installs it on their smartphone, usually compatible with both Android and iOS. Apps like Intact my Drive and Desjardins Ajusto automatically start collecting data once the vehicle is in motion.

b) Consent and Permissions

Users must grant location and motion permissions to allow the app to track trips accurately. Canadian privacy laws ensure the data is securely handled and not shared outside the insurance company.

c) Trip Monitoring

Each time the vehicle is driven, the app records trip data. It measures how fast the driver accelerates, brakes, takes corners, and whether the phone is being used during the trip.

d) Driving Score Calculation

Based on collected data, a driving score is generated. This score is used to determine if the driver qualifies for a discount. The score is often visible in the app dashboard, offering real-time feedback.

e) Feedback and Coaching

Telematics apps in Canada do more than track; they coach. Most apps provide tips like “Avoid hard braking” or “Reduce phone usage,” helping drivers gradually build better habits.

f) Discount Application

At the end of the monitoring period, usually 3 to 6 months, the insurer applies a discount (ranging from 5% to 25%) based on the score. Some insurers like TD and belairdirect also offer an initial enrollment discount just for signing up.

Why Are Telematics Apps Popular Among Drivers in Canada?

The appeal of driving apps for Canadians using telematics lies in three key factors:

a) Cost Savings

According to 2024 data, Canadian drivers using telematics saved an average of 15–25% on their premiums. For young drivers under 25, these savings can amount to hundreds of dollars annually.

b) Transparency

Instead of general assumptions based on age, gender, or location, telematics insurance in Canada is based on actual driving behavior. This feels fairer to many Canadians.

c) Insurance Customization

With pay-as-you-drive options like CAA MyPace, Canadians who drive less than 12,000 km per year can significantly cut costs.

Also Read:

Who Benefits Most from Telematics in Canada?

- Young drivers: Often hit with high premiums, but safe driving scores help bring costs down quickly.

- Retirees: Drive shorter distances and during off-peak hours—ideal for usage-based savings.

- Urban drivers: In cities like Toronto, Vancouver, and Montreal, many people drive fewer kilometres, making apps like MyPace extremely cost-effective.

Telematics Apps vs. Plug-In Devices: What’s Used More?

While plug-in OBD devices were once common in Canada, smartphone telematics apps have taken over due to:

- Greater convenience (no hardware needed)

- Real-time feedback

- Easier onboarding process

Most top Canadian insurers now offer app-based tracking only.

How One Driver in Ontario Saved with Telematics

One of my clients, a 23-year-old university student in Mississauga, was quoted over $3,200 annually for auto insurance. After enrolling in the belairdirect Automerit program, she:

- Received an initial 10% discount

- Drove cautiously for 120 days

- Scored 91/100 in the app

At renewal, she saved $660 on her premium. Her score also helped her build trust with the insurer, setting her up for future savings. Her exact words? “It finally feels like my driving is being judged, not my age.”

Do Telematics Apps Affect Privacy?

Canadian insurers must follow PIPEDA (Personal Information Protection and Electronic Documents Act) when collecting telematics data. These apps do not:

- Monitor real-time location beyond trip mapping

- Access personal files or contacts

- Sell driving data to third parties

Still, drivers must read privacy policies carefully before signing up.

Are There Drawbacks to Telematics Apps in Canada?

While driving apps for Canadians using telematics offer great benefits, a few challenges exist:

- Strict scoring models: Harsh braking in unavoidable situations can still lower your score.

- Battery usage: Some users report faster phone battery drain.

- Driving context is ignored: Apps can’t always differentiate between safe vs. unsafe reasons for braking or acceleration.

Still, the pros far outweigh the cons for most safe drivers.

List of Telematics Apps in Canada (2025)

| App Name | Insurance Company | Max Discount | Best For |

| my Drive App | Intact Insurance | 25% | Everyday drivers |

| Automerit App | belairdirect | 25% | Young and new drivers |

| en-route Auto App | The Co-operators | 25% | Responsible family drivers |

| Ajusto App | Desjardins | 25% | Data-driven safe drivers |

| MyAdvantage App | TD Insurance | 25% | Commuters and road trippers |

| Journey App | Aviva Canada | 20% | Tech-savvy and cautious users |

| MyPace App | CAA Insurance | Pay-as-you-drive | Low-mileage drivers |

Also Read:

Final Thoughts: Should You Use Telematics Apps in Canada?

If you’re a safe, responsible, or infrequent driver in Canada, using a telematics driving app is a no-brainer. These tools turn everyday driving into a cost-saving opportunity. This is something that traditional insurance models don’t always allow. Plus, they make the roads safer by encouraging better habits.

With leading insurers offering fair pricing, easy setup, and clear data, it’s no surprise that Canadians are embracing telematics apps in 2025 more than ever.

Whether you’re just starting out behind the wheel or looking to save hundreds of dollars annually, telematics driving apps in Canada are changing the game and they’re only getting smarter.

RELATED POSTS

View all