Interested in Pricing Trends?

Get automatic alerts for this topic.

June 17, 2025 | by ltcinsuranceshopper

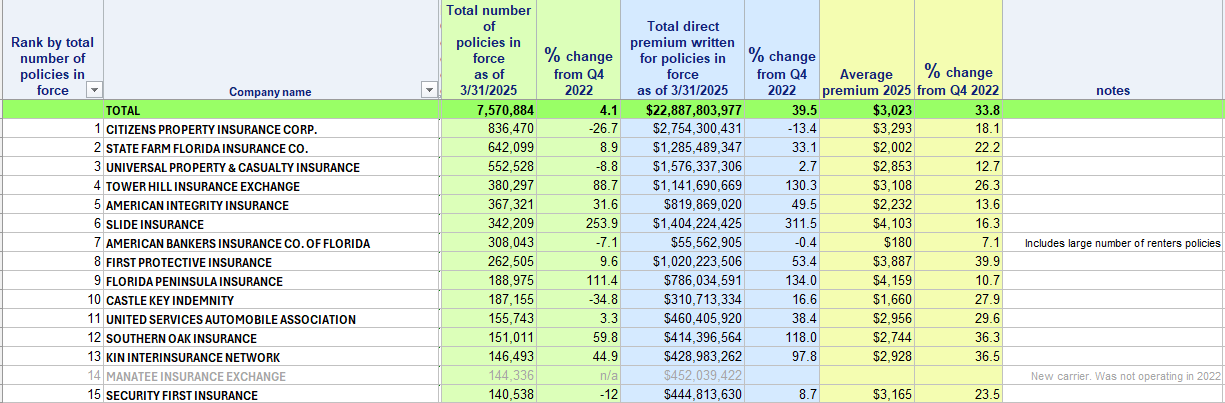

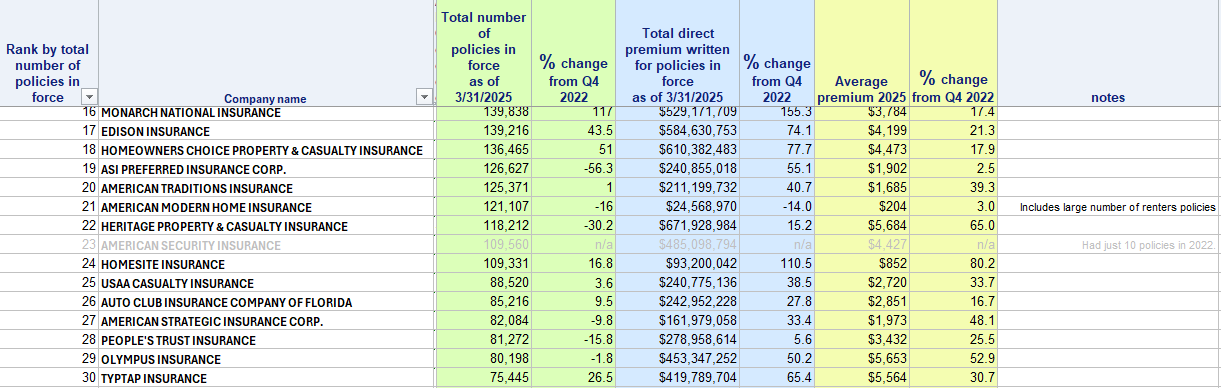

Newly posted data from Florida regulators show that, in the last three years, the number of property insurance policies in the state has risen only slightly while direct premium written and average premiums have climbed significantly.

![]() The first-quarter 2025 data from the Florida Office of Insurance Regulation, when compared to the last quarter of 2022 – the period just before state lawmakers approved far-reaching statutory changes – gives a snapshot of the market and what has changed since the litigation-limiting reforms were enacted.

The first-quarter 2025 data from the Florida Office of Insurance Regulation, when compared to the last quarter of 2022 – the period just before state lawmakers approved far-reaching statutory changes – gives a snapshot of the market and what has changed since the litigation-limiting reforms were enacted.

The data includes personal residential and commercial residential lines. The personal residential policies listed include all types, such as condominium unit, mobile home, dwelling-fire, and renters’ insurance, OIR noted. Here are some highlights as analyzed by Insurance Journal and veterans of the Florida insurance industry:

The database included all personal lines policies, but was not broken down by policy type. That’s why American Bankers Insurance Company of Florida, and American Modern Home Insurance, which write heavily in renters’ coverage, both reported average annual premiums of less than $205.

While some homeowners, attorneys, Florida lawmakers and members of Congress have recently bashed insurance carriers for raising rates, insurers from 2016 to 2023 blamed excessive claims litigation costs for forcing repeated rate increases, something Florida lawmakers addressed with sweeping reform legislation in 2022 and 2023. But since then, some costs have continued to put upward pressure on premiums, one longtime Florida analyst said.

“Premium increases, even where policy counts have decreased, are largely being driven by inflation in construction replacement costs and increases in reinsurance costs and/or the required reinsurance capacity needed to mitigate against solvency risks,” said Paul Handerhan, president of the Federal Association for Insurance Reform, an advocacy group that has tracked the Florida market for years.

He noted that things are beginning to balance out for the industry. Underwriting development has trended in a positive direction recently. The AM Best financial rating firm reported in May that, after eight years of losses, Florida’s personal property insurance market reported an underwriting profit in 2024.

The full quarterly OIR report, in Excel spreadsheet, can be accessed here. A separate database, available on the same OIR site, has data broken down by policy type, by company.

The reports are based on data provided each quarter by insurers and are known as the Quarterly Supplemental Reports (QUASR). Incidentally, in keeping with recent statutory changes, OIR has discontinued the quarterly reporting and now requires insurers to report monthly data. The monthly personal residential and commercial residential (known as PMIR) reporting, using form OIR-D0-1185, requires the following data for each ZIP code:

Topics

Trends

Florida

Pricing Trends

Get automatic alerts for this topic.

View all