Polish Policymaker Kotecki Still Sees Some Chance of Interest-Rate Cut in July

Poland may still reduce interest rates as early as July despite the central bank’s new projections showing a higher inflation path and hawkish comments by Governor Adam Glapinski, policymaker Ludwik Kotecki said.

Article content

(Bloomberg) — Poland may still reduce interest rates as early as July despite the central bank’s new projections showing a higher inflation path and hawkish comments by Governor Adam Glapinski, policymaker Ludwik Kotecki said.

Article content

Article content

Kotecki, a member of Glapinski’s Monetary Policy Council, told Bloomberg that the central bank’s new staff forecasts published this week were too bullish on economic prospects and overly pessimistic on inflation, giving too much sway over price growth to government decisions.

Advertisement 2

Article content

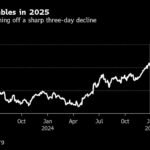

The MPC has kept Polish interest rates unchanged since late 2023 even as central banks in the Czech Republic and Hungary reduced borrowing costs to help revive slowing economic growth. Kotecki, who’s been at odds with the governor over the need to loosen the monetary strings, said that the strong zloty could help push the 10-member panel toward cuts.

There’s “some chance” of a rate cut in July, Kotecki said in an interview in Warsaw. The first reduction should be “cautious”, with a 50 basis-point move seen as “too risky,” he said.

Glapinski said on Thursday that Poland’s inflation will likely drop to the target of 2.5% only in 2027 and that the MPC won’t take actions to help the economy until this happens. He also signaled that rate hikes weren’t likely as keeping borrowing costs stable should be enough to slow price growth. A day earlier, the MPC held its benchmark at 5.75%, as expected by all 33 surveyed economists.

‘Very Animated’

Glapinski said that core inflation, which strips out volatile food and energy prices, would remain around 4% this year. Kotecki, meanwhile, said he prefers to look at so-called super-core inflation, a measure that also excludes the impact of government-regulated prices. This indicator is already within the central bank’s tolerance range for headline inflation and will remain there for the next three years, he said.

Advertisement 3

Article content

“This is why I see room for rate cuts in the coming months,” he said. He expects MPC discussions to become “very animated” in future months.

Even if an initial motion to reduce rates doesn’t win a majority within the panel, the likelihood of easing will be greater in each following month, he said, predicting a softening in the views of some fellow policymakers.

“It seems that some eggs laid by the more hawkish MPC members are beginning to hatch into doves,” he said. “This is a good development.” He declined to specify which panelists may be turning.

The central bank’s three-times-a-year economic projections showed higher economic growth this year and next, and inflation at 2% to 4.8% in 2026, up from 1.4%-4.1% seen in its previous forecast from November. The upward revisions were seen as a sign that rates will stay on hold longer.

“I don’t share the optimistic assumptions regarding the economic growth,” Kotecki said, citing risks including geopolitics, trade wars, the economic situation in Germany and limited access to loans by Poles. He expects the gross domestic product to expand 3.5% at most this year.

Article content