Tariffs: A Non-Political Explanation And Investment Implications

Politics has a terrible track record of interfering with public understanding of economic concepts, and few economic tools have been as politicized as tariffs are right now.

CNBC does a reasonably good job of staying neutral, but even there, the political bias is evident in just about every guest discussing the issue. One analyst will say tariffs are ushering in extreme inflation and trade wars, while the next says the turmoil is just a detox before the golden age of American prosperity. It would seem political bias is playing a role in projections of the future.

Just as investors would be wise to mitigate emotions in their investment decisions, economic factors are best considered without political bias. So let’s get to it.

This article will discuss the economic mechanics of tariffs and how they might impact investments. If I am writing correctly, you should have absolutely no idea what my political views are.

Mechanics of a tariff

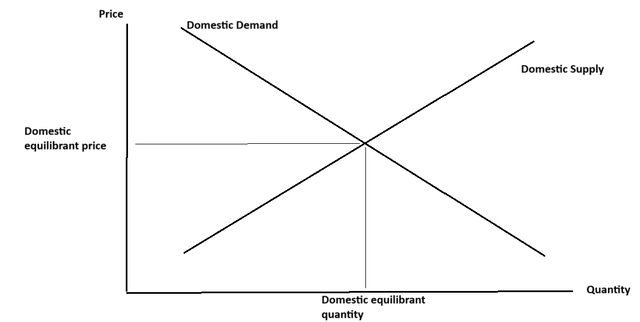

A tariff is a tax or other duty applied to imported products. Its effects can best be understood through supply and demand. Let’s start with domestic production and work from there.

2MC

U.S. production has an upward sloping supply curve as producers will be willing to produce more units if the price is higher.

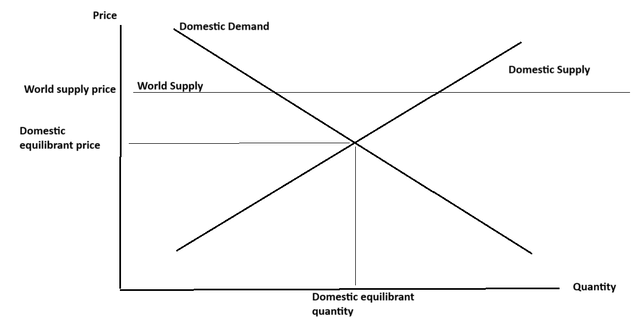

The world as a whole, however, produces so many units of a given good that the supply curve can be thought of as a flat line. In other words, if it costs $X to import 1 unit of a good, we can functionally import as many units at that price as is needed to satisfy domestic demand.

Consider a product that the U.S. is really strong at producing such as corn.

2MC

In this case, domestic production of corn is already sufficient to handle domestic demand such that there would naturally be no imports of corn. The domestic equilibrant price is below the price at which the world supplies corn (imports). As such, a tariff on corn imports would do nothing.

Thus, tariffs are really only applicable when the world is supplying a product at a price below the domestic equilibrant price.

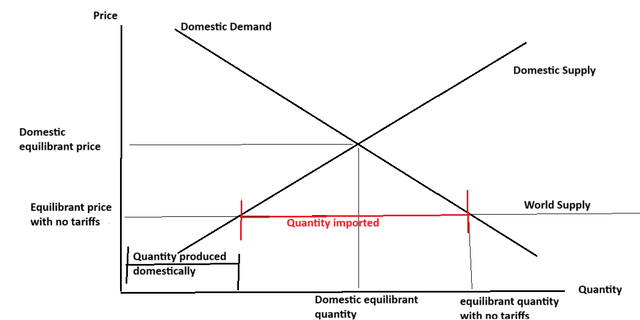

Consider such a product below:

2MC

The equilibrant price without tariffs is substantially lower than the domestic equilibrium and the overall quantity demanded is higher because the price is lower.

Within that higher quantity, a small portion is produced domestically, but most domestic producers are unwilling to produce at that lower price, so the remainder gets produced by foreign countries and is imported (red line on graph above).

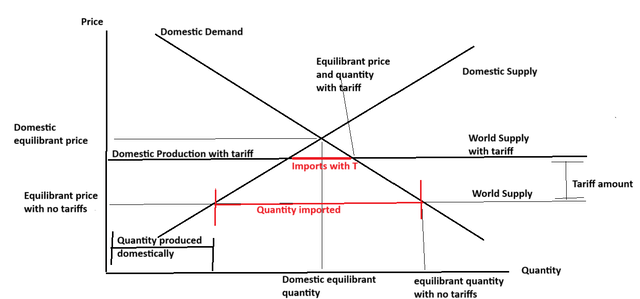

Now, let’s introduce a tariff.

2MC

The tariff functionally raises the price of imports represented as a vertical shift in the world supply price line. This causes 4 notable changes:

- Equilibrant price is now higher

- Equilibrant quantity is now lower

- Domestic production is now higher

- Quantity imported is now lower

Who pays for the tariffs?

This a hotly debated and politicized topic. President Trump’s team says the foreign countries pay for them while his opponents say U.S consumers pay for them.

Oddly enough, they are both sort of correct.

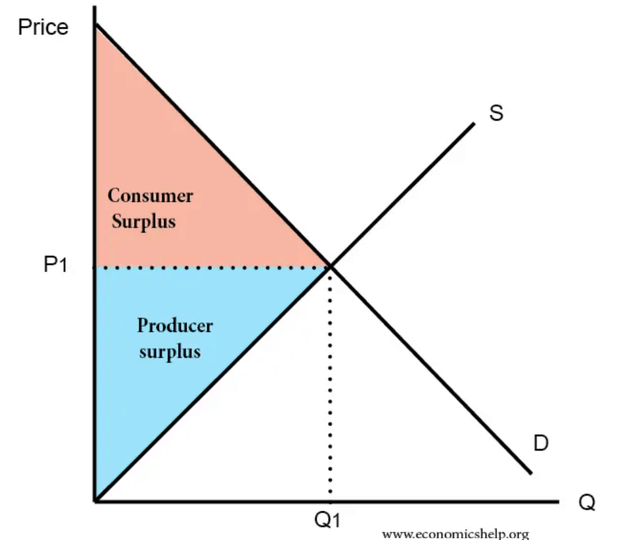

Foreign producers lose a portion of their producer’s surplus and domestic consumers lose a portion of their consumer’s surplus. For reference, here is what very basic surplus regions look like.

economicshelp.org

The lost surpluses of foreign producers and domestic consumers go toward increased domestic producer surplus and government revenue (from tariffs).

Tariff Impact on Inflation

Inflation is one of the more difficult economic concepts because it involves the entire economy and can often surprise even the best economists.

Some economists believe that tariffs cause short-term inflation, and the reasoning is straightforward. As we saw in the example above, introducing the tariff raised the equilibrant price consumers paid. That, in a very direct sense, represents inflation.

In the longer term, it is a bit less clear as supply chains will adjust. If the tariff results in increased domestic production, that helps counter inflation as more supply is one of the sustainable ways to fight inflation. Overall, tariffs are likely inflationary in the short-term with unclear long-term impacts.

Tariff Impact on GDP

The classic mnemonic for GDP calculation is CIGX: Consumption, Investment, Government spending and Net exports.

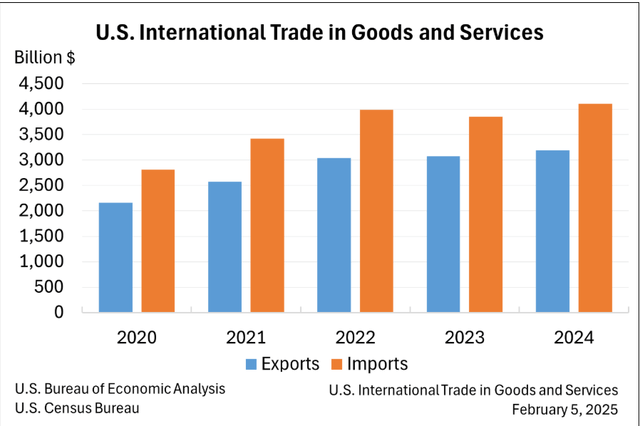

In 2024, the U.S. had a trade deficit of $918.4 billion according to the U.S. Bureau of Economic Analysis.

BEA

This $918 billion net imports figure is subtracted from CIG to get GDP.

As seen in the example earlier, tariffs reduce the volume of imports with consumption shifting to either domestically produced goods or substituting a different good. To the extent that tariffs reduce net imports, they would increase GDP.

The tradeoff here, of course, is that imports are not necessarily a bad thing. Presumably someone realizes a consumer surplus when they import.

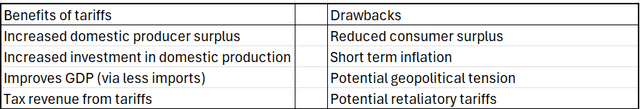

Overall impact of tariffs

Tariffs are an economic tool used throughout the world both historically and presently. They may come in the form of tariffs or another tool that has the same effect like a Value-Added Tax (VAT) or quotas.

Like most economic tools, tariffs involve tradeoffs. Below we will summarize the key benefits and costs of tariffs.

2MC

One thing worth noting is that the increased domestic production is only beneficial if it makes sense. For example, if we introduced an enormous tariff on bananas, it could be possible for domestic farmers and scientists to come up with a way to expand production beyond the tiny amount currently grown in Florida and Hawaii. However, that probably doesn’t make economic sense given how cheaply and efficiently bananas can be produced in climates where they naturally grow.

Depending on how a tariff is implemented, either side of this equation could be much larger than the other. They can be either good or bad and should be analyzed on a case-by-case basis. Hopefully this article is helpful in providing the tools with which to do that while avoiding political bias.

Potential ways to invest during tariffs

2 pathways:

- Invest in areas that are largely immune to geopolitical factors

- Invest in domestic producers that benefit from potential tariffs

Largely unaffected

Apartment REITs are overwhelmingly internal. Someone living in the U.S. rents an apartment located in the U.S. The potential impact tariffs might have is making development more difficult as certain supply chains might be challenged. This would be a net positive as it would reduce competing new supply. We like Camden (CPT), Centerspace (CSR), and NexPoint (NXRT).

Potential beneficiaries of Tariffs

Domestic manufacturing tends to be on the beneficiary side of tariffs while shipping is negatively impacted. As such, there is a rift among industrial real estate.

Both logistics warehouses and manufacturing facilities are labeled into the broad category “industrial” but in this environment I would lean more toward manufacturing facilities. Gladstone Commercial (GOOD) has a large portfolio of light manufacturing facilities which may see increased demand and therefore higher rent upon renewal.

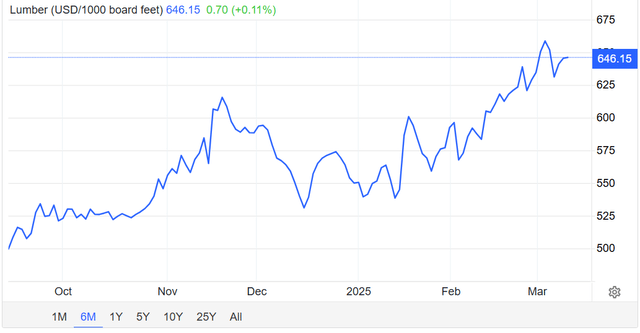

Timber REITs are also in play here. Both the U.S. and Canada have vast forests and are naturally strong producers of wood products. Despite our domestic production capabilities, the U.S. does import a fair amount of lumber from Canada which presently can produce it slightly cheaper. If the potential 25% tariff on lumber sticks, it would significantly benefit U.S. lumber producers.

Weyerhaeuser (WY) is a mixed bag as its domestic sawmills would increase in profitability, but WY also has some Canadian operations which would be harmed by the tariffs. Thus, I see it as a neutral for WY but its more domestic peers like Potlatch (PCH) would be beneficiaries overall. Lumber prices have risen substantially, partially due to demand, but also in anticipation of potential tariffs.

TradingEconomics

The takeaway

Tariffs are complex instruments involving lots of tradeoffs. It is difficult to determine whether they are good or bad overall and I will not weigh in on that judgment call.

Within the tradeoffs, there are clear financial winners and losers. To the extent one believes tariffs will stick around, it could be worth investing in the beneficiaries.