Consumer Trust Issues Hinder Industry Efforts to Close Protection Gap: Survey

March 3, 2025 | by ltcinsuranceshopper

Most insurance executives surveyed last year believe they have “an ethical obligation” to close the protection gap—and also believe that “lack of trust in the insurance industry” is a key barrier standing in the way.

Economist Impact, a division of the Economist Group which aims to partner with corporations, governments and nonprofits to deliver positive societal change, and SAS, a provider of data analytics and AI solutions, conducted the “Future of Insurance” survey of more than 500 insurance executives from 17 countries in September and October 2024.

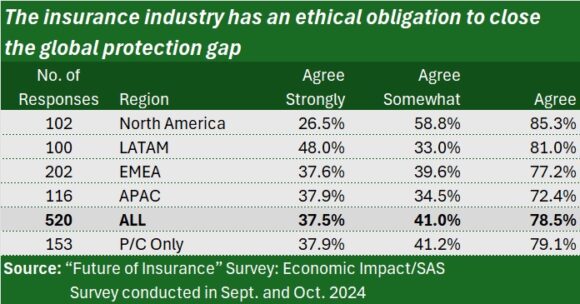

Just over 78% agreed with the statement, “The insurance industry has an ethical obligation to close the global protection gap,” with 37.5% saying they “agree strongly” and 41% agreeing “somewhat.”

The term global protection gap refers to the difference between insured and uninsured losses across life, health, natural catastrophe and crop insurance. In dollars, Swiss Re Institute measured a $1.8 trillion gap for 2022, according to a 2023 report titled “Restoring resilience.” More recently, Aon and WTW separately calculated a 60% protection gap for losses from natural disasters globally for 2024 (2025 Climate and Catastrophe Insight, Aon, Jan. 22,2025 and WTW Natural Catastrophe Review 2024, WTW, Jan. 28, 2025)

Insurance executives surveyed by SAS and Economist Impact across the globe also believe that there is significant business opportunity to be found in closing the global protection gap. Just over 40% “agree strongly” that this is the case and 35.7% somewhat agree.

They face barriers to closing the gap, however, they also agree.

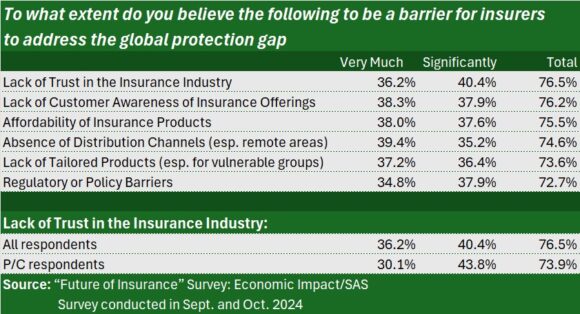

Insurance executives regard the following as top barriers that “significantly/very much” limit their organization’s ability to address the global protection gap:

Franklin Manchester, Principal Global Insurance Advisor at SAS, highlighted the trust issue that topped the list with 76.5% citing waning consumer trust as a key factor. “It’s no wonder why,” he said. “As carriers retreat from disaster-prone areas and data privacy violations are revealed, insurers must act decisively to regain consumer and regulator confidence,” he said in a media statement.

“Full data transparency and investment in responsible innovation would be a significant step forward to reputation and brand reform—one of the top three outcomes the surveyed execs report could come from closing the protection gap,” he said.

For P/C insurance executives surveyed, other positive outcomes of closing the protection gap ranked in the top three were a diversified investment portfolio and more diversification of insurance products. Across all insurance sectors, executives also saw increased insurance profits as a potential beneficial outcome (tied for third-place with product diversification).

More Report Themes

While executives answered many questions about the protection gap, climate change and ESG initiatives, the broad focus of the report was to identify significant trends poised to shape the industry in the coming decade, strategies insurers are pursuing to stay ahead of these trends and potential roadblocks.

Aggregate survey results across all regions and all sectors of the insurance industry show that executives ranked “changing market dynamics”—specifically, the entry of new competitors and industry consolidation—and “the rise and spread of AI and generative AI,” far and away, as the top two trends most likely to influence the industry. Forty-eight percent selected changing market dynamics out of a list of a dozen potentially impactful trends, and 42% selected AI.

While most of the other trends, like increasing cybersecurity risks and increasing data privacy regulations, garnered 25-30% of the selections, the next most popular selection was the pressure to prioritize ESG principles—selected by 39% of respondents.

