Stock Market Today: Stocks weaken after surprising wholesale inflation reversal, Oracle rally

September 10, 2025 | by ltcinsuranceshopper

This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Wednesday. This is TheStreet’s Stock Market Today for Sept. 10, 2025. You can follow the latest updates on the market here with our daily live blog.

Update: 4:31 p.m. ET

Direct Your Attention to Tomorrow: The CPI Beckons

Investors were in for a surprise with the release of the Producer Price Index (PPI) today. Will we be getting a surprise in the Consumer Price Index (CPI) tomorrow?

Analyst consensus is that both Core CPI and CPI rose by 0.3% in August, which would bring their year-to-year run rate to +3.1% YoY and +2.9%, respectively. By contrast, analysts were looking for a similar increase from the PPI today; instead, it declined by 0.1%.

Tomorrow’s biggest data drop is out at 8:30 a.m. ET. We’ll also get more labor market data in the form of Initial & Continuing claims.

Update: 4:03 p.m. ET

Closing Bell: Here’s How It Went

U.S. equity markets are now closed for the day. Three of the four indexes bailed after a surprise PPI print and strong Oracle earnings buoyed an early-day rally.

Here’s how things went from the last tick of yesterday to the close today. It makes the indexes look like they had a pretty bad day, all things considered:

The S&P 500’s (+0.30%) late showing put the index the index at a fresh close today, at 6,532.04. And even though the Nasdaq (+0.03%) is below where it was in after hours yesterday, the index also had a fresh record as well.

The Russell 2000 (-0.22%) and Dow (-0.48%) were not so lucky.

The top-performing stock of the day was Oracle (ORCL) (+35.9%), which is no surprise if you were following along all day. Other hyperscaler and data center connected names like CoreWeave (CRWV) (+16.8%), Applied Digital (APLD) (+11.7%), IREN Limited (IREN) (+11.3%), and Core Scientific (CORZ) (+10%) were also among top-performers.

On the other end of the market, earnings from Synopsys (SNPS) (-35%), Rubrik (RBRK) (-18%), and Chewy (CHWY) (-16%) caused the stocks to plummet. They also sold off even more as the trading day proceeded.

Update: 3:34 p.m. ET

Going… Going… Gone

Heading into the home stretch, there’s some weight over the market: maybe it’s Russia’s drone incursion, Trump’s plan to appeal the Lisa Cook firing case, or the overwhelming weight of living in an increasingly low-trust, politically violent America.

Maybe it’s all of the above! Doesn’t matter! Investors don’t like it!

Equities are sagging into the late day after the Producer Price Index (PPI) notched a surprise decline and earnings from Oracle ORCL and other megacap tech firms helped pull up the market. But at last glance, the market has erased most of its gains today.

The S&P 500 (+0.14%) is the only index in the green, on track for another record close after notching an intraday high. The other three indexes are not looking so hot: the Nasdaq (-0.16%), Russell 2000 (-0.36%), and Dow (-0.67%) are down heading into the homestretch.

Update: 1:22 p.m. ET

Trump on Poland-Russia Fracas: “HERE WE GO!”

President Donald Trump posted this on Truth Social earlier this morning:

What’s with Russia violating Poland’s airspace with drones? Here we go!

The President has been trying to broker a peace deal between Ukraine, where the drones were reportedly en route to. Congressional Republicans have signaled a slew of new tariffs could be imposed on Russia as a result.

In the meantime, Poland has invoked NATO Article 4, allowing for there to be an urgent inquiry into the matter by the defense bloc.

Update: 1:08 p.m. ET

Klarna, Biggest IPO of 2025, Opens At $52

Buy now, pay later firm Klarna KLAR is now trading, opening around $52, a 20%+ premium to the company’s $40 offering price. It has since pulled back to $45, paling some of its early gains. 8x oversubscribed, Klarna’s public listing is among the largest of the year, raising over $1.3 billion.

Update: 12:59 p.m. ET

Klarna Indicated To Open $52-53/sh

All morning, investors have been keeping their eye on what’s expected to be the biggest market debut of the year: buy now, pay later company Klarna. Delayed a seemingly innumerable number of times, the stock was last indicated to open at $52-53/sh, a sweet premium to its $40 offering price. Given the narrow band, the stock could begin trading any moment now.

Update: 12:27 p.m. ET

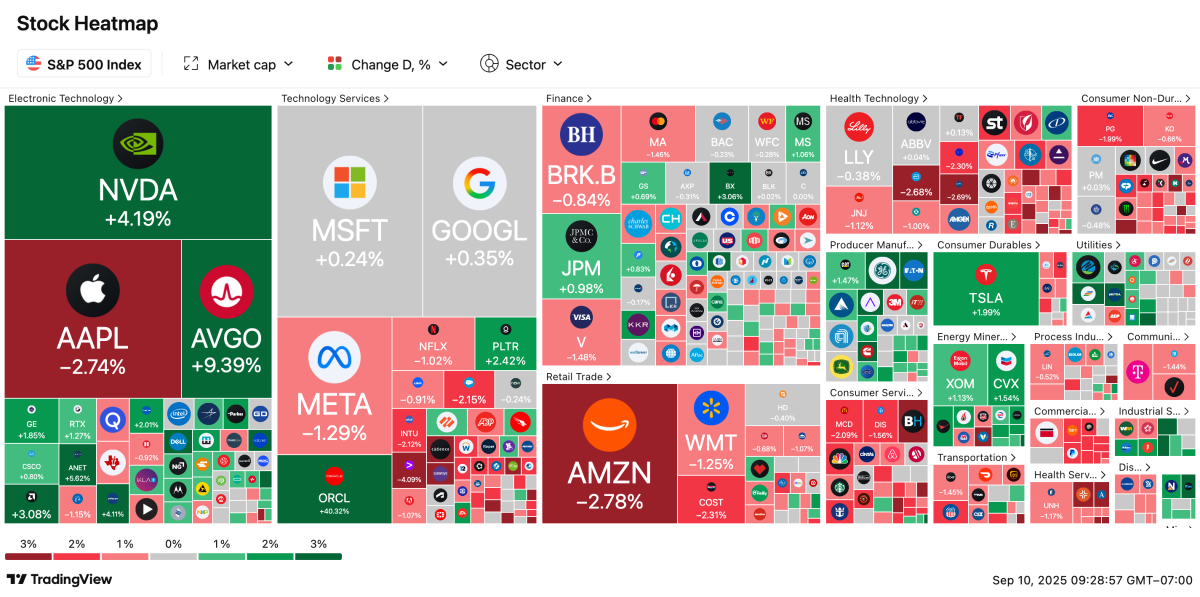

Midday Movement: Oracle Atop the S&P 500

Oracle (ORCL) (+40.3%) has augured higher highs for stocks and investors are getting them today, just days after chipmaker Broadcom (+9.3%) made its mark on Wall Street with exciting earnings of its own.

Both stocks are rising, even as shares of other megacaps like Amazon AMZN (-2.7%) and Apple (-2.7%) are sagging. The S&P 500 (+0.44%) is the top-performing index of the day, carried higher in part by the best-performing stock

Here’s the index heatmap:

TradingView

Update: 9:33 a.m. ET / 10:32 a.m. ET

Market Higher After PPI Decline

The U.S. stock market is now open. Jumps from the futures session have carried over into the new trading day, with the Nasdaq (+0.46%), S&P 500 (+0.45%), and Russell 2000 (+0.43%) on the rise. The Dow (-0.15%) fell.

At the open, Oracle (ORCL) (+30.7%) is the market’s top-performing stock, which is helping to prop up other hyperscalers like CoreWeave (CRWV) (+18%). Meanwhile, yesterday’s other earnings such as Synopsys (SNPS) (-31%), Chewy (CHWY) (-12%), and Rubrik (RBRK) (-9%) posted declines to start the day.

In other news:

- This morning, Klarna will also begin the process of going public; we’ll provide more updates as the company’s indications start to narrow.

- Ozempic maker Novo Nordisk will lay off 9,000 employees as sales of its superstar drug face greater competition

- Poland has requested an Article 4 ‘consultation’ with other NATO members after Russian drones invaded its airspace en route to Ukraine last night

Update: 8:30 a.m. ET

PPI Posts Surprising Month-Over-Month Decline; Stock FUtures Jump

The Producer Price Index posted a surprise month-over-month decline in August, falling 0.1%. Core PPI also fell 0.1%. Year-over-year, the PPI and Core PPI rose 2.6% and 2.8% respectively. Services, particularly trade services, drove the decline as the price of goods advanced.

The PPI was saw a downward revision for July; originally indicated to rise 0.9% MoM, the Bureau of Labor Statistics now says wholesale inflation advanced just 0.7% in the period. Still, the year-over-year figures are above the Fed’s 2% inflation target.

Investors expected a modest rise in the PPI in August, but not a decline. As a result, the surprise print sent U.S. stock benchmarks jumping into the opening bell.

At last glance, futures on the Nasdaq (+0.54%), S&P 500 (+0.50%), and Russell 2000 (+0.30%) all made big jumps. The Dow (UNCH) also jumped near the green.

Update: 4:16 a.m. ET

Everything On Deck for Today

As we mentioned in yesterday’s edition of Stock Market Today, we’re in the waning days of the Q2 earnings season. Today, there’s just two domestic firms with a market capitalization greater than $1 billion set to report: Chewy (CHWY) and IDW Media Holdings IDWM.

However, the real story today is the Producer Price Index (PPI), the first of two major inflation reports this week. As the name implies, the PPI measures costs on producers; it also rose at a higher rate in July than Personal Consumption Expenditures (PCE) and the Consumer Price Index (CPI).

That means that investors will be keeping a close watch on the August report today, due out at 8:30 a.m. ET. If the print falls within expectations (+0.3% year-over-year), then the market could continue to soldier upwards today. A misprint, or bad showing, could cause the market to shutter ahead of the CPI release for August which is due out tomorrow.

Aside from that, buy now pay later firm Klarna is set to test its odds on Wall Street today with its upsized initial public offering. We wrote a little bit about Klarna and other forthcoming IPOs last week:

Related: The next Circle could be one of these three upcoming fintech IPOs

Everything You Missed Last Night

After the closing bell yesterday, there was no shortage of excitement with the markets: whether it was a new record close for the S&P 500 and Nasdaq Composite, a ‘blindsiding’ report from Oracle (ORCL) , Poland shutting down its busiest airport because of a Russian drone swarm, or the two Trump headlines that made waves in the evening. Here are three stories to read today to get caught up:

Related: Investors write off Oracle earnings miss as management promises stratospheric growth

Related: The Supreme Court has agreed to hear challenges to this key Trump policy

Related: Trump’s Fed takeover effort handed setback after court sides with embroiled Fed Governor

RELATED POSTS

View all