Chinese Solar Leaders Offer Only Slow Remedies for Industry Pain

Chinese solar sector luminaries offered solutions at China’s annual parliament that could help their beleaguered industry in the long-term — but not much to staunch the current bleeding.

Article content

(Bloomberg) — Chinese solar sector luminaries offered solutions at China’s annual parliament that could help their beleaguered industry in the long-term — but not much to staunch the current bleeding.

Article content

Article content

Panel makers focused on improving the industry’s technology, expanding overseas trade and reforming China’s power markets at the National People’s Congress in Beijing over the past week. Less time was spent on fixes to the industry’s overarching problem — overcapacity that’s sent prices into a deflationary spiral and hammered profitability.

Advertisement 2

Article content

“The development of China’s solar industry has entered a no-man’s land,” Longi Green Energy Technology Co. Chairman Zhong Baoshen said on the sidelines of the meeting. “Breaking out depends on original technology and independent innovation.”

The growth of China’s solar industry has been largely driven by private firms, and their success has meant that many corporate leaders have been invited to join the country’s main legislative bodies. While these conferences are largely symbolic, they do give members a platform to discuss issues they see as most pressing.

For Sungrow Power Supply Co. Chairman Cao Renxian, whose firm produces solar inverters and battery storage units, that means the creation of electricity futures to help producers hedge growing price volatility as intermittent renewables become a bigger source of generation.

Longi’s Zhong pushed for increased research and development to deploy new products, such as roofs and other building materials that feature integrated panels. That could help bring more solar generation to China’s rural areas, creating more clean energy and providing an economic boost for poorer regions, he said.

Article content

Advertisement 3

Article content

Wang Gang, chairman of glassmaker Shandong Jinjing Science & Technology Co., wants more support for perovskite, a next-generation solar film that could boost the power output of panels but remains commercially untested.

While such efforts may pay long-term dividends, they’re unlikely to solve the industry’s more pressing problem with excess supply, which has driven prices to record lows and put pressure on corporate bottom lines. China’s seven major solar manufacturers posted a combined net loss of 28.4 billion yuan ($3.9 billion) last year, Bloomberg Intelligence analyst Chia Chen said at a separate event in Beijing on Tuesday.

More important to the near-term success of the sector will be measures like voluntary output cuts agreed to by more than 30 manufacturers. Such measures should start to pay off within months, Tongwei Co. Chairman Liu Hanyuan told reporters at the congress.

Analysts seem to agree, with the market consensus of those same seven major manufacturers rebounding to a combined net income of 10.5 billion yuan this year, BI’s Chen said.

On the Wire

Advertisement 4

Article content

Talks between the US and China on trade and other issues are stuck at lower levels, people familiar with the matter said, with both sides talking past each other and failing to agree on the best way to proceed.

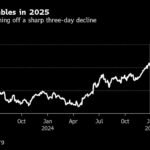

After a stellar climb in Chinese equities this year, market participants say a longer lasting rally will depend on a meaningful return of global funds.

Taiwan started anti-dumping probes into beer and certain steel products from China, adding to a string of measures targeting Chinese exports by trade partners around the world.

This Week’s Diary

(All times Beijing unless noted.)

Wednesday, March 12:

- Mysteel international iron ore market conference in Qingdao, day 2

- CSIA’s weekly polysilicon price assessment

- CCTD’s weekly online briefing on Chinese coal, 15:00

Thursday, March 13:

- Mysteel international iron ore market conference in Qingdao, day 3

- CSIA’s weekly solar wafer price assessment

- EARNINGS: Rusal

Friday, March 14:

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: CATL, Hongqiao

Article content