In another section of the survey, 80% of respondents said they believe other industries have made more progress on ESG commitments than insurers.

Given the timing of the collection of survey responses—before the U.S. elections last year—Carrier Management couldn’t help but wonder whether some results might be different were the survey conducted again today. As President Trump ushers in a new era of deregulation in the U.S., with less focus on climate, DEI and other initiatives, and the EU retreats from some planned ESG regulations, do insurance industry executives still see an ethical responsibility to close the protection gap? Is there still the same impetus to follow through on ESG commitments?

While there isn’t another study in the works right now, Manchester offered some thoughts via email.

“The environmental, social and governance three-legged stool has a branding problem, and it’s often used interchangeably with ‘climate,’ ‘sustainability’ and ‘resiliency.’ Valid concerns have been raised about large organizations (and nations) exiting climate accords and commitments in recent weeks, but we must acknowledge that insurers, by definition, have a stake in the environment, social issues and governance,” he said.

“They are companies with mission and value statements, with reputations to manage, and with foundations that drive positive change.”

In addition, he said that “all technologies (not only AI) must be governed—not only to support regulation but also because capital matters and solvency requirements are real. Technology run amok can bankrupt a carrier faster than you can say ‘inconvenient truth,’” he said. (Editor’s Note: “An Inconvenient Truth was a 2006 documentary about former U.S. Vice President Al Gore’s campaign to educate people about global warming.)

Manchester also noted that investments in ESG pay off for insurers and society, referring to a recent study finding that every $1 invested in resiliency reduces damage and cleanup by $6, and economic loss by $7: a return of 13-to-1.

Tech Strategies and Outcomes: What About Talent?

Surveyed executives were asked to identify the avenues they believe would help their organizations most effectively target the global protection gap. Three of the most popular methods involve technology:

- Using technologies to make insurance products more affordable (48%); 40% of the respondents’ organizations are currently deploying.

- Developing innovative insurance products like parametric or microinsurance (42%); currently in action at 40% of respondents’ organizations.

- Leveraging data to better assess risks and design products (39%); 32% of the respondents’ organizations are working on.

Turning the focus inward, much of the survey focused on technology investments and other strategies that insurance executives have been pursuing, or expect to move on in the near future in order to take advantage of broader trends and achieve desired outcomes.

“What are the most important outcomes for your organization to achieve through efforts to stay ahead or take advantage of these trends?”

Forty-six percent of the executives answering this question selected “minimizing underwriting and operational costs” as a target outcome. No other targeted outcome was close. Ranking second, selected by one-third of executives, was “market expansion.”

Which of the following strategies have been, or do you expect to be, most effective for your organization to stay ahead or take advantage of these trends?

Here, “optimize actuarial processes” was the clear frontrunner, selected by 43 percent of executives. Increased use of data for decision-making ranked behind that (35%).

Only 27% of executives said they believe closing the skills gap would be among the most effective strategies to employ to take advantage of emerging trends, and just 28% will prioritize “talent management” in the next three-to-five years. And in terms of targeted outcomes, “improved employee retention and satisfaction” ranked ninth out of a dozen possibilities, selected by one-quarter of the surveyed executives as a desired outcome.

These results surprised Manchester.

“The industry is barreling towards a talent crisis. We’re seeing data on the silver tsunami of outgoing talent—and a lack of interest from potential up-and-comers—cited in the U.S., as well as in Europe and Asia-Pacific. This is a crisis in the making,” he said.

“Keeping talent is hard and a lack of talent spells disaster. We can water down concern about AI stealing jobs from humans in insurance when reckoning with the fact that AI can supplement the work of what underwriters, adjusters, or agents do.” But the reverse isn’t true, he said, referencing an idea from Nvidia CEO Jensen Huang: “‘AI won’t steal your job. Someone who’s an expert with AI will.’”

Said Manchester: “Insurers need to understand that people are their greatest asset. Hiring good ones, training them well, giving them the tools they need to be successful and providing clear, regular feedback on their performance is part of a successful business strategy.”

Beyond talent initiatives and setting ESG goals, the executives were asked to indicate whether they have already implemented or expect to implement 11 specific strategies—ranging from cybersecurity investments to setting up agile organizational structures—in the next three-to-five years.

The most likely strategies to be have been implemented already were agile organizational structures (43%), diversifying distribution channels (42%), and optimizing actuarial processes (40%).

Sixty-four percent of insurers have not invested in cybersecurity nor established transparent guidelines for collection, use and storage of data.

Topics

Trends

RELATED POSTS

View all