Fresh labor market data fuel Fed interest rate cut chatter

September 5, 2025 | by ltcinsuranceshopper

Updated: 9:45 am EST to include August unemployment report data.

You may have had a hot summer but the nation’s labor market?

Not so much.

It’s looking rather cool.

Related: Hiring data show disturbing trend just days before crucial jobs report

So cool, in fact, some economists and market watchers forecast a big change later this month when the Federal Reserve votes on the benchmark Federal Funds Rate.

This move could affect interest rates from auto loans and credit cards on Main Street to stock market expectations and risks on Wall Street.

“The wide miss on the August employment report builds the potential for a Fed rate cut, but the question is still whether we get one or more before the end of the year,” Chris Versace, the veteran trader and TheStreet Pro lead portfolio manager, said.

“Next week’s August [Consumer Price Index and Producer Price Index] figures could help clear up that picture.”

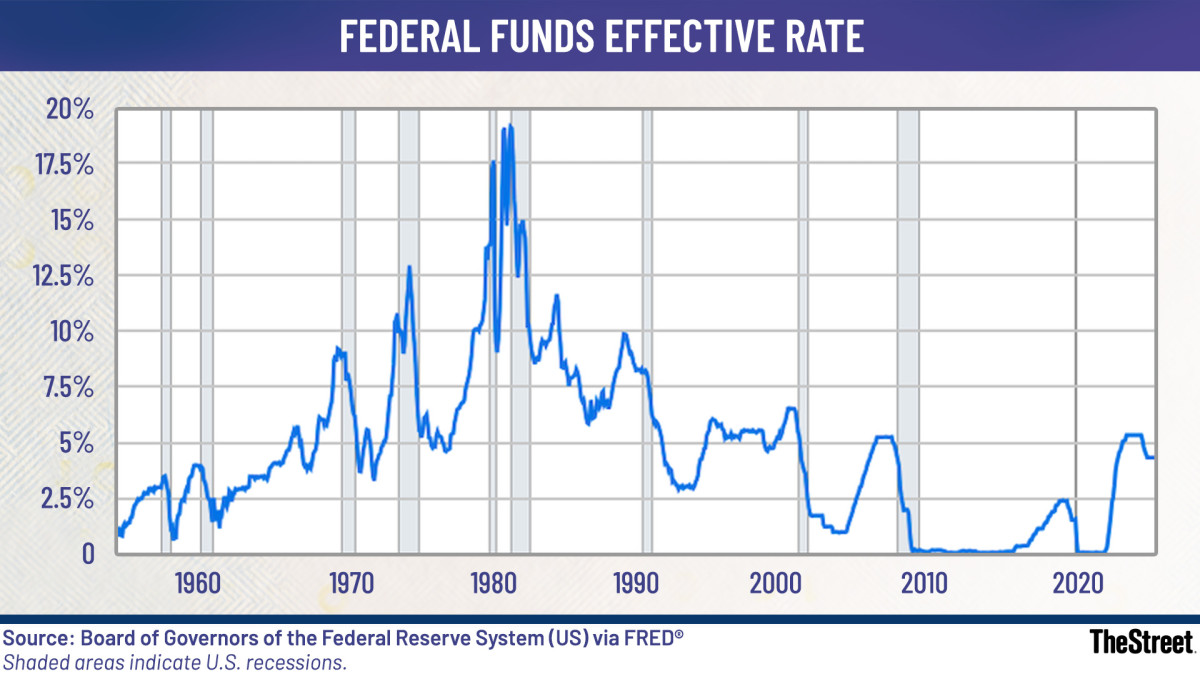

Source: Board of Governors of the Federal Reserve System

How jobs influence the Fed’s dual mandate

- The Fed’s dual mandate from Congress is to maintain price stability and low unemployment through its monetary policy actions.

- The independent central bank has held the benchmark Federal Funds Rate in a range of 4.25% to 4.5% since December 2024, mostly because it is concerned that tariffs will increase inflation.

- Fed Chairman Jerome Powell recently signaled a cut could be warranted in the near future amid a “shifting balance of risks.”

- The policy-making Federal Open Market Committee votes on the funds rate Sept. 17.

Key signals for the Fed from the latest job reports

- Private-sector hiring slowed sharply in August, with just 54,000 jobs added, according to the ADP Employment Report, which also showed a slightly upwardly revised 106,000 increase in July.

- Initial unemployment benefits rose to the highest since June, increasing by 8,000 to 237,000 in the week ended Aug. 30, the Labor Department reported.

- Layoffs jumped 39% to 85,979 in August, the highest total for August since 2020, according to global outplacement firm Challenger, Gray and Christmas.

- The Job Openings and Labor Turnover Survey (Jolts report) for July showed job openings fell to the lowest in 10 months: Available positions decreased to 7.18 million from a downwardly revised 7.36 million in June.

August jobs report shows labor market continues to cool

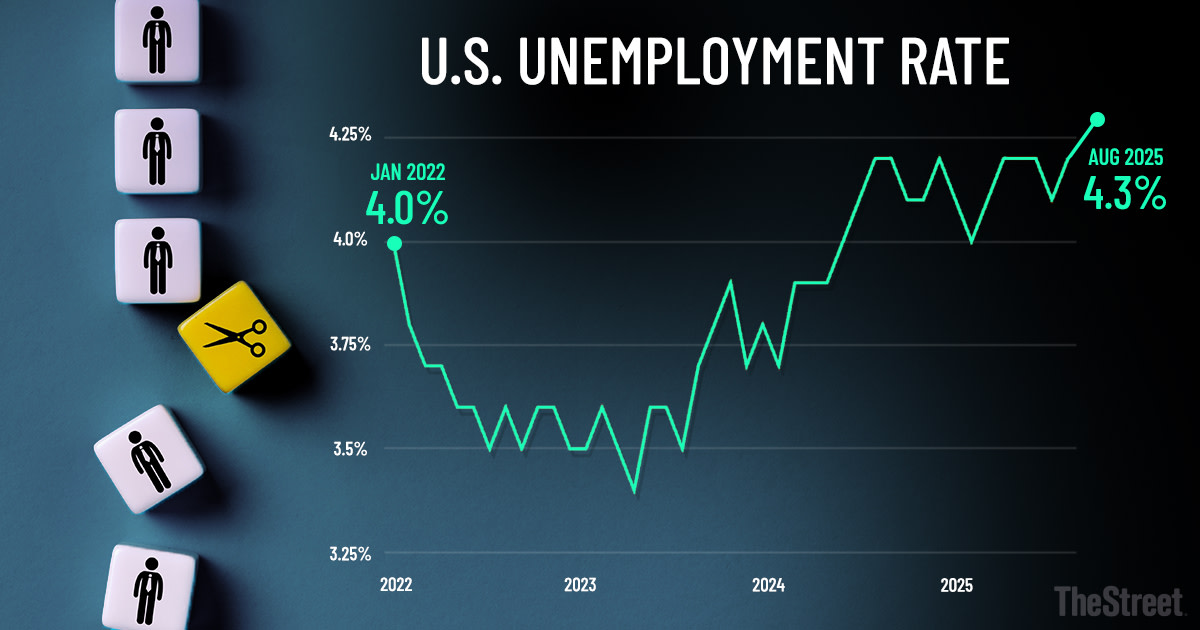

- Job growth slowed to a crawl in August, and the unemployment rate rose to its highest level since late 2021, the Bureau of Labor Statistics reported Sept. 5.

- The unemployment rate increased to 4.3%, as was expected, from 4.2% in July.

- Nonfarm-payroll jobs increased by 22,000 in August after rising an upwardly revised 79,000 in July.

- August’s job report also included a downward revision to June, which showed the economy lost 13,000 jobs.

- That’s the first negative employment month since December 2020, ending what was the second-longest period of employment expansion on record.

- Health-care jobs in August again led all sectors, adding 31,000 jobs while social assistance contributed 16,000.

- Wholesale trade and manufacturing both saw declines of 12,000 for the month.

TheStreet/Shutterstock

What top economists are saying about rate cuts

Former Fed Vice Chairman Roger Ferguson described the labor market as “cold” but “not alarming.’’

The August figures put an interest rate cut in place for discussion when the FOMC meets this month, Ferguson told CNBC.

But he stopped short of forecasting a timeline, noting that “there’s more data to come.” The Consumer Price Index report will be released Sept. 10.

“I think the Fed is in a very data-driven mode,’’ Ferguson said.

Federal Reserve Bank of New York President John Williams, who is a voting member of the FOMC, said Sept. 4 that it would “become appropriate” to cut interest rates “over time” but didn’t specify a timeline.

Related: Here’s how stocks react to Fed interest rate cuts

“Looking ahead, if progress on our dual-mandate goals continues as in my baseline forecast, I anticipate it will become appropriate to move interest rates toward a more neutral stance over time,” Williams said in prepared remarks.

The Fed faces a “delicate” balance when it comes to employment and inflation risks, he noted.

More Federal Reserve:

- Fed official sends bold 5-word message on September rate cuts

- New inflation report may have major impact on your wallet

- Morgan Stanley makes major change to Fed interest rate cut forecast

- Can the president fire a Federal Reserve governor?

- DOJ turns up the heat to remove embattled Fed official

“The balancing here has moved some of the concerns around the employment mandate a little higher, and on the margin, on the inflation mandate a little bit lower,” Williams told reporters after his speech.

The day before, Fed Governor Christopher Waller had doubled down on his stance for a September rate cut of 0.25 percentage point followed by additional cuts over the next three to six months.

Waller repeated his assertion that tariff inflation appears to be transitory and less of a risk than the labor market’s increasingly cool numbers.

Waller, reported to be a top candidate to replace Powell as chairman, dissented at the July FOMC meeting alongside Governor Michelle Bowman when the Fed opted to hold rates steady.

It was the first FOMC dissent during Powell’s term as chairman and in decades at the Fed.

Waller and Bowman, both Trump 1.0 appointees as is Powell, said signs of weakness in the labor market validated the need to cut the funds rate.

The weak August jobs report triggered speculation among some market watchers that the Fed might vote for a jumbo rate cut of 0.5 percentage point at the September FOMC meeting.

The widely respected CME Group FedWatch Tool reported a 16% probability of a half-point cut and a 84% likelihood of a quarter-point trim after the BLS data were released Sept. 5.

Related: Waller sends bold 3-word message on Fed

RELATED POSTS

View all