Some of the worst investing mistakes happen when it is easy to make money. We must admit that making money from the markets has been child’s play since Covid. During and just after Covid, governments flooded the system with cheap money in the name of stimulus. When this waned, retail investors switched en masse to risky assets hoping for higher returns.

This unrelenting gush of liquidity has led to exceptional returns from many asset classes in the last five years. But it is dangerous to assume that these high returns will continue in perpetuity.

Beware the recency bias

It is rarely that multiple asset classes deliver blockbuster returns at the same time. But Indian investors have experienced this in the last five years.

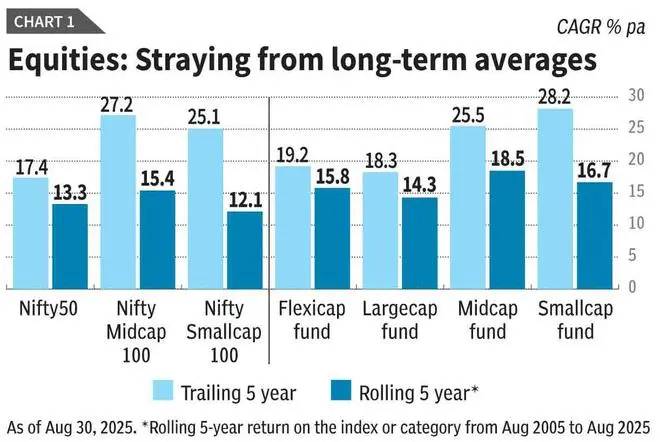

Large-cap and flexi-cap equity funds have belted out 18 per cent and 19 per cent CAGR (compounded annual growth rates) respectively. Mid- and small-cap funds have more than trebled in value with 26 per cent and 28 per cent. Gold and silver have managed 14 per cent and 12 per cent CAGR over five years, gaining nearly 40 per cent in one year. Even investors taking the passive route have enjoyed a wild ride, with the Nifty50 belting out a 17 per cent CAGR, the Nifty Midcap100 27 per cent and the Nifty Smallcap100 25 per cent.

When recent returns are this high, we get tempted to attribute them to our own skills rather than luck. We also build our future financial plans on rosy assumptions. Covid has also spawned an army of online influencers who base all their ‘advice’ on their own limited experience. They urge you to skip pre-paying loans to max out equity SIPs (Systematic Investment Plans), shun fixed deposits, stockpile gold and silver, and buy into Nasdaq companies.

But all of this is heavily influenced by recency bias — a minefield in investing. Today, it is far more important for you to protect the wealth you have already made, than chase any extra returns. Many assets that have run up carry a higher risk of capital losses after their abnormal winning streak.

Protection > Returns

No one can tell you when a correction will unfold, or how deep or long it will be. But you can still do two things to protect your wealth. One, reduce your allocation to assets which have delivered outlier returns in the last five years. Add weights in those that have been under-performers. Two, reset your return assumptions lower, when you build future financial plans.

To do this though, you need to know what returns are realistic for any asset class. Mean reversion is the most powerful force in markets. Therefore, to reset to realistic return expectations, you can use history as a guide. Here’s how.

Equities: Re-adjusting to earnings

Equities, especially small-cap and mid-cap stocks, have been stellar assets to own in the last five years. On a total return basis, if the Nifty50 has racked up about 17 per cent CAGR in the last five years, Nifty Midcap100 shot out the lights with a 27 per cent CAGR and Nifty Smallcap100 has made 25 per cent. (All returns as of August 30 2025).

But one-off factors were at work powering those returns. The 2020-24 rally was driven by the Indian economy experiencing a sharp rebound from Covid and company earnings racing ahead of the economy.

India’s GDP grew at 8.2 per cent CAGR in real terms and 13.6 per cent in nominal terms in the four years from CY2020 to CY2024. The corporate tax cut in September 2019 provided a further steroid shot to corporate earnings. Therefore, between December 2020 and December 2024, earnings of Nifty50 companies grew at a 20 per cent CAGR and earnings of Midcap100 and Smallcap100 companies raced at over 35 per cent and 27 per cent CAGR. A consumption binge triggered by the Covid unlock, government doubling down on capex and ultra-low interest rates powered this surge.

But with these factors waning, both the economy and earnings are now normalising. India’s real and nominal GDP growth fell to 6.5 per cent and 9.8 per cent respectively in FY25. In Q1 FY26, real growth improved to 7.8 per cent, but nominal growth was muted at 8.8 per cent. These are not poor growth rates but are a return to India’s ‘old normal’ of 6.5-7 per cent real growth.

Corporate earnings have lost speed too. Since January 2025, Nifty50 earnings have grown 4.8 per cent and Nifty500 earnings by 9.2 per cent. Therefore, stock prices, which matched earnings growth from 2020 to 2024, are now re-adusting to this. This explains why since January 2025, Nifty50 returns are at 4 per cent while the Midcap and Smallcap indices are down 2.5 per cent and 8.2 per cent respectively.

Therefore, it is earnings growth that will decide stock returns over the next two-three years. Here, large-caps seem to be on a stronger wicket than mid-caps or small-caps. Earnings of about 15 per cent in large-caps may be enough to justify the current Nifty50 PE (price-earnings multiple) of 21 times. But as the Nifty Midcap100 and Smallcap100 trading at a lofty PE of 31 times, they need to deliver 20-25 per cent earnings growth to hold on to their current valuations. So far, mid-caps have sustained strong growth while small-caps have floundered. The latter are thus more vulnerable to a correction and a return reset.

A rolling return analysis of market-cap based returns over the last 20 years also reinforces the same conclusion. Small-caps and mid-caps have strayed more from their “normal” return bands than large-caps. The analysis indicates that over the last two decades, Nifty50 has averaged a 13 per cent CAGR for five-year periods, Nifty Midcap100 averaged about 15 per cent and Smallcap100 12 per cent (yes, less than large-caps!) (See table 1). The small-cap space is clearly where reversion to mean will pinch you the most.

Takeaway: While large-caps, mid-caps and small-caps have all delivered above-normal returns in the last five years, large-caps have less distance to cover if earnings mean revert. Small-caps will correct the most. Investors with high allocations to the small-cap segment should be looking to book profits and re-allocate to large-caps to protect wealth. If your SIPs are skewed towards mid- or small-cap funds, brace for a phase of low to negative returns and a longer waiting period of seven-plus years.

Gold/silver: Not without risks

While there are many folks sounding the alarm on stock markets, there aren’t many cautioning investors on precious metals. The global growth outlook is today very foggy, thanks to President Trump’s whimsical turns. The US economy is priming for a slowdown and the dollar’s reserve status is wobbly. This has prompted institutions and central banks to make a beeline for gold. With Rupee depreciation providing an additional boost, gold has delivered a staggering 40 per cent gain for Indian investors in the last one year.

Silver is not far behind with a 37 per cent gain. Silver is being propped up by widespread expectations of a supply deficit in the metal for the next few years, and its use in green energy and electric vehicles. But while the above sound like great reasons to keep stockpiling gold and silver, there is risk in joining these consensus trades after their big gains.

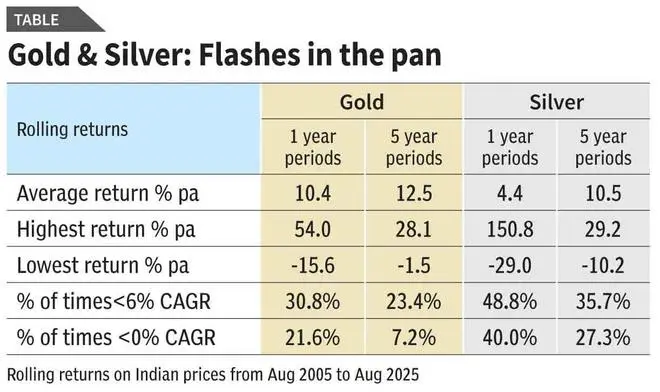

Gold and silver look like they can give stocks or bonds a run for their money today. But the 20-year rolling return analysis shows that after delivering eye-popping returns in short bursts, they can lie low for several years, underperforming both stocks and bonds! A rolling one-year return analysis shows that in their best year since 2005, gold and silver delivered gains of 54 per cent and 150 per cent respectively. In their worst years, they fell 16 per cent and 29 per cent. More worryingly, they subjected their investors to long spells of poor returns. Gold has delivered less than 6 per cent returns about 30 per cent of the time. Its more erratic cousin silver has delivered losses about 40 per cent of the time over one-year periods. (See table 2).

Gold has delivered a median 12.5 per cent CAGR over the long run, while silver has managed about 10.5 per cent. These are the levels at which you should set your expectations when deciding on your allocations.

Takeaway: Don’t think of gold or silver as return boosters at this stage. History shows that their spells of brilliant returns are often followed by a mediocre phase. Gold is the better long-term performer than silver and can be held as a portfolio hedge. With silver, tactical entry and exit is key to keeping your returns. If you already have 15-20 per cent exposure to gold/silver in your portfolio, don’t add to weights.

Debt funds: Room for returns

Unlike equities or bullion, bonds have had a hard time delivering returns post-Covid. As inflation reared its head, India’s monetary policy committee hiked rates and tightened up on liquidity.

The 10-year government security yield which had tumbled to 5.9 per cent in December 2020, shot up to 7.45 per cent by June 2022 before beginning to cool off again. Having hiked the repo rate to 6.5 per cent in February 2023, MPC held on to those rates until January 2025. Since then, it has reduced rates by 100 basis points before announcing a pause. This short rate-cutting cycle has led to the bond markets wiping out a lot of the gains they had made pre-empting the cuts. The 10-year G-Sec yield has firmed up from 6.3 per cent in May to 6.6 per cent by August 30, 2025.

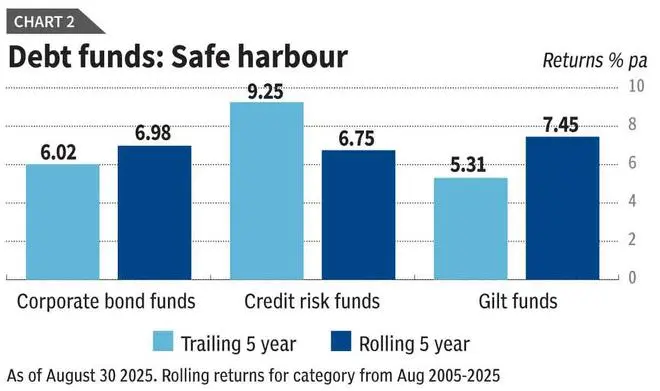

Consequently, trailing five-year returns on corporate bond funds (about 6 per cent) and gilt funds (5.3 per cent CAGR) are, today, well below their long-term averages of about 7 per cent and 7.5 per cent. However, returns on credit risk funds at over 9 per cent are well above the long-term averages. This reflects the lack of default events in the last five years, which has led to the bond market getting a little complacent about credit risks. Credit risk funds could therefore be susceptible to negative surprises over the next five years. (See table 3)

Takeaway: Investors in debt fund categories such as gilt funds, corporate bond funds or short-/medium-duration funds which invest in high-quality instruments, do not have much to worry about from mean reversion. Gilt funds and corporate bond funds still offer room for healthy accruals with the prospect of limited capital gains, if the rate cuts resume. The 10-year G-Sec yield is currently at 6.6 per cent and five-year AAA and AA corporate bonds trade at 7.3 per cent and 8 per cent respectively. High quality bonds and debt funds investing in them, are also a good parking ground for the profits booked on your riskier equity or precious metal holdings.

Published on September 6, 2025