Stock Market Today: Stocks fall after Fed Chair's remarks, warnings about "no risk-free path"

September 24, 2025 | by ltcinsuranceshopper

This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Tuesday. This is TheStreet’s Stock Market Today for Sept. 23, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 5:02 p.m.

Micron Beats Earnings

Micron (MU) (+2% in after hours) is rising after reporting earnings, showing sustained demand for memory products amid a boom in data center development nationwide.

Update: 4:45 p.m.

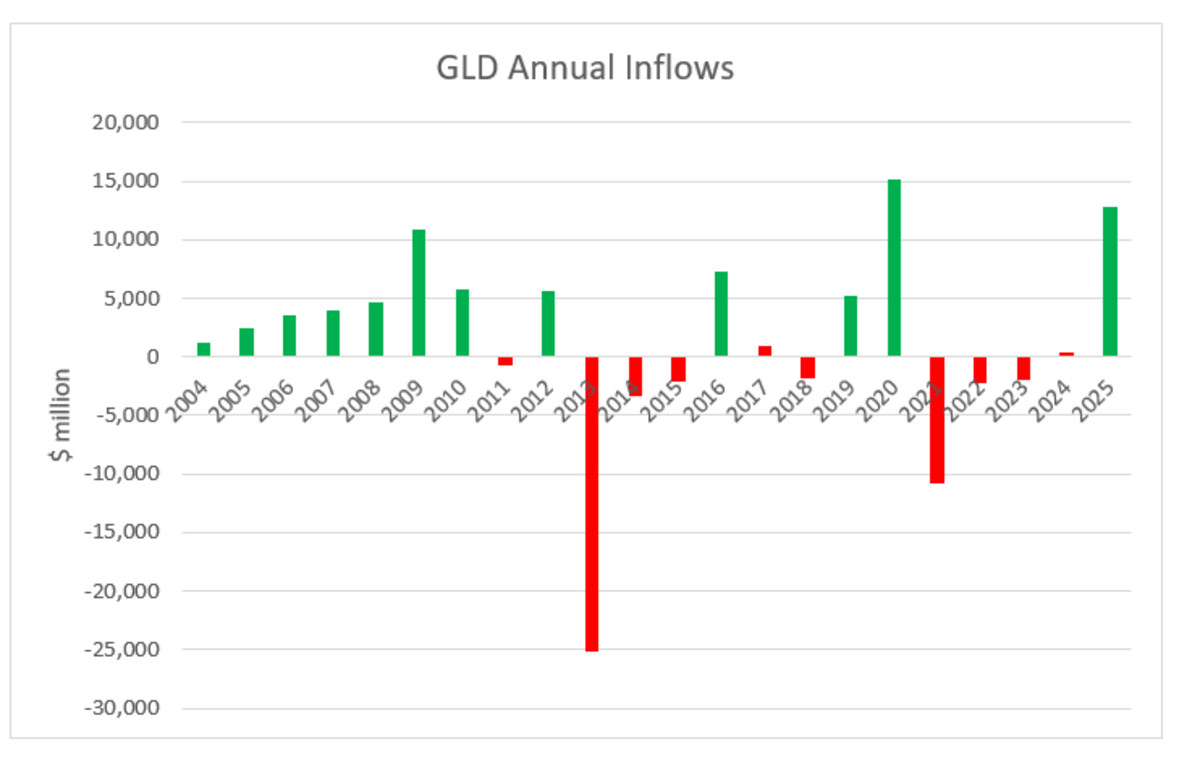

Lucky 37 for Gold: Record ETF Inflows

It’s record #37 of the year for Gold, which notched another record close today, despite pulling back from its intraday highs. The Continuous Gold Contract (+0.58%) rose to 3,796.90 after jumping through the $3.8K level.

Maybe it’s not really any surprise, considering the largest gold ETF had its largest inflows in history yesterday, per etf.com. And what’s more, fund flows are now positive year-over-year.

Update: 4:03 p.m.

Market Close: 0-for-4 in the Green

The U.S. markets are closed. The Russell 2000 (-0.06%) was the best-situated, followed by the Dow (-0.19%). The S&P 500 (-0.55%) and Nasdaq (-0.95%) is also further behind.

Update: 3:22 p.m.

Heading Downhill: Stocks Turn Over

So much for more record highs today. All four major indexes have turned over this afternoon, following comments from various Fed Governors and Chairman Jerome Powell.

The Nasdaq (-1.03%) is worst off, followed by the S&P 500 (-0.67%). The Dow (-0.26%) and Russell 2000 (-0.25%), which moved in lockstep throughout the day, have also given up their gains.

Heading towards the close, it looks like declines from all four indexes today. Such is life at the top of the market.

Update: 1:43 p.m.

Gold On Track for 37th Record Close

Gold is going strong today, on track for its 37th record close. The Gold Continuous Contract is up nearly 1%, sitting above $3,800.

Update: 12:36 p.m.

Fedspeak: Recapping Today’s Talks

Fed Governors have been at the mic all day, starting with Fed Governors Goolsbee (Chicago), Bowman (Vice Chair, Supervision), and Bostic (Atlanta).

Goolsbee doubled down on the importance of meeting the 2% target and said that he’s “not thinking” about a 50 basis point cut.

Bowman said she was worried the central bank was “behind the curve” on the labor market, adding that faster cuts will be needed if conditions continue to worsen.

Bostic warned that more inflation could be coming, while suggesting that the neutral rate could be “rising.”

And now, Fed Chair Powell is delivering his first remarks since the FOMC press conference. It’s mostly a collection of things we’ve already heard.

Powell reiterated points that there is “no risk free path” on inflation and the labor market. He described rates as “modestly restrictive” while stressing the importance of balancing policy by not cutting too fast (exacerbating inflation) or too slow (stresses labor market.)

Update: 12:29 p.m.

What’s Trump Been Up To Today?

President Donald Trump just wrapped fiery remarks at the UN General Assembly, where he said that his presidency was “the golden age of America” and that the U.S. is the “hottest country anywhere in the world.”

The President also touched on the stock market’s rally, “uncontrolled migration”, and promised lower gas prices a year from now. He also touched on the need to end the “Gaza War” and the Russian attacks on Ukraine.

The remarks come just an hour after the administration proposed a widely-anticipated new H-1B visa process.

Update: 12:15 p.m.

Midday Movers

Heading into midday, the Nasdaq (-0.32%), S&P 500 (-0.16%), and even Dow (+0.13%) are losing steam, declining from highs this morning. Even the strong-spirited Russell 2000 (+0.61%) is lower.

That said, it’s time to check in on the market. Market-wide, there’s 3,271 stocks rising and 2,105 declining, per data from FinViz.

Looking specifically a firms just above a $2 billion market cap, let’s take a look at the top-performers and worst-performers of the day:

Winners

At the top of the market, we have Crane NXT CXT (+15.8%), Landbridge Company LB (+15.3%), and BigBear.ai Holdings BBAI (+12.8%), among others.

Here are the top 20 performers:

Losers

Strive Inc ASST (-15.3%), Diginex DGNX (-13.8%), and Firefly Aerospace (-12.6%) are the worst-off today, all down double-digits.

Here’s the bottom 20:

Update: 11:54 a.m.

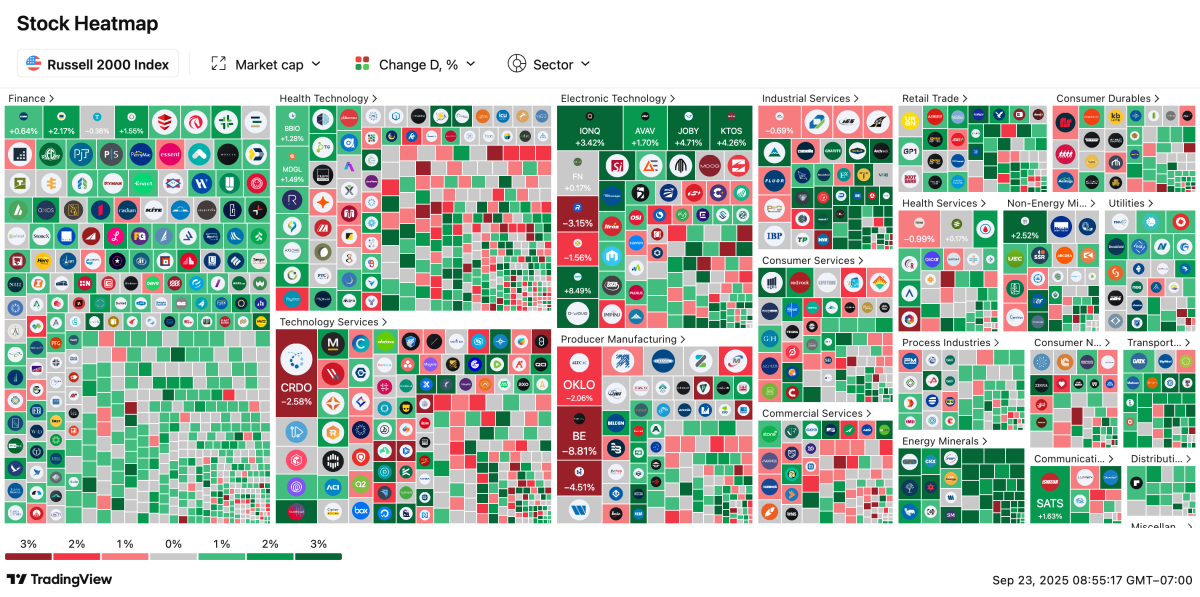

Heatmap: Russell 2000

The Russell 2000 (+0.71%) is having a pretty solid day, despite other benchmarks sinking. It’s currently sitting just off intraday highs and is trending for a record close.

Looking at the heatmap reveals a more complicated story, though. 627 of the index’s holdings are in the red at the moment, about a third of them in total.

Despite the index’s rise, there’s definitely a healthy amount of red; stocks like New Fortress Energy (-9.1%), Arrive AI (-8.87%), and Global Medical REIT (-8.56%) are leading the index’s losers.

On the flip side, Zspace ZPC (+37%), Better Home & Finance BTR (+37%), and NextNRG NXXT (+30.7%).

Here’s the heat map:

Update: 9:52 a.m.

Russell 2000 Sets New Intraday High

The Russell 2000 just set an intraday high, surpassing the 2,472.27 price point that it notched on Sept. 19.

To set a new record close, the index just has to stay above 2,467.70, which was set Sept. 18 and represents the growth index’s first record since Nov. 2021. It would be its second record close of the year.

Update: 9:31 a.m.

Opening Bell: Stocks Flat-ish

U.S. stocks are now trading. The S&P 500 (+0.02%) is at 6,693.86, inching closer to the crucial 6,700 milestone. The Nasdaq (-0.05%) is at 22,778.64 this morning. In other words, pretty flat. We’ll have to see if these two can get out of their funk.

By contrast, the Russell 2000 (+0.44%) and Dow (+0.32%) are going a little stronger this morning. They tend to move together

Update: 7:13 a.m.

Data Drop Validates Fed’s Dovish Positioning

In the last 30 minutes, the S&P Global PMI and Richmond Fed Manufacturing and Services data dropped.

S&P Global Composite PMI (53.6), Manufacturing PMI (52), and Global Services PMI (53.9) came in softer than last month, but not by much.

The Richmond Fed Manufacturing Index (-17), Manufacturing Shipments Index (-20), and Services Revenues (+1) also came in lighter than in August.

Update: 6:32 a.m.

Futures Mixed Ahead of Opening Bell

For the moment, three of the four most-watched U.S. equities benchmarked are in decline; the Russell 2000 (-0.02%), Nasdaq (-0.08%), and S&P 500 (-0.10%) among them. The Dow (+0.05%) is the sole exception in the green at the moment.

A.M. Headlines

Here are a handful of stories crossing the wire before the market opens this morning:

China and the U.S. are said to be closed to a “huge” deal for Boeing (BA) aircraft.

A new report from Bain says that AI firms might come up $800 billion short of the revenue required to “meet projected demand” by 2030.

Gold continues its rally, with Dec. 2025 futures surpassing $3.8K

OECD raised U.S. and global growth forecast; warns that tariff impacts still have yet to be realized

AutoZone (AZO) (-2%) sales rose because of price increases; booked fifth consecutive earnings miss

Update: 7:19 a.m.

Everything (We Know) Happening Today

Increasingly, the story on Wall Street is turning from the recent Fed rate cut to the future ones. JP Morgan Chase (JPM) CEO Jamie Dimon said in an interview last night that cutting rates further from here will be “hard” for the Fed to cut further from here.

With that, bullish investors are going to have to find reasons to keep up the momentum, especially outside of the narrow handful of equities that are keeping the indexes alive. Yesterday was S&P 500’s, Nasdaq’s and Dow’s 28th, 19th, and 7th record close of the year. For Gold, it was the 36th.

Futures today are mixed this morning, so if that’s to continue, there’s a balance to walk from day-to-day. Here is what could help move markets today:

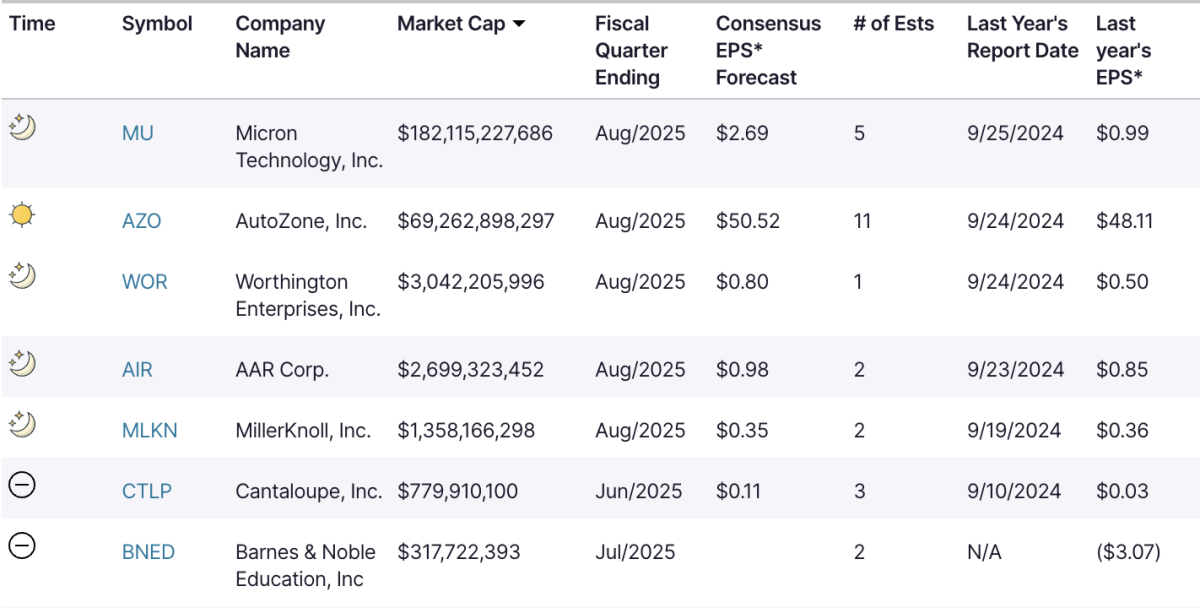

Earnings

Nasdaq says there’s 15 earnings reports today. Of them, six are for firms over a $1 billion market cap.

Among them are Micron Technology (MU) , AutoZone (AZO) , among others. Also included in today’s earnings festivities is comeback story Barnes & Noble Education BNED, which might have interesting results.

Per the company, here’s the top earnings reports on deck for today:

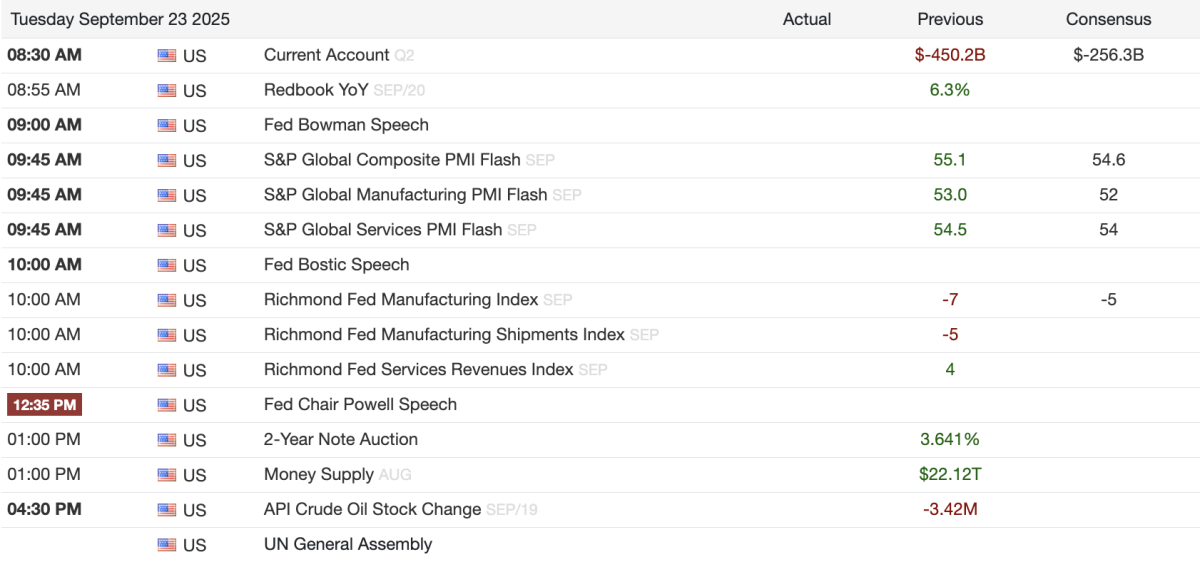

Economy

Today, there’s a modest list of economic prints inbound, including the Current Account, S&P Global PMI, and Richmond Fed Index.

Plus, today we’ll be hearing speeches from Fed Governors Bowman (Vice Chair of Supervision), Bostic (Atlanta), and Powell (Chairman), in that order.

Here’s everything on the docket toady, per TradingEconomics:

RELATED POSTS

View all