Medicare Advantage Is Failing Its Mission. Here’s How Washington Could Finally Fix It

June 12, 2025 | by ltcinsuranceshopper

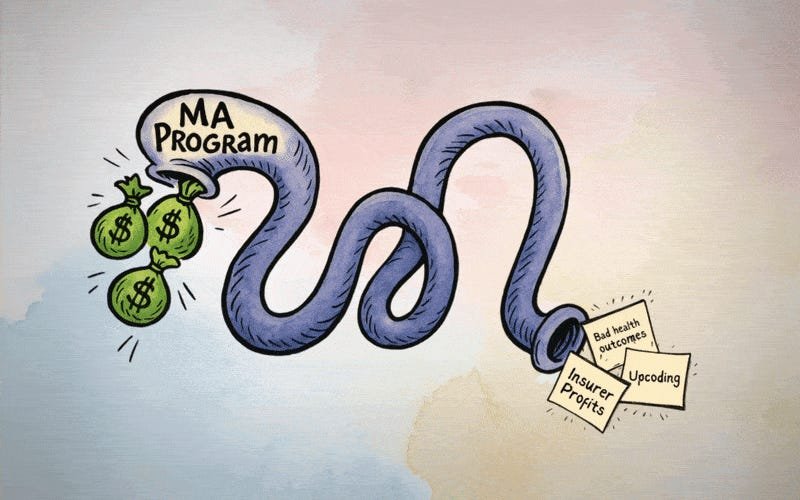

In the first half of 2025, we have heard many leaders share their concerns with the current results of the Medicare Advantage (MA) program and the need for changes. Dr. Mehmet Oz, administrator of the Centers for Medicare and Medicaid Services, spoke multiple times about issues with upcoding in MA during his confirmation hearing. Lawmakers on both sides of the aisle have also been vocal about the need for reform in MA, including the co-chairs of the GOP Doctors Caucus, Reps. Greg Murphy and John Joyce, and Democratic Rep. Alexandria Ocasio-Cortez. Most recently, CMS Deputy Administrator Stephanie Carlton spoke about these issues at the recent annual conference of the Association of Health Care Journalists in Los Angeles.

Carlton noted that the original intent of MA was “better outcomes for patients” and “better value for taxpayers,” but that the current program is not achieving those goals. She specifically mentioned research from the Medicare Payment Advisory Commission and other groups showing that “MA is more expensive than fee-for-service”. Fee-for-service, in which health care providers are paid for each service provided to patients, is used in traditional Medicare. Carlton went on to describe the need to “course correct” the program. We wholeheartedly agree.

Luckily, there are solutions to these issues within MA that both the executive branch and Congress can address. CMS has the authority to address upcoding, where insurers add more codes to a patient’s record to increase their reimbursement from the government, in multiple ways. First, CMS should continue the changes to the risk-scoring system initiated under the Biden Administration, which removes codes that CMS determines are abused within the Hierarchical Condition Category system. Researchers have found that this method could largely eliminate current overpayments going to insurers, which total tens of billions of dollars a year. CMS also has the authority to increase the coding intensity adjustment, which is the factor by which risk scores are adjusted by the agency to account for greater coding intensity by MA insurers.

The coding intensity adjustment used by CMS is currently 5.9%, which is the statutory minimum. Research shows that the true coding intensity adjustment should be more than 20%; increasing it to this level would reduce Medicare spending by more than $1 trillion over 10 years. There are ways to achieve these savings while also promoting competition, which is why Republicans created Medicare Advantage in the first place, and not compromising quality. Finally, CMS should exclude codes added to a patient’s record from home health risk assessments (HRAs) performed by insurers. That’s because insurers have used HRAs to add codes for diagnoses that patients were never treated for, enabling them to pocket billions of taxpayer dollars.

Carlton also shared her commitment to plans recently announced by CMS to substantially increase both the pace and the scale of Risk Adjustment Data Validation (“RADV”) audits of MA plans. CMS implemented changes in 2023 to increase the scope of audits and recoupment of overpayments from insurers beginning with 2018 audits, but progress has been painstakingly slow, with CMS originally slated to begin issuing 2018 audit findings in 2026. The intensified efforts will require needed investments in technology and people.

Another issue diluting the value of MA to taxpayers is the excessive use of supplemental benefits of questionable utility, including things like gym memberships, which serve mainly as marketing tools for insurers. The money spent on such benefits has more than doubled over the past five years.

Congress can also take action to reform MA in meaningful ways. First, Congress should work with the HHS Secretary and CMS Administrator and provide oversight and accountability to ensure necessary changes to the risk-adjustment methods and processes, including audits and recovery of overpayments. It is also important to ensure that insurers and their downstream vendors are compliant with applicable CMS rules and regulations, both in terms of clinical and documentation requirements and the payments they receive for these activities.

Congress could also pass legislation to develop a new risk adjustment system that prevents gaming by insurance companies. This system could base risk scoring on data from patient encounters with their medical providers rather than just diagnostic codes. This would ensure that patients are treated for any diagnosis used in their risk scores, to ensure that extra diagnoses are not added that patients are not being treated for. Additional scrutiny of how MA rebates are being used and a re-evaluation of permissible benefits are also needed. Further, Congress could implement a cap on out-of-pocket (OOP) expenses for traditional Medicare beneficiaries. Currently, only MA plans offer a cap on OOP expenses, which reduces competition between MA plans and traditional Medicare. Adding an OOP cap to TM would level the playing field between MA and TM, likely resulting in MA plans improving their coverage and benefits, and focusing less on upcoding and withholding care. This would improve the quality of care and competition within the Medicare and MA programs.

Insurance companies running MA plans have created a system in which taxpayers and patients are not getting the value they pay for. It is promising that leaders in the current administration and on both sides of the political aisle in Congress are expressing a desire to change this system for the better. There are many solutions to the issues within MA that can be enacted quickly and effectively to improve care and value for seniors and people with disabilities who are enrolled in those plans.

Rachel Madley is Director of Policy and Advocacy at the Center for Health & Democracy. She previously worked for Congresswoman Pramila Jayapal. She received her PhD from Columbia University and has written for publications including The New York Times.

Seth Glickman, MD, is a former senior vice president and chief medical officer of Blue Shield of California. He now is a researcher and advocate for reform in the health care finance space.

RELATED POSTS

View all