Azvalor Asset Management H2 2024 Letter

Nikada

Dear co-investor,

2024 was a year of sowing. Following the harvests of 2021 to 2023 (+122% in Azvalor International, +71% in Managers, and +64% in Iberia), in 2024 we sowed again the returns that we will reap in the future.

We closed 2024 with 2.920 billion euros AUM and more than 75 million euros of net inflows, making us the value investing manager with the highest growth in this sector (see news). More than 2,500 new co-investors joined Azvalor during this period, adding up to over 27,000.

The macroeconomic context is already well analysed and we have little to add. As always, we focus on building a portfolio for any scenario, rather than predicting the specific future scenario (which no one gets right in a consistent manner). We are particularly concerned about sovereign debt (in the West). The United States has never had such a large budget deficit with such low unemployment. If unemployment rises, how high will the deficit go? Therefore, we do not believe that holding bonds as a long-term investment is a sound strategy today.

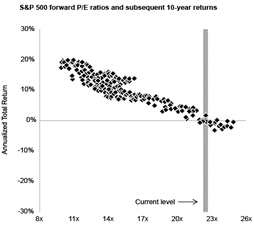

However, after almost 30 years of investing, we do consider ourselves experts in finding the investment opportunities that the market offers. The current menu is attractive and bodes well for the potential of our funds, in contrast to our expectations for the indices. At the end of the year, for example, we find the major US indices trading at high multiples of earnings—which are also high. If earnings come down a bit and multiples contract a little, we could easily see 20-30% declines in the equity markets—and even then they would not be significantly undervalued. Historically, higher starting valuations have systematically led to lower future returns and vice versa (see chart1).

At Azvalor, we invest against the grain of the major fashions and narratives: our portfolios are nothing like the indices, and it can happen (as it did in 2022) that they perform well even in market downturns. In fact, although it may be anecdotal, our portfolios have outperformed on days when the indices have fallen—since the beginning of 2025.

Our portfolios

Today, as in the past, our portfolios are made up of good businesses that we can understand (for us, this means predicting their development over 10 years), managed by people who put shareholders first and, above all, bought at attractive prices thanks to situations of temporary market pessimism. How to find these opportunities, and how to know when problems are temporary… that is our “Coca-Cola formula”, what we call the Azvalor method, which is the sum of an investment philosophy and a corporate culture based on the training of investment teams, hard work, excellence and meritocracy.

In 2024, Azvalor’s fund portfolios saw modest growth, while value creation has been remarkable. Value is created in several ways: by businesses increasing their profits and by capital rotation—selling companies that have risen and buying others that have fallen in price without justification. The result: an increase in the upside of the funds. Let’s look at the details.

Azvalor Iberia

The net asset value of Azvalor Iberia increased by +3.4% to reach €149.1 in 2024, giving a return of +49% from its launch to the end of the year, and +60% at this letter’s closing date.

The portfolio is concentrated in a small number of companies (the top 10 account for around two thirds of the total) that we know very well, almost all of them companies that we have followed closely for decades and for which we therefore have even more confidence in terms of competitive position, management quality and valuation.

The fund’s performance in recent years has been below our historical track record. Some of our companies have faced headwinds, but this is changing and the market is beginning to acknowledge it.

A good example of this is Tubacex. We invested in it almost 8 years ago, attracted by the significant change in model—led by Jesús Esmoris—towards higher value-added products, and an attractive purchase price on the stock market. COVID and headwinds drove the company down from €3.5/share at the beginning of 2018 to levels of around €1/share in March 2020, which we used as an opportunity to significantly increase the portfolio position. Today, it is our top holding, and the market has started to recognise its value with a +40% increase in the last 6 months alone. However, we believe that there is still a long way to go as the wind in the sector is now a tailwind and the company has improved a lot over the last 8 years. Our price target is still well above the share price, and this does not include the value creation that this management team could achieve through acquisitions.

Another example is Prosegur Cash (OTCPK:PGUCY), where most of the profits are in Brazil and Argentina, which, should now have a tailwind after suffering for several years.

We are therefore very confident that the portfolio will perform positively and “live up” to its upside, which we estimate at +80%. 2

Azvalor International

The net asset value of Azvalor International was flat at €235 in 2024, with an accumulated return of +135% at the end of the year and +143% at this letter’s closing date.

As mentioned above, after years of record profitability in 2021 and 2022, 2024 was poor in terms of results, yet very rich in terms of “sowing”. Today, the international portfolio is once again clearly more attractive than usual.

We have a number of global leaders trading at valuations unbefitting companies of such quality and competitive position, and they are doing so for cyclical reasons. And we have many other regional leaders in the same situation. We have companies with essential assets, others that are impossible to replicate even with unlimited capital, and others that are privileged because they are the lowest-cost producers in their class. All are trading at attractive prices because of pessimism about their short-term prospects. The vast majority are companies with strong balance sheets, prepared for any macroeconomic or sectoral context, with only a few exceptions, which are very small in aggregate and which are exceptions chosen for their particular attractiveness. They are also overwhelmingly shareholder-focused companies, something we find increasingly rare. In almost all of them, we either have a controlling shareholder who invests his wealth with us and is concerned about creating value, or we see the right mix of incentives, capital allocation decisions and shareholder remuneration (investments, dividends, share buybacks).

Our experience in applying our investment process over many years shows that, in the aggregate, our valuations of companies are not only broadly correct, but actually conservative: their share prices tend to exceed our valuations over a reasonable period of time.

We can therefore say with confidence that the value of our portfolio is just over twice the net asset value (+105% upside). If the past is prologue, this upside should enable us to generate double-digit annualised returns over the next few years.

Azvalor Blue Chips

The net asset value of Azvalor Blue Chips fell by -2.2% in 2024, although it has accumulated a positive return of +89% from its launch to the end of the year and +92% up to this letter’s closing date.

Azvalor Blue Chips offers the unique feature of investing at least 75% of its equity exposure in companies with a market capitalisation of more than 3 billion euros. However, the fund currently has around 70 million euros under management and therefore still keeps the important advantages of a small portfolio. These advantages are, first, the ability to concentrate—it is more concentrated than Azvalor International. The second advantge is the possibility of including some smaller companies with a relevant weighting (it can take advantage of a greater number of opportunities), which together account for around 25%. And finally, as a third virtue, it has the “agility” needed to take better advantage of market volatility by being able to vary the weighting of the different companies more quickly according to their short-term movements.

Over the last financial year we have been particularly successful in exploiting these virtues to create value, and this is the fund that currently offers the greatest upside—which we estimate at almost +115%.

Azvalor Managers

Azvalor Managers generated a return of +12.9% in 2024, and from its inception just over six years ago up to this letter’s closing date it has delivered a return of +78%, in line with the fund’s long-term objective. This has been achieved in an environment where large growth companies have massively outperformed smaller value companies, by almost 10% per annum over this period. Our portfolio now trades at 9.6x earnings, a discount of more than a 50% relative to the global equity market, and 70% to the Nasdaq index (Morningstar data).

The portfolio has a significant exposure (76%) to small and mid-cap companies, with almost no overlap with market indices. We have continued to receive takeover bids for our investments, with six companies in our portfolio subject to bids in 2024, and one in the first weeks of 2025.

During 2024 Azvalor’s investment team added two new Managers to the fund who we believe are exceptional, complementing the existing managers and improving the long-term risk-return trade-off. The fund holds more than 120 million euros under management and more than 1,600 investors.

Azvalor Global Value (Pension Fund)

Azvalor Global Value is one of the few pension funds from independent asset managers which is well above the 150 million euros threshold (197 million euros at the end of 2024), having more than 4,200 co-investors—having grown by more than 300 new investors in 2024.

With an average annualised return of +18.5%, Azvalor Global Value closed January 2025 as the fund with the best 5-year return among the 960 pension funds in Spain (Morningstar data).

Its portfolio, which combines companies present in Azvalor Iberia and Azvalor Internacional, returned -2.34% over the year and has accumulated +93% since the launch. The fund continues to have a high upside—of almost +115%.

What’s new at Azvalor

This year we will celebrate our tenth anniversary. We thank all the co-investors who have been with us for all or part of this time, and also those who have left us—hopefully after having accomplished the mission of delivering the expected returns.

As for corporate news, we are pleased to announce that we have been granted the ISO27001 quality certification (information security, cyber security and privacy management systems). This certification confirms the quality of some processes that are critical to the smooth running of the company.

In the field of sponsorship and patronage, we are pleased to announce that Azvalor has become a benefactor of the Teatro Real, considered to be the leading performing arts and musical institution in Spain. In the same vein, Azvalor has joined the foundation “Amigos del Museo del Prado” [Friends of the Prado Museum]—an institution with more than 40 years of activity focused on supporting the main national art gallery, closely linked to the history of Spain.

Azvalor has also signed an agreement with Comillas Pontifical University to sponsor the Comillas Alumni Chartered Financial Analyst (‘CFA’) Club and a collaboration agreement with España Rumbo al Sur, a pioneering programme with 20 years of experience in training young people through trips and practical experiences, with the aim of promoting values such as effort, the pursuit of excellence, commitment to the environment, entrepreneurship and long-term vision.

As always, we would like to highlight Davalor, our project in collaboration with África Directo, which concentrates our main commitment to helping those most in need. In 2024, we contributed more than 600,000 euros to the projects managed by Davalor/África Directo, bringing the total to over 4 million euros since we embarked on this beautiful journey, projects such as the construction and reconditioning of schools, the renovation of infrastructure in hospitals and dormitories, the construction of solar energy systems, the purchase of educational materials for schools and the funding of medical treatments. Thousands of people, along with their families and communities, have benefited from Davalor’s social work. Our deepest gratitude goes out to all those who have participated in these initiatives—and to Africa Directo’s team.

Final considerations

In a world that rewards immediacy, it is hard to invest long-term. However, our co-investors have found out that the effort is worthwhile. They know that the funds which have outperformed their indices over the long term have generated their excess returns during just 5% of the time. In other words, over this 10-year period (120 months) the “celebration” moments account for only 6 months. Trying to guess when those moments will arrive is futile, so our recommendation is to “invest what you don’t need in the short term and forget about it”. Those who have done so—with us—have seen their money multiplied by a factor of 2.5 over these ten years.

With humility, but also with joy, we share the news that Azvalor has been the only Spanish fund manager to have achieved a return of more than 100% in five years (see news). This is the result of your patience and our “Azvalor method”. We will continue to work on these two pillars in order to generate attractive returns.

Once again, we would like to thank you for your trust and invite you to contact our Investor Relations team for further information on any of the above—or any other topic of your interest.

Azvalor Asset Management SGIIC Team

|

Footnotes 1Source: All charts) IBES, LSEG Datastream, S&P Global, J.P. Morgan Asset Management. The dots represent monthly data since 1988, the earliest year available. Data as at 31 January 2025. 2 The estimated values indicated throughout the document have been obtained as a result of the difference between the estimated value of each of the underlying assets of the portfolios, based on our internal valuation models, and the prices at which each of them is currently quoted on the stock markets. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.