While the markets may have shown some recovery over the last two weeks, most stocks are still in a bear market or at least in correction territory. Very few stocks have bucked the trend. Stocks that are trading at or close to their 52-week highs are outliers in this context. One such stock is Bajaj Finance (BFL), which is just 3 per cent off its 52-week high. The stock’s performance comes on the back of strong fundamentals in the nine months ended FY25 (9M FY25).

The company has always been synonymous with growth, with its AUM (assets under management) growing at a staggering CAGR of 38.5 per cent in the last 15 years (FY09-24). AUM growth did slowdown in FY21 though, to a mere 4 per cent, as a response to the pandemic. But the company quickly came back on track, supported by mortgage and Urban B2C portfolios, with AUM growth for FY22, FY23 and FY24 recorded at 29 per cent, 25 per cent and 34 per cent respectively.

Though some part of this growth can be attributed to the low base of FY21, it will be interesting to see if the company can sustain it in the years to come, especially with an AUM of close to ₹4 lakh crore (just a few thousand crores shy of Kotak Mahindra Bank’s loan book). Valuation at 6.1x trailing P/B (price to book value), is cheaper than five-year and 10-year averages of around 8x. However, growth too, while strong, will be relatively lower from here as compared to historical growth rates.

The management has guided for growth of 25-27 per cent in AUM and 23-24 per cent in profit, while maintaining RoE (return on equity) at 21-23 per cent in the long term (exact period not mentioned). Like valuation is 25 per cent cheaper to 10-year average, growth, even in the best case, is also going to be 20-25 per cent lower than 15-year CAGR in AUM.

While we would like to note that the company is on a strong footing, the valuation appears fully priced for its growth. While existing investors can hold on to the stock, fresh positions can be avoided at current levels.

Business

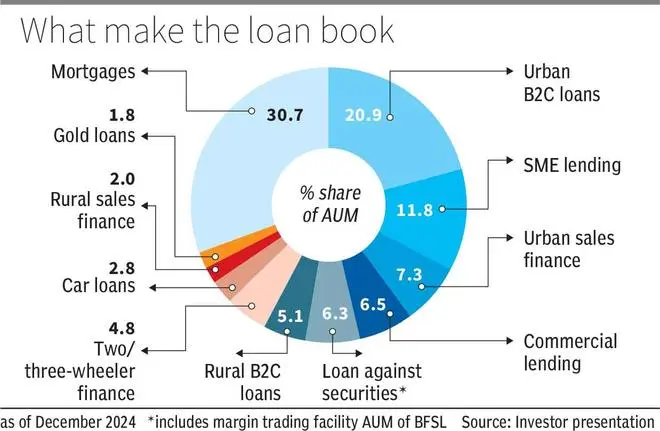

Bajaj Finance is a deposit-taking NBFC that is into diversified lending. Its AUM is made up of 11 portfolios, as can be seen in the infographic. While some of them are self-explanatory, here’s a brief about the products offered under each of them.

B2C loans include personal loans and credit cards segregated into urban and rural. Sales finance includes consumer durable loans — again segregated into urban and rural. SME lending comprises of unsecured working capital loans and secured business loans, among others. Commercial lending includes IPO financing, ESOP financing, loans to large/ emerging corporates and loans to industries such as auto, light engineering, specialty chemicals and financial institutions.

Fundamentals

BFL has a stellar growth record. In the last 15 years (FY09-24), the stock has delivered a profit CAGR of a staggering 50 per cent with an RoE that has rarely deviated off the 20 per cent mark.

In 9M FY25, the AUM has risen 28 per cent year on year, pre-provisioning operating profit up 26 per cent and net profit up 15 per cent. The NBFC is well capitalised with a capital adequacy ratio of 21.6 per cent as of December 2024.

The fairly new portfolios of car loans (3 per cent of AUM) and gold loans (2 per cent of AUM) can add growth. New areas such as near prime, affordable housing and green finance (EV and renewable energy loans) have also been identified.

However, the company has been facing asset-quality issues recently, though within the tolerable corridor. Gross NPA ratio stands at 1.12 per cent, up from 0.95 per cent, as of December 2023. GNPA ratio, as per the management’s long-term guidance, is 1.2-1.4 per cent. Credit cost, too, has inched up to 2.1 per cent (for 9M FY25) from 1.6 per cent recorded a year ago.

These are largely due to delinquencies in the two-/ three-wheeler loans and used-car loans, following which the company has cut its exposure to the used-car portfolio by close to 30 per cent. The new car loans, on the other hand, are doing well. BFL has also cut down exposure to overleveraged customers who have three or more live unsecured loans.

These measures could mean that asset quality could improve, going forward. Also, the proportion of stage-2 accounts (30-89 days past due) have either down or remained stable for most products as of Q3 FY25. The management is optimistic that the worst of delinquencies could be behind.

What works

For a finance company, growth in assets will highly hinge on the ability to raise ample funds at the right price. This is where BFL shines, with its credit rating of AAA/Stable by CRISIL. This has helped BFL’s cost of funds to remain stable at just below 8 per cent since March 2024. The funding mix is as follows – NCDs 37 per cent, bank loans 29 per cent, customer deposits 20 per cent and others 14 per cent.

BFL has also raised NCDs recently with coupon rates a good 20-30 basis points below the current cost of funds. This will help support margin. The management notes that in the case of rate cuts, pricing will be based on risk undertaken and margins will not be compromised.

Technology and data analytics have always been a mainstay of BFL’s strengths. Going forward, the company looks to invest in AI to transform into a ‘FIN-AI’ company, as part of its BFL 3.0 (FY25-29) framework. These investments are expected to bring about better precision in underwriting and cost efficiencies.

Why hold and not a buy?

While the management’s guidance for AUM growth of 25-27 per cent is impressive, sustaining such high growth may not be easy, especially on a high base. The management has even noted that the company has peaked in terms of the number of locations (cities/ towns) served.

The industry in which the NBFC operates is highly cyclical. With consumption-based loans forming half the AUM and mortgages (largely dependent on prime housing finance) another one-third, growth will be susceptible to economic downturns.

For instance, some analysts had built in a growth rate of 40 per cent for the medium-term in 2019. However, the company delivered an AUM growth of a lower 22 per cent compounded between December 2019 and December 2024. The stock has also performed just in line with Nifty in the last five years (since February 2020, weeding out the Covid fall in March). Covid can be seen as a proxy for a downcycle here and implies the need to build in a higher margin of safety. It is better to err on the side of caution and be conservative in growth estimates. There is also no dearth of competition in the space the company operates in.