How Do I File an SR-22 Form If My License Was Suspended?

August 10, 2025 | by ltcinsuranceshopper

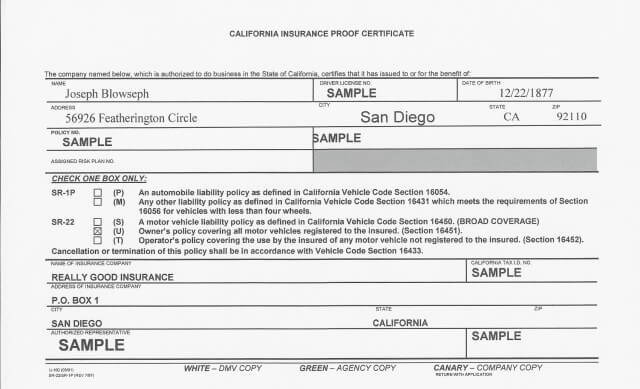

If you’ve had your driver’s license suspended, there’s a good chance your state may require you to file an SR-22 form before you can get back on the road. Many people assume the SR-22 is a special type of insurance, but in reality, it’s simply a certificate your insurer files with the state to prove you meet the required minimum liability coverage.

Still, while the form itself is straightforward, filing it when your license has already been suspended can be tricky. The rules vary by state, and the costs, both in money and time, can be significant if you don’t handle the process correctly.

In this article, I’ll explain everything you need to know about how to file an SR-22 form when your license is suspended, share real-life experiences from my clients, and give you insights on how the process differs in states like Florida, California, Louisiana, and Michigan.

What Exactly is an SR-22 Form?

Before we get into the filing process, let’s clear up one common misconception: the SR-22 is not an insurance policy. Instead, it’s a form that your insurance company submits to your state’s Department of Motor Vehicles (DMV) or equivalent agency.

This form certifies that you carry at least the state’s minimum required auto insurance coverage. It acts as a guarantee to the state that you’ll remain insured for a set period, often three years. If your policy lapses during this time, your insurer is required to notify the DMV immediately, which can lead to another suspension.

Also Read:

Why Would You Need an SR-22 After a License Suspension?

In my career, the most common reasons clients have needed to file an SR-22 include:

- DUI or DWI convictions: These are the leading cause of SR-22 requirements nationwide.

- Multiple traffic violations: Accumulating too many points on your driving record can trigger the need.

- Driving without insurance: This is one of the quickest ways to get your license suspended.

- Serious at-fault accidents: Especially those involving bodily injury or major property damage.

When your license is suspended for one of these reasons, the state wants assurance that you’ll be financially responsible if you’re allowed to drive again. That’s where the SR-22 comes in.

Step-by-Step: How to File an SR-22 Form If Your License Was Suspended

Over the years, I’ve guided hundreds of drivers through this process, and while each case is unique, the general steps look like this:

1. Contact an Insurance Company That Offers SR-22 Filings

Not every insurance company handles SR-22 filings, so your first step is to find one that does. If your current insurer doesn’t offer it, you may need to switch providers. Some carriers will cancel policies after a license suspension, so this part is critical.

2. Purchase or Reinstate an Auto Insurance Policy

You can’t file an SR-22 without an active auto insurance policy. If your license is suspended and you don’t own a vehicle, you’ll need a non-owner SR-22 policy. This provides coverage when you drive a car you don’t own and still satisfies state requirements.

3. Request the SR-22 Filing

Once you have the right policy, your insurer can file the SR-22 directly with the DMV in your state. You can’t file it yourself.

4. Pay the Filing Fee

Most insurers charge between $15 and $50 for the filing. However, the bigger cost comes from increased premiums; drivers who need an SR-22 often pay 50% to 100% more for insurance.

5. Maintain Continuous Coverage

If your coverage lapses during the required SR-22 period (often three years), the insurer must inform the DMV, and your license could be suspended again.

Real-Life Client Story: Filing an SR-22 in Florida

A few years ago, I worked with a client named David from Orlando, Florida. David had his license suspended after a DUI conviction. He assumed that once the suspension period ended, he could simply start driving again. Unfortunately, when he went to the DMV, they told him he needed to file the SR-22 form before his license could be reinstated.

David’s old insurance provider wouldn’t issue SR-22 filings, so he was stuck. I helped him secure a non-owner SR-22 policy through a carrier that specialized in high-risk drivers. We filed the form the same day, and within a week, the DMV reinstated his license.

The biggest takeaway from David’s story? Don’t wait until the suspension period ends to find out what’s required for reinstatement. Starting the process early can save weeks of delays.

State-by-State Differences: Florida, California, Louisiana, and Michigan

While the SR-22 process is similar nationwide, some key differences exist:

- Florida: Often requires FR-44 instead of SR-22 for DUI cases, which mandates much higher liability limits (100/300/50). For other offenses, SR-22 applies with the state’s minimum coverage.

- California: Requires SR-22 for three years after certain offenses. You must maintain coverage without any lapse, or the DMV will suspend your license again.

- Louisiana: SR-22 is required for up to three years and must be filed before reinstatement. Louisiana insurers can be strict about mid-term cancellations.

- Michigan: Uses SR-22 filings less frequently, but when required, you must maintain it for three years and may face higher premium increases than in other states.

Costs and Insurance Premium Impact

According to data from the Insurance Information Institute, drivers with an SR-22 pay, on average, $993 more per year than drivers without one. This is because the underlying offense, such as DUI or reckless driving, places you in a high-risk category.

However, you can reduce these costs by:

- Completing state-approved defensive driving courses.

- Maintaining a clean record during the SR-22 period.

- Shopping around for insurance companies who specialize in high-risk drivers.

How Long Must You Keep the SR-22 on File?

Most states require SR-22 filings for three years, though this can vary. For example, in Florida, certain offenses can require up to five years. In California, the three-year rule is standard, while in Michigan, it can range between two and five years depending on the offense.

If you cancel your car insurance policy before the SR-22 period ends, your insurer will send an SR-26 form to the DMV to notify them of the cancellation, and your license could be suspended again.

Avoiding Common Mistakes When Filing an SR-22 After a Suspension

In my professional experience, the most common mistakes drivers make are:

- Waiting until the suspension ends to start the process: This causes unnecessary delays.

- Not shopping for specialized SR-22 insurers: Many standard carriers will not file the form.

- Letting coverage lapse: Even a one-day lapse can restart the SR-22 period from the beginning.

Also Read:

Final Thoughts: Your Best Path Forward

Filing an SR-22 form after a license suspension may sound intimidating, but with the right guidance, it’s a manageable process. The key is to start early, work with an insurer experienced in SR-22 filings, and maintain continuous coverage until your obligation ends.

As a broker, I’ve seen too many drivers make the mistake of assuming this is just a formality. In reality, your SR-22 status can affect your insurance costs, your ability to drive legally, and even your future job opportunities if driving is part of your work.

If you’ve had your license suspended, don’t try to navigate the SR-22 process alone. The right advice at the right time can save you not just money, but months of frustration.

RELATED POSTS

View all