Polished Gem GEICO Fuels Berkshire Hathaway Operating Gains

The work that GEICO’s chief executive has done to “repolish” Berkshire Hathaway’s “long-held gem” got a special shout-out in Warren Buffett’s Berkshire Hathaway 2024 annual report to shareholders last weekend.

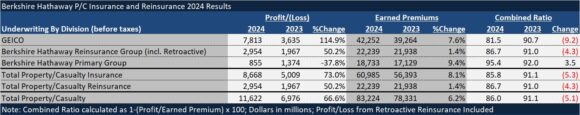

GEICO’s $4 billion-plus jump in 2024 underwriting profit (before taxes) versus 2023, and another $5 billion boost in investment income across all of Berkshire’s insurance operations compared to 2023, explained the bulk of the conglomerate’s improvement in operating income.

Berkshire’s total operating income of $47.4 billion after taxes was $10 billion higher than operating income for 2023—up by 27% on a percentage basis.

“In 2024, Berkshire did better than I expected, though 53% of our 189 operating businesses reported a decline in earnings,” Buffett wrote in his annual letter opening the report.

GEICO was one of Berkshire’s businesses that recorded increased earnings last year. Underwriting profit before taxes of $7.8 billion was more than double $3.6 billion posted in 2023—and a reversal of a nearly $2 billion underwriting loss recorded for 2022.

“In five years, [CEO] Todd Combs has reshaped GEICO in a major way, increasing efficiency and bringing underwriting practices up to date,” Buffett wrote. “GEICO was a long-held gem that needed major repolishing, and Todd has worked tirelessly in getting the job done. Though not yet complete, the 2024 improvement was spectacular,” he wrote.

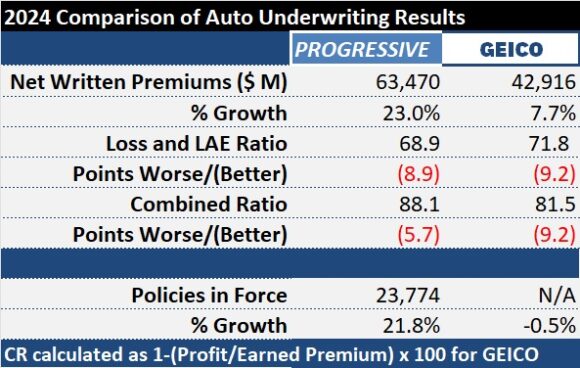

GEICO’s combined ratio landed at 81.5 for 2024—9.2 points better than 2023 and more than 20 points better than 2022.

The Management’s Discussion and Analysis (MD&A) section of the report attributes GEICO’s 2024 improvement in pretax underwriting earnings to higher average premiums per policy and “improved operating efficiencies.”

The operating efficiencies, however, did not impact the expense ratio in 2024. The expense ratio didn’t budge—remaining at 9.7 in 2024 and 2023—while the loss and loss adjustment expense ratio improved to 71.8. In 2023, part of the combined ratio improvement came from a 2.0 point drop in GEICO’s expense ratio.

While GEICO did not cut staff as sharply in 2024 as it did in 2023, the latest staffing figure for the personal auto insurer stands at 28,247—a level that is now below the employee count GEICO reported way back in 2013. The number of employees at GEICO is now 33% lower than its high point of 42,156, recorded five years ago in 2020.

GEICO’s policies-in-force continued to fall in 2024—but only slightly. The MD&A reveals the 2024 PIF count was 0.5% lower than the year-end 2023 PIF. In the 2023 annual report, GEICO had reported almost a 10% drop in policies-in-force.

The rate of decline in policies-in-force slowed in the first half of 2024, and then the number of policies grew in the second half of the year. Still, the overall decline for the year stands in contrast to competitor Progressive, which saw policies and net written premium both grow more than 20% in 2024.

No ‘Monster’ Event; Prior-Year Liability Reserves

Commenting on the property/casualty insurance businesses generally, Buffett noted “insurance pricing strengthened during 2024, reflecting a major increase in damage from convective storms.”

“Climate change may have been announcing its arrival,” he said. “However, no ‘monster’ event occurred during 2024. Someday, any day, a truly staggering insurance loss will occur—and there is no guarantee that there will be only one per annum.”

Although they did not impact Berkshire’s 2024 earnings, the company estimated losses of $1.3 billion from the California wildfires in January.

In 2024, GEICO’s results were impacted by $360 million in losses related to Hurricanes Helene and Milton. Berkshire’s other primary insurance operations incurred $350 million of catastrophe losses, and the reinsurance operations recorded $800 million in cat losses.

“We are not deterred by the dramatic and growing loss payments sustained by our activities. (As I write this, think wildfires.) It’s our job to price to absorb these and unemotionally take our lumps when surprises develop,” Buffett wrote in his letter.

“It’s also our job to contest ‘runaway’ verdicts, spurious litigation and outright fraudulent behavior,” he wrote, referring to the impacts of social inflation.

This year’s annual report included a more direct reference to social inflation in management’s discussion of the results of Berkshire Hathaway Primary Group—the only one of the three major P/C divisions (GEICO, Berkshire Hathaway Primary Group and Berkshire Hathaway Reinsurance Group) to report lower underwriting profits in 2024 than in 2023.

In spite of recording highest top-line premium growth among the three segments, the report explained a 2.1-point increase in BH Primary’s loss and LAE ratio partially reflects a lower level of takedowns for prior accident years’ claims—almost $0.5 billion lower than BH Primary recorded in 2023.

“The comparative decline reflected a significant increase in loss estimates at GUARD and lower reductions in estimated losses across several of our other businesses that write medical professional liability and commercial liability coverages, partially offset by increased reductions of property loss estimates.”

“During 2024, due to deteriorating loss experience, management at GUARD performed a comprehensive review of claims and significantly increased estimated ultimate claim liabilities,” the report says, adding that for other businesses in BH Primary Group, lower amounts of favorable development related to prior years’ liability claims “was attributable to unfavorable social inflation trends, including the impacts of jury awards and litigation costs.”

Still, Buffett remains bullish on Berkshire’s insurance and reinsurance businesses. “All things considered, we like the P/C insurance business. Berkshire can financially and psychologically handle extreme losses without blinking,” he wrote. “We are also not dependent on reinsurers and that gives us a material and enduring cost advantage,” he noted.

Berkshire’s own P/C reinsurance operations recorded $3.8 billion of underwriting profits in 2024, with retroactive reinsurance posting $0.9 billion of underwriting losses. P/C reinsurance written premiums declined 2.1% to $21.9 billion, while earned premiums grew 1.4%. The report discloses a charge of almost $0.5 billion recorded by the group’s National Indemnity Company related to a settlement agreement of a non-insurance affiliate that filed for bankruptcy, which impacted underwriting expenses.

Featured images: AI-generated (Adobe/Firefly